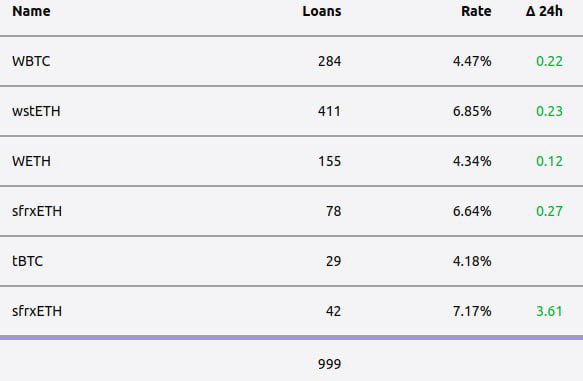

On November 6, 2023, the Curve community announced that there were 999 crvUSD loans.

999 crvUSD loans

🔄 crvUSD Now Swappable for satUSD on River

Curve Finance's crvUSD stablecoin is now available on River, enabling direct 1:1 swaps with satUSD. **Key Details:** - Direct integration with [River](https://river.inc) - 1:1 exchange ratio between crvUSD and satUSD - Expands utility for Curve's stablecoin ecosystem This follows the recent launch of the scrvUSD/crvUSD exchange rate on API3 Market, which allows users to deposit crvUSD in Curve's Savings Vault to receive scrvUSD - a yield-bearing version of the stablecoin available across 40+ blockchains. The integration provides another avenue for crvUSD holders to access different stablecoin options within the DeFi ecosystem.

🔧 Curve DAO Votes to Smooth Out crvUSD Borrow Rates

Curve Finance has put forward a governance proposal to adjust how crvUSD borrow rates respond to price changes. **What's changing:** - The proposal aims to make borrow rates **less dependent** on crvUSD price fluctuations - This creates a **less steep dependency** curve for rate adjustments - The change is part of ongoing efforts to smooth out the borrowing experience **Additional context:** - A separate proposal recently passed to increase the fee share cap for Savings crvUSD (scrvUSD) - This means scrvUSD depositors can earn higher yields during active market periods - Both proposals represent "tweaks in prod" - live adjustments to the protocol's economic parameters Vote on the proposal: [Curve DAO Proposal #1342](https://www.curve.finance/dao/ethereum/proposals/1342-ownership/)

💰 Curve Finance Adds Incentives to crvUSD/pyUSD Pool

Curve Finance has added additional incentives to its crvUSD/pyUSD stablecoin pool on Ethereum. **Key Details:** - The pool received new incentive rewards to encourage liquidity provision - Transaction confirmed on [Etherscan](https://etherscan.io/tx/0xfbc6dce11fc53a920be1c781bc5fe16a1ad2ed6028e15b8949f87b8569de28dd) - Users can deposit liquidity at [Curve's pool interface](https://www.curve.finance/dex/ethereum/pools/factory-stable-ng-42/deposit) This marks a continued effort to deepen liquidity for Curve's native stablecoin crvUSD paired with PayPal's pyUSD.

🏛️ Aragon Launches Token Ownership Framework with Curve as Reference Case

Aragon Project has released its **Ownership Token Framework**, featuring Curve as a launch reference implementation. The framework demonstrates how programmatic mechanisms can transparently route value and control onchain. **Key developments:** - Framework emphasizes enforceable onchain ownership rights - Curve's bonding curve model serves as reference for transparent value routing - Part of Aragon's broader Token Ownership Index initiative The framework addresses a critical gap in crypto markets: **verifiable tokenholder rights**. By establishing clear standards for what's actually enforceable onchain, Aragon aims to make crypto-native tokens more investable through ownership clarity, automation, and value accrual mechanisms. This builds on Aragon's 2026 commitment to improve token standards and market infrastructure.

Curve Finance January 2026 Monthly Recap Released

Curve Finance has published its monthly recap for January 2026, highlighting a particularly active month for the protocol. The report covers key developments and activities across Curve's ecosystem during the first month of the year. While specific details weren't provided in the announcement, these monthly recaps typically include: - Protocol metrics and trading volume updates - New pool deployments and integrations - Governance proposals and community decisions - Technical improvements and upgrades Curve continues its role as a leading decentralized exchange focused on stablecoin trading and deep on-chain liquidity through its specialized automated market maker design. [Read the full January recap](https://news.curve.finance/curve-monthly-recap-january-2026/)