Synapse

The Synapse network is secured by cross-chain multi-party computation (MPC) validators operating with threshold signature schemes (TSS). The network is leaderless, and maintains security by each validator running the same process upon receiving on-chain events on the various chains that the MPC validator group tracks. Once two-thirds of all validators have collectively signed the same transaction using their own individual key, the network achieves consensus and issues a transaction to the destination chain.

Hypercall Launches Deep Delta Hedging Venue on Hyperliquid

Fri 30th Jan 2026

Hypercall is launching what it claims will be the deepest delta hedging venue globally, built on Hyperliquid's infrastructure.

**Key Features:**

- Direct integration with Hyperliquid's matching and risk engine

- Access to deep liquidity and portfolio margin

- Crypto-native user experience

- Hypercall handles options design, risk, and settlement

- Hyperliquid provides liquidity and spot/perpetual trading infrastructure

The platform combines specialized options trading capabilities with Hyperliquid's existing trading infrastructure.

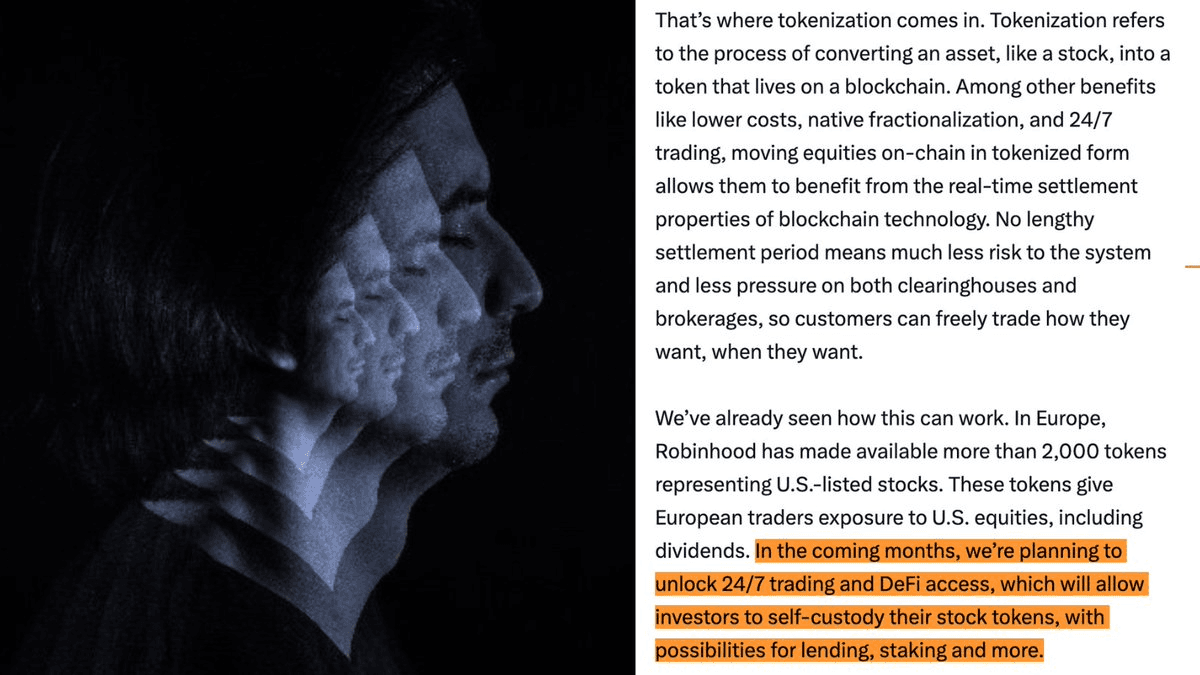

Robinhood Shifts to On-Chain Operations Amid Hypercall Competition

Fri 30th Jan 2026

**Robinhood is being forced to adopt on-chain infrastructure** to maintain its competitive position against Hypercall, a significant strategic shift for the traditional trading platform.

