YEL.Finance

Yield Enhancement Labs (YEL) - a next-gen hybrid DeFi protocol that focuses on yield enhancement and is currently powered by Ethereum, Binance Smart Chain, Fantom and Polygon.

YEL manages liquidity across multiple DeFi protocols and chains, bringing together yield farmers and protocols to facilitate maximum capital efficiency.

We have already passed Solidity Finance Audit and cooperate with such major players as QuickSwap, ApeSwap, SpookySwap, SpiritSwap, HyperJump, AnySwap and others.

YEL Finance Announces Sonic Labs S1 Airdrop Claim Period

Mon 28th Jul 2025

Yield Enhancement Labs (YEL) has confirmed the upcoming distribution of airdrops for Sonic Labs S1 Chapter 1 & 2 participants.

- Eligible users can claim their rewards at [YEL Finance Dashboard](https://app.yel.finance/dashboard/campaigns)

- Distribution follows successful completion of farming periods for both chapters

- Chapter 3 launch anticipated in near future

*Participants who completed farming activities should prepare screenshots of their YEL Points for verification.*

**Note**: Token distribution process will begin in the coming days for qualified participants.

WETH Potion Launch on SonicLabs Offers Dual Farming Options

Thu 1st May 2025

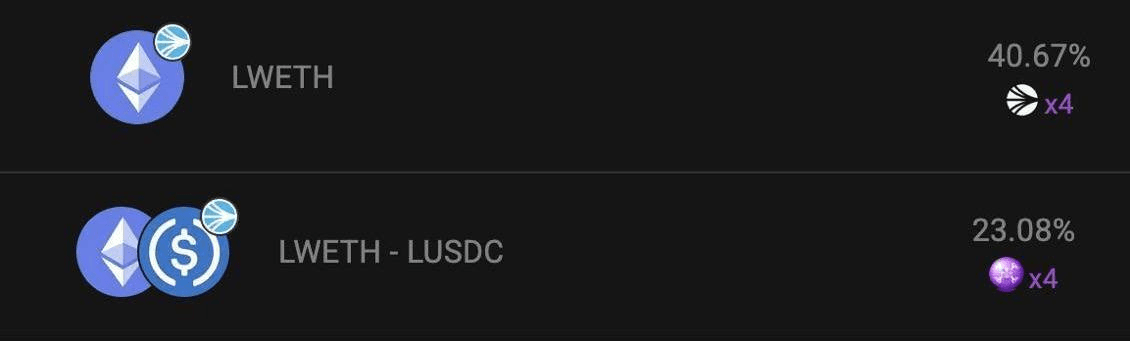

SonicLabs has launched a new WETH Potion offering two farming options:

- **Single-Sided Staking** at 40% APR with no impermanent loss

- **LP Farming** available at 23% APR

Users can access these farming opportunities through [Yel.Finance](http://Yel.Finance). The platform aims to help users capitalize on market volatility while minimizing risk.

This launch follows the successful deployment of the wagmicom Potion earlier this year, which introduced similar volatility farming features.

