🔧 Curve DAO Votes to Smooth Out crvUSD Borrow Rates

🔧 Curve DAO Votes to Smooth Out crvUSD Borrow Rates

🔧 Curve tweaks rates

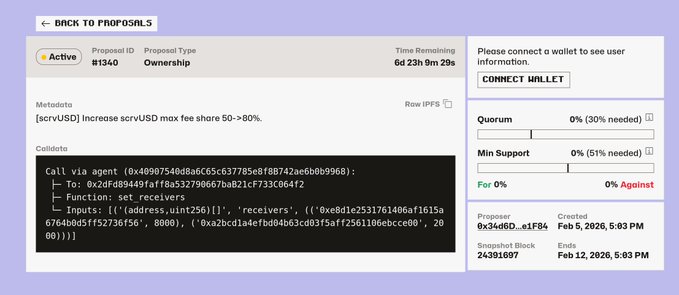

Curve Finance has put forward a governance proposal to adjust how crvUSD borrow rates respond to price changes. The vote aims to make rates less dependent on crvUSD price movements, creating a flatter, more predictable borrowing cost structure.

Key changes:

- Reduces the steepness of rate adjustments when crvUSD price fluctuates

- Follows an earlier proposal to increase fee share caps for Savings crvUSD (scrvUSD)

- Part of ongoing efforts to optimize the crvUSD stablecoin mechanism

This "tweak in prod" approach represents Curve's iterative refinement of its algorithmic stablecoin parameters. The proposal is currently live for community voting on the Curve DAO platform.

Borrowers could benefit from more stable rates, while scrvUSD depositors recently gained potential for higher earnings through the fee share adjustment.

Another important "tweak in prod" vote - making crvUSD borrow rate LESS dependent on crvUSD price (e.g. less steep dependency) curve.finance/dao/ethereum/p…

A proposal to increase upper limit for the share of fees which Savings crvUSD can potentially be getting. It means, in days/weeks like now, scrvUSD depositors will earn more! curve.finance/dao/ethereum/p…

Curve Finance crvUSD/pyUSD Pool Receives Additional Incentives

The crvUSD/pyUSD liquidity pool on Curve Finance has received additional incentives, as confirmed by an [Ethereum transaction](https://etherscan.io/tx/0xfbc6dce11fc53a920be1c781bc5fe16a1ad2ed6028e15b8949f87b8569de28dd). **Key Details:** - The pool is available on [Curve's Ethereum deployment](https://www.curve.finance/dex/ethereum/pools/factory-stable-ng-42/deposit) - This marks a continued effort to boost liquidity for the stablecoin pair - Users can deposit into the pool to earn rewards The incentive addition aims to attract more liquidity providers to the crvUSD/pyUSD pool, strengthening the trading depth for these stablecoins on the Curve platform.

🏛️ Aragon Launches Token Ownership Framework with Curve as Reference Case

Aragon Project has released its Ownership Token Framework, featuring Curve as a launch reference implementation. The framework demonstrates how programmatic mechanisms can transparently route value and control onchain. **Key Points:** - Curve serves as the reference model for enforceable onchain ownership - Framework aims to establish better standards for crypto markets - Part of Aragon's broader Token Ownership Index initiative The development addresses a critical gap in crypto investing: verifiable information about tokenholder rights. Aragon's 2026 roadmap focuses on making crypto-native tokens investable through three pillars: ownership clarity, automation, and value accrual mechanisms. The framework emphasizes that onchain ownership is only meaningful when it's actually enforceable through code, not just claimed in documentation.

Curve Finance January 2026 Monthly Recap Released

Curve Finance has published its monthly recap for January 2026, highlighting a period of significant activity across the protocol. The report covers key developments and metrics from the past month, though specific details about new integrations, volume changes, or protocol updates were not disclosed in the announcement. **Key Points:** - January marked a busy period for Curve Finance operations - Monthly recap follows the protocol's regular reporting cadence - Previous recaps show consistent monthly updates to the community The full report is available on Curve's official news platform for those seeking detailed metrics and developments from the month.

Eywa Security Incident Prompts User Vote Review Warning

Following a security incident at eywa.fi (CrossCurve), users are advised to review and consider removing votes allocated to Eywa-related pools. **Key Points:** - Security incident affects eywa.fi platform - Users with votes in Eywa pools should reassess positions - Participants urged to remain vigilant with third-party projects - Risk-aware decision making emphasized The warning comes as CrossCurve previously reported over $16.2M TVL across pools, 863 veEYWA holders, and 51M+ locked EYWA tokens. Users should evaluate their exposure and take appropriate action based on their risk tolerance.