Arbitrum Reaches Milestone as First Layer 2 to Surpass $150B in Swap Volume

Arbitrum Reaches Milestone as First Layer 2 to Surpass $150B in Swap Volume

🚀 Scaling New Heights

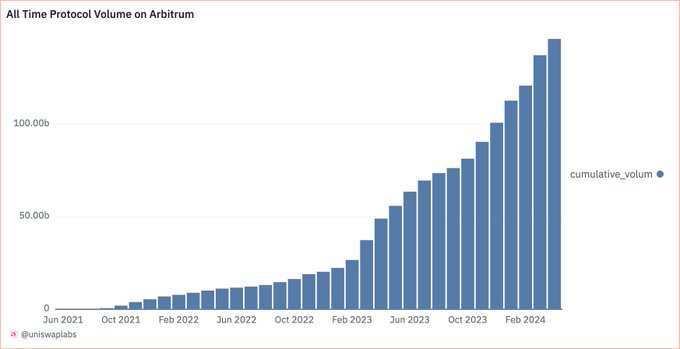

Arbitrum, a layer 2 scaling solution for Ethereum, has officially become the first of its kind to exceed $150 billion in swap volume. This significant achievement highlights the growing adoption and utilization of layer 2 technologies aimed at enhancing the scalability and efficiency of the Ethereum network. Arbitrum's milestone comes after anticipation built up in late April when it was on the cusp of reaching this swap volume milestone.

It’s official: Arbitrum is the first L2 to pass $150B in swap volume 🔷

Arbitrum is about to be the first L2 to pass 150B in swap volume 👀

Uniswap Skills Now Available in Bankr Catalog for Agent Integration

Uniswap has integrated its Skills into the Bankr catalog, enabling AI agents to interact with the protocol's core functions. **What's Available:** - Swaps - Liquidity provider (LP) planning - Hooks - Other protocol actions This follows Uniswap's recent beta launch of its Developer Platform, which allows builders to generate API keys and add swap and LP functionality to applications. The platform previously released seven Skills for structured access to protocol actions. The integration represents a step toward combining autonomous agents with decentralized finance infrastructure, giving developers tools to build agentic workflows on-chain.

Uniswap Hook Trends Dashboard Now Live on Dune Analytics

A new Dune Analytics dashboard is now available to track trending hooks in the Uniswap ecosystem. **Key Features:** - Monitor real-time hook adoption and usage patterns - Compare performance across different hook implementations - Access historical data on hook trends The dashboard builds on previous analytics tools that tracked Uniswap activity across V2, V3, and V4 deployments. This latest addition provides deeper insights into how developers are utilizing hooks - a key feature of Uniswap V4 that allows for customizable pool behavior. [View the dashboard](https://dune.com/queries/4640631/7728644) This tool helps developers and traders understand which hooks are gaining traction and how they're being implemented across the protocol.

Angstrom Raises $1 Billion for Uniswap Hooks Development

Angstrom has secured $1 billion in funding to advance hooks technology on Uniswap. **What are hooks?** - Programmable extensions that allow developers to customize liquidity pool behavior - Enable new features like dynamic fees, custom order types, and advanced trading strategies - Part of Uniswap V4's architecture for greater flexibility **Why it matters:** - Represents significant institutional confidence in DeFi infrastructure - Could unlock new use cases for decentralized exchanges - Positions Angstrom as a major player in the next generation of AMM technology The funding marks one of the largest investments in DeFi tooling to date.

Flow.bid Launches Nine-Minute Token Auctions Using CCA Protocol

**Flow.bid is implementing the CCA (Credible Commitment Auction) protocol** to create rapid nine-minute token auctions. The system enables automated agents to register tokens, discover market prices, and deploy liquidity directly to Uniswap v4. **Key features:** - Permissionless and configurable auction framework - Automated price discovery mechanism - Direct integration with Uniswap v4 for liquidity deployment The CCA protocol aims to streamline token distribution by helping projects establish credible market prices and bootstrap initial liquidity. The protocol is now accessible through the Uniswap Web App interface.

Uniswap Opens Developer Platform Beta with API Keys for Instant Integration

Uniswap has launched its Developer Platform in beta, allowing any builder to generate API keys and integrate swap and liquidity provider functionality directly into their applications. **Key Features:** - Instant API key generation for developers - Quick integration of swap functionality - Built-in LP (liquidity provider) capabilities - Launch timed for ETHDenver hackathon participants The platform aims to simplify the process of adding decentralized trading features to applications, reducing integration time from potentially days to minutes.