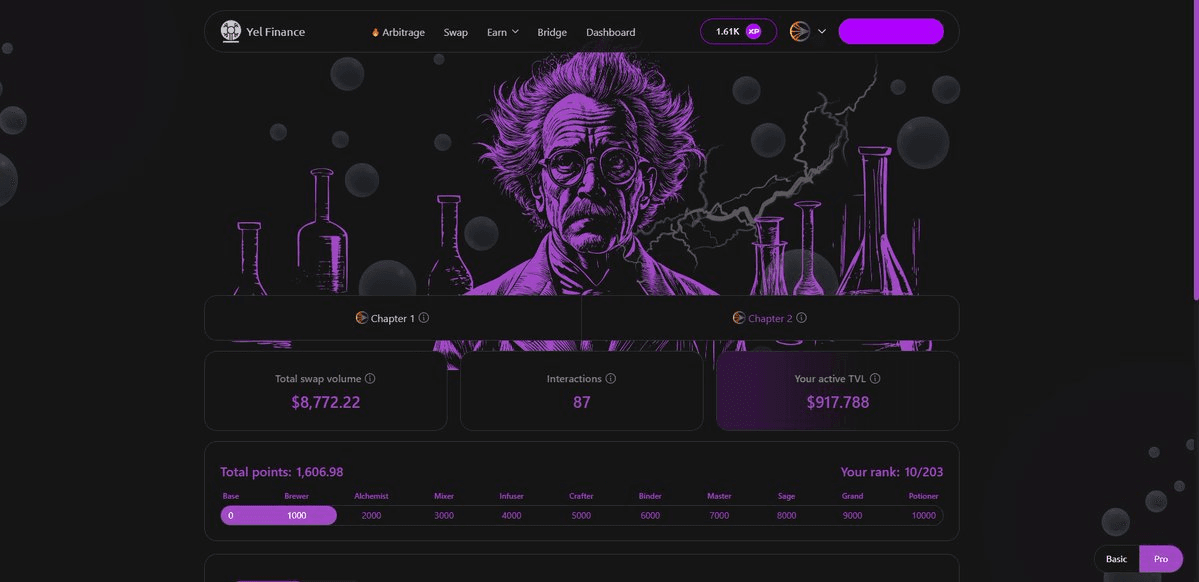

Yel Finance Launches Points System for Swaps and Interactions in Chapter 2

Tue 8th Apr 2025

Yel Finance introduces a new points-based reward system in Chapter 2:

- Users earn points for three activities:

• Staking assets

• Performing token swaps

• Platform interactions

All swap revenue (0.01%) and FeeM transaction fees will be used to buy back $YEL tokens for community distribution at Chapter 2's conclusion.

The system rewards active participation - more engagement means higher rewards. Points accumulation is now live on [Yel.Finance](http://Yel.Finance), with every transaction contributing to potential rewards.

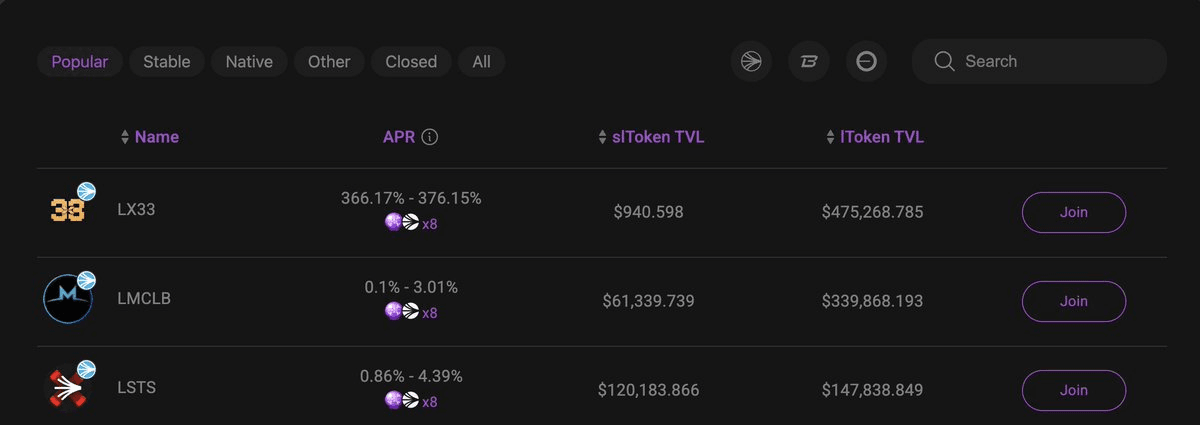

x33 Potion by ShadowOnSonic Reaches $475K TVL

Thu 27th Mar 2025

The x33 Potion protocol, developed by ShadowOnSonic, has achieved significant growth by accumulating over $475,000 in Total Value Locked (TVL) within its first 24 hours of launch. This milestone follows Sonic Labs' recent success, which saw their TVL reach an all-time high of $324M in February 2025.

