Aragon Launches Value Accrual Toolkit with veTokens and Gauges

Aragon Launches Value Accrual Toolkit with veTokens and Gauges

🔒 Governance Gets Superpowers

Aragon has introduced its Value Accrual Toolkit, featuring two key components:

- veLocker System: Implements time-weighted voting power through token locking, encouraging long-term commitment

- Gauges: Enables token holders to direct capital allocation and emissions through voting

The toolkit aims to bridge the gap between governance and value creation in onchain organizations. Key features include:

- Customizable lock durations and voting power

- Resource allocation across predefined categories

- KPI-based payouts and bribe markets

- Analytics and optimization tools

Currently managing $35B+ in assets across 10,000+ organizations. Learn more

Some of the biggest challenges we’ve seen in major onchain organizations are capital allocation and bootstrapping liquidity. With tools like velockers and gauges, they can now align incentives more effectively. Read more: blog.aragon.org/building-for-v…

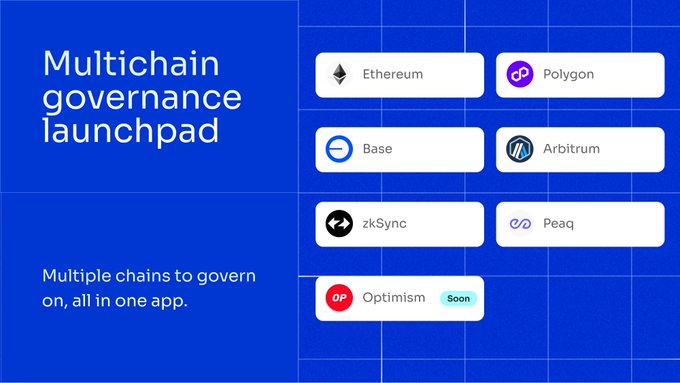

Launching your organization onchain comes with multiple checkpoints, like determining UX priorities & choosing which chain to deploy on. The Aragon app allows you to launch your project on multiple chains quickly, freeing up more time to focus on what truly matters +

Modular governance → pragmatic decentralization Allowing organizations to scale while ensuring real ownership and direct accountability.

With modular governance, organizations can deploy bespoke, adaptable models without costly custom contracts or audits.

veLockers put power into truly aligned participants' hands. Gauges direct that power into action. The result? A value accrual flywheel. This isn't just tokenomics, it's a strategic blueprint, empowering onchain organizations to align incentives, accrue value, and scale with

Scale your onchain organization by building on the Elastic Network. With tooling for governance and value accrual available to builders on @ZKsync and powered by Aragon, organizations can unlock the advantages of building top-to-bottom onchain infrastructure without overhead,

Build your onchain organization on the Machine Economy network! The future of DePIN governance is decentralized. With governance tools and value accrual available to builders on @peaq, they can benefit from moving onchain without the usual overhead, trade-offs, and complexities.

Building your organization onchain means decentralizing ownership for transparent decision-making, effective management, & open building, but it often comes with trade-offs across critical areas, like growth and sustainability. Here's the thing though... it doesn't have to.

Aragon Pushes Automated Governance to Replace Endless DAO Proposals

Aragon is shifting onchain governance from constant proposal voting to rule-based automation. Their new approach addresses a core inefficiency: DAOs shouldn't need human approval for routine tasks like payroll or treasury rebalancing every month. **Key developments:** - Launching the **Token Ownership Index** to verify which tokens grant actual control rights versus speculative assets - Introducing governance automation that executes recurring decisions based on predefined rules - Distinguishing "ownership tokens" (like Aave, Lido, Curve) from memecoins through verifiable onchain rights The timing aligns with maturing capital flows and regulators favoring transparent, rule-based systems over discretionary control. Vitalik Buterin's 2026 forecast similarly emphasized automated governance design. Aragon argues proposal-based governance doesn't scale when communities vote on the same actions repeatedly. Their solution: define rules once, automate execution, and reserve human discretion for decisions that truly require it. Read the full framework: [Beyond Proposals Part I](https://blog.aragon.org/beyond-proposals-pt-i-automation-and-the-art-of-not-governing/)

Aragon OSx Introduces Policy Plugins for Automated DAO Operations

Aragon OSx has introduced **policy plugins** that enable DAOs to automate routine operations without requiring constant voting. The plugins are designed with four key characteristics: - **Deterministic**: Predictable outcomes based on set rules - **Rule-bound**: Operate within defined parameters - **Permissionless to trigger**: Anyone can initiate when conditions are met - **Governed in scope, not execution**: Governance sets boundaries, not individual actions This approach allows organizations to automate treasury operations like payouts, token buybacks, burns, and fund flows while maintaining governance oversight. The system builds on Aragon's previous work with Optimistic Dual Governance, which combines efficient team operations with stakeholder veto rights. [Learn more about Aragon OSx](https://www.aragon.org/osx)

🔓 Final Vault Opens

The fourth and final pre-deposit vault on Status L2 has launched, developed by Aragon in partnership with Generic Money. **Key Features:** - Early liquidity access for users - Onchain yield opportunities - Pre-mainnet asset staking The vault allows users to contribute liquidity and earn Karma tokens before Status L2's mainnet launch. Status L2 is positioning itself as Ethereum's first gasless Layer 2 with a shared-yield model. Aragon is offering similar liquidity bootstrapping solutions for other pre-mainnet protocols and networks.

Vitalik Buterin Calls for Smarter DAOs Beyond Constant Voting

Vitalik Buterin addressed a critical challenge facing decentralized autonomous organizations: the unsustainable model of requiring human votes for every decision. While Buterin originally conceived DAOs in 2013 as organizations governed by code and community voting without central authority, he now highlights the need for evolution beyond constant manual governance. **Key implications:** - Current DAO models create voter fatigue - Need for more automated decision-making systems - Balance required between decentralization and efficiency The statement suggests a shift toward DAOs that leverage smart automation while maintaining decentralized principles, reducing the burden on participants to vote on routine matters.

Aragon Partners with Generic Money for Onchain Yield Generation

Aragon has announced a partnership with Generic Money to enable networks to generate onchain yield for ecosystem development. **Key Points:** - Generic Money's neutral stablecoin infrastructure integrates with Aragon's value accrual primitives - The collaboration aims to help web3 projects capture and distribute more value - Partnership builds on Aragon's existing multi-chain presence across Ethereum, Polygon, Base, Arbitrum, Optimism, zkSync, BNB Chain, and Peaq The integration allows organizations using Aragon's governance and tokenomics tools to direct generated yield toward ecosystem growth initiatives.