**Key developments:**

- The move represents a major pivot for Robinhood, traditionally a centralized platform

- Hypercall's market pressure is driving this blockchain adoption

- This follows Robinhood's earlier exploration of offshore prediction markets outside the US

The competitive landscape is pushing traditional finance platforms toward decentralized infrastructure to retain users.

Hypercall Launches Options Explainers for Beginners

Fri 30th Jan 2026

Hypercall has released educational content aimed at making options trading more accessible.

The new **Options Explainers** covers fundamental concepts including:

- Options payoffs

- Theta decay

- Slippage

The materials are designed specifically for beginners entering the options trading space. The platform continues its mission to reduce friction in options trading and is seeking community feedback on the educational resources.

Full documentation available at [docs.hypercall.xyz](https://docs.hypercall.xyz/docs/options-explainers/)

Hypercall Launches Practical Options Education for Traders

Fri 30th Jan 2026

Hypercall has released a new education platform designed for practical trading rather than theoretical learning.

The platform offers two distinct courses:

- **Options Explainers (01)**: Covers fundamental concepts including options payoffs, theta decay, and slippage - aimed at beginners

- **Reading Volatility (12)**: Focuses on volatility analysis for traders

The courses are available at [blog.hypercall.xyz](https://blog.hypercall.xyz/hypercall-options-education-path/) and [docs.hypercall.xyz](https://docs.hypercall.xyz/docs/options-explainers/)

The initiative addresses a gap in options education, which often prioritizes theory over actionable trading knowledge.

Hypercall Releases Documentation Portal

Mon 26th Jan 2026

Hypercall has launched its official documentation portal, providing developers and users with comprehensive technical resources.

**Key Details:**

- New docs site available at [docs.hypercall.xyz](https://docs.hypercall.xyz/)

- Full release details shared on the [Hypercall blog](https://blog.hypercall.xyz/hypercall-docs-release/)

- Documentation aims to support developers building with Hypercall's infrastructure

The release marks a step forward in making Hypercall's technology more accessible to the developer community through structured technical guidance.

Testnet Rollout Announced in Three Phases Leading to Mainnet

Mon 26th Jan 2026

A three-phase testnet rollout has been announced, marking the path toward mainnet launch.

**Phase breakdown:**

- **Phase 1:** Standard margin trading with mobile-first testnet

- **Phase 2:** Portfolio margin capabilities and desktop platform

- **Phase 3:** Mainnet readiness based on learnings from earlier phases

The phased approach allows for iterative testing and refinement before the full mainnet deployment. Each phase builds upon the previous one, starting with core margin trading features on mobile and expanding to more advanced portfolio margin tools on desktop.