Key points:

- Rapid adoption with $475K TVL in under 24 hours

- Part of the growing Sonic Labs ecosystem

- Demonstrates continued momentum in the DeFi sector

Yel.Finance Launches Secondary Market for x33 Token with Single-Sided Vault

Thu 20th Mar 2025

Yel.Finance expands its volatility farming ecosystem by introducing a secondary market for the $x33 token on Sonic Labs. The new offering includes:

- Single-sided vault with zero impermanent loss

- Liquidity provision options

- Farming rewards regardless of market conditions

This launch follows their successful implementation of similar markets for $GHOG and @wagmicom tokens, demonstrating Yel.Finance's continued expansion in the DeFi space.

*Users can choose between staking in the vault or providing liquidity to earn rewards.*

[Start farming on Yel.Finance](http://Yel.Finance)

Yel.Finance Launches New YOKO Single-Sided Vault

Mon 6th Jan 2025

Yel.Finance has launched a new single-sided vault featuring the $YOKO token from Yoko.live. The vault offers:

- Zero impermanent loss protection

- Volatility mining capabilities

- Staking and LP provision options

This release follows recent successful vault launches for SpookySwap's $BOO token, Beethoven X's $stS token, and HeyAnon's token - all featuring similar single-sided vault mechanics.

**Key Benefits:**

- Risk mitigation through single-sided exposure

- Volatility-based earning potential

- Multiple staking options

Visit Yel.Finance to start using the new YOKO vault.

YEL Protocol Development Update

Mon 20th Jan 2025

YEL Protocol continues its development trajectory with steady progress since October 2023. The team maintains consistent monitoring and iteration of the protocol's performance across multiple chains including Ethereum, BSC, Fantom, and Polygon.

Key developments:

- Ongoing integration with major DeFi platforms

- Enhanced cross-chain liquidity management

- Continued protocol optimization post-Solidity Finance Audit

The protocol sustains its focus on yield enhancement and capital efficiency while working with established partners like QuickSwap, ApeSwap, and SpookySwap.

Sonic Labs Forms Strategic Partnership with Gamma Strategies

Mon 16th Dec 2024

Sonic Labs announces a strategic partnership with Gamma Strategies to enhance their Concentrated Liquidity pools.

Key points:

- Gamma Strategies will provide automated liquidity management

- Focus on optimizing yields for users

- Implementation of passive yield generation

- Integration with existing Sonic pools

The partnership aims to streamline liquidity provision while maximizing fee generation for pool participants. Users can benefit from professional management without active involvement.

Want to participate? Visit Sonic Labs' platform to explore the new managed liquidity pools.

Technical Issues Lead to Temporary Contract Pause on Base and Fantom

Thu 14th Nov 2024

Yield Enhancement Labs (YEL) has temporarily suspended contract operations on Base and Fantom networks due to technical issues.

- All user funds remain secure (SAFU)

- Pause affects only Base and Fantom networks

- Daily updates available through Discord channel

This follows previous technical challenges from October 2023 when crypto withdrawals were temporarily halted while fiat withdrawals remained operational.

*Users should monitor Discord for status updates and further instructions.*

Yield Enhancement Labs Launches on Fantom Network with Equalizer Partnership

Thu 14th Nov 2024

Yield Enhancement Labs (YEL) has officially launched on the Fantom network, marking a strategic expansion of their volatility mining services.

Key developments:

- Strategic partnership with Equalizer, a leading Fantom DEX

- Integration with Fantom network's point system for Chapter 1 participation

- Received 22,000 FTM from Fantom Foundation for ecosystem contributions

- Development support through GasM program

The expansion strengthens YEL's multi-chain presence alongside existing operations on Ethereum, BSC, and Polygon networks.

**Next Steps**: Watch for upcoming Equalizer integrations and new features on http://Yel.finance