A Day in the Life of a DeFi User with Trava.Finance

A Day in the Life of a DeFi User with Trava.Finance

🤔 DeFi Made This Guy Cry

John W.'s journey into DeFi highlights common challenges faced by crypto newcomers. Initially overwhelmed by complex information across social media and forums, he found himself burned out without making progress.

The turning point came when he discovered two key tools:

- Trava.finance: A decentralized lending platform

- AImstrong AI: Smart yield strategy assistant

His experience mirrors that of Meralyn T., a freelance designer who successfully navigated her first crypto earnings using these platforms.

Key Takeaway: New DeFi tools are making crypto investing more accessible for beginners.

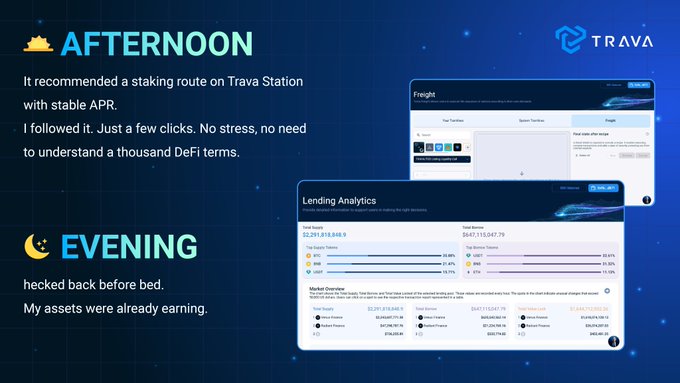

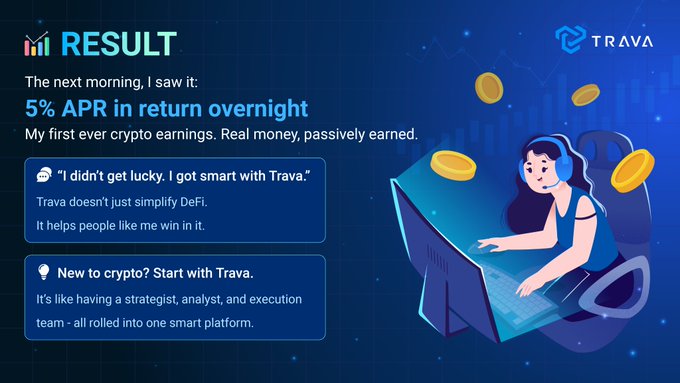

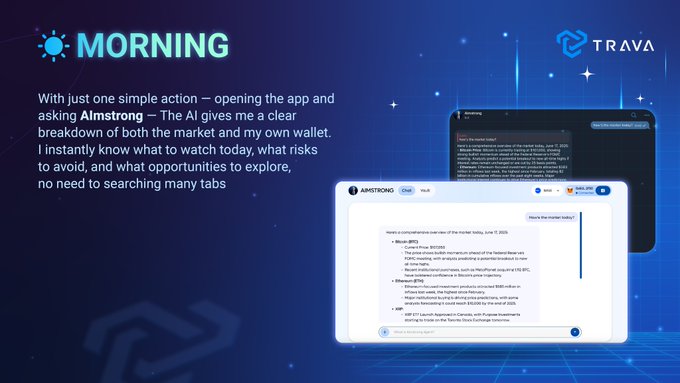

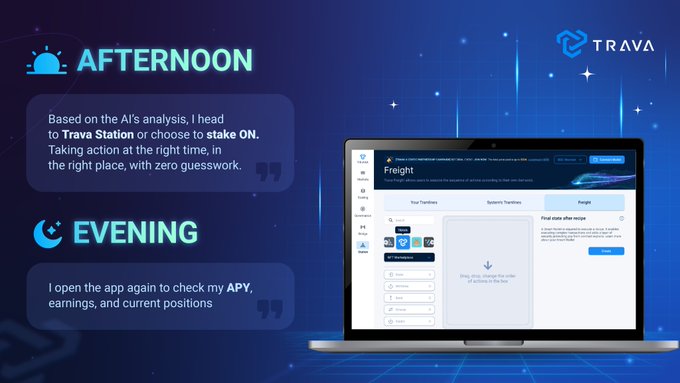

📰 ⚔️ A DAY IN LIFE OF A DEFI USER My First Crypto Earnings with trava.finance ⚔️ Meet Meralyn T., a freelance designer taking her first steps into DeFi 🚶♀️🪙 No background in crypto. Just a goal: earn passive income in a smart way. Follow a day in her journey with

☀️A Day in the Life of a DeFi User with Trava.Finance 🌛 Perhaps some of us have felt curious about crypto, yet overwhelmed by the complex world of DeFi. John W. faced the same challenge - he spent hours scrolling through Twitter threads, YouTube tutorials, and

Trava Finance Launches 6% APR USDC Lending on Ethereum

Trava Finance has launched USDC lending on Ethereum with rates up to 6% APR, starting June 17th. This follows their successful Base chain integration offering 5% APR. Key features: - Consistent yield generation on stablecoins - Low fees and fast transactions - Secure, user-friendly platform The platform enables users to earn passive income through their USDC holdings while maintaining security and ease of use. Learn more at [Trava Finance](https://app.trava.finance/pool-list)

Trava Station Launches Portfolio Dashboard for DeFi Asset Management

Trava Finance has introduced a comprehensive Portfolio dashboard within Trava Station, offering users a unified view of their DeFi positions. Key features include: - Consolidated overview of lending, staking, and governance positions - Real-time tracking of net worth, debts, and claimable rewards - Token performance monitoring - NFT holdings visibility - Smart wallet activity tracking The dashboard integrates with Trava Station's existing features like Freight, Junction, Analytics, and Recommendations. Users can access all functionalities through a single interface at [Trava Station](https://app.trava.finance/station/portfolio). *This update streamlines DeFi portfolio management by eliminating the need to switch between multiple platforms.*

Trava Finance Launches Governance System with Staking Rewards

Trava Finance introduces a new Governance Vault system that allows $TRAVA token holders to participate in protocol governance and earn rewards. Key features: - Convert $TRAVA to $sTRAVA for voting rights - Earn protocol revenue rewards - Longer lock periods grant increased voting power The governance system enables users to help shape the platform's future while earning rewards. Token holders can now visit [Trava's governance dashboard](https://app.trava.finance/governance/dashboard) to start participating. Previous implementations included options to lock $rTRAVA and $TRAVA/BNB LP tokens for veTRAVA voting power.

Trava Lending Market Update: USDC Lending Conditions on Base Chain

**Current USDC Lending Metrics on Moonwell (Base Chain)**: - Deposit APY: 3.62% - Borrow APY: 4.50% - Utilization Rate: 89.81% - Max LTV & Liquidation Threshold: 88% **Market Analysis**: High utilization rates are creating narrow lending spreads. With no safety buffer for borrowers, liquidation risks are significant. This continues a trend from previous months, where Base chain lending rates have remained competitive but risky. **Historical Context**: Earlier rates in April showed lower but more stable metrics: - Ionic Protocol: 3.04% deposit / 8.28% borrow - Moonwell: 2.97% deposit / 4.38% borrow - ZeroLend: 2.15% deposit / 3.74% borrow