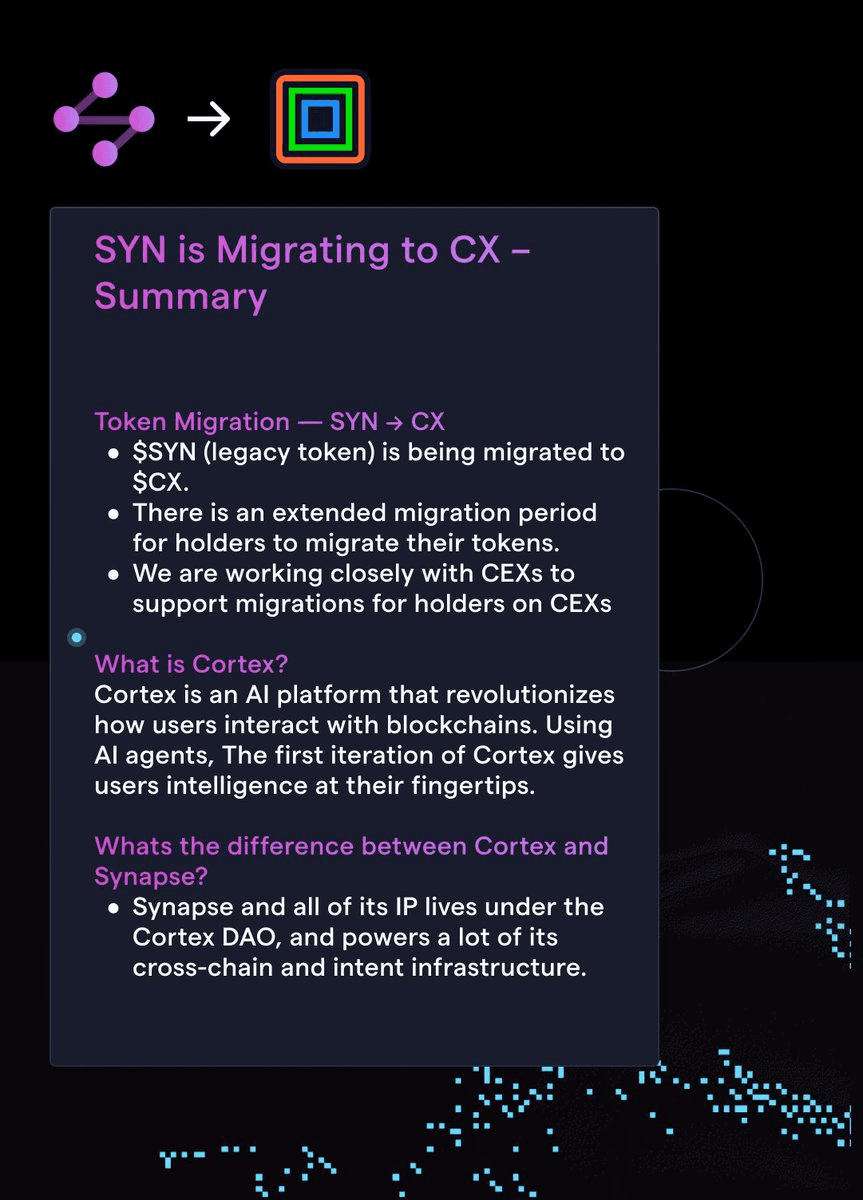

Synapse Protocol Transitions to Cortex DAO with Token Migration

Tue 8th Apr 2025

Synapse Protocol announces its integration into Cortex DAO, with the SYN token migrating to CX.

Key Updates:

- Synapse Protocol now operates under Cortex DAO governance

- SYN token holders will transition to the new CX token

- Official documentation available at [Synapse Docs](https://docs.synapseprotocol.com/docs/About/DAO) and [Cortex Docs](https://docs.cortexprotocol.com/)

Users should:

- Follow @Cortex_Protocol for latest updates

- Only trust official channels for migration information

- Contact official channels with questions

**Security Notice**: Be vigilant against potential scammers during the migration process.

Cortex Protocol Integrates with Synapse for Chain Abstraction

Thu 7th Nov 2024

Cortex Protocol is implementing chain abstraction technology powered by Synapse ($SYN), enabling seamless cross-chain operations through AI-managed intelligent accounts.

Key features:

- Instant intent settlement via Synapse

- Zero-click user experience

- AI agents managing on-chain actions

- Multi-chain transaction capability

- Natural language processing for blockchain interactions

The system supports multiple networks including Base, Optimism, Ethereum, Polygon, and Arbitrum, with Gnosis Safe integration for enhanced security.

Synapse Bridge Cost Analysis Shows Significant Savings

Thu 7th Nov 2024

Recent analysis comparing major cross-chain bridges reveals **Synapse** as the most cost-effective option:

- Outperforms competitors on 85 of 100 routes

- Averages 87% cheaper than alternatives

- Testing covered ETH and USDC transfers

- Routes include Ethereum and major L2s

The analysis includes detailed methodology and verification code, allowing users to independently confirm results. This follows earlier comparisons showing similar cost advantages across different route combinations.

*View full methodology and code: [Synapse Mirror Post](https://synapse.mirror.xyz/mUk-EpaWHW1EJjOOQRpTPeHqT0j1302_2ody80ixdoQ)*