PropellerSwap

Users often struggle with comparing token swap prices across multiple platforms to find the best deal. PropellerSwap solves this problem by aggregating liquidity from various on-chain and off-chain sources, and doing the hard work of finding the favorable price through routing, protecting it from MEV and improving the chance of a successful transaction. Swapping tokens is simple through the user-friendly front-end, and dApps can integrate the solver API by referring to the documentation.

Stabiliser Bot Gains 9.55% While ETH Drops 22% in 60-Day Mainnet Test

Fri 30th Jan 2026

A trading bot called Stabiliser completed a 60-day live test on Ethereum mainnet, trading the ETH/USDC pair with notable results:

**Performance Metrics:**

- **+9.55% profit** in USD terms (after gas costs)

- **32% outperformance** vs. simply holding ETH

- Executed during a period when ETH declined 22%

**Trading Activity:**

- ~1,500 trades executed

- Selected from 18,000 identified opportunities

- Ran on mainnet before public release

The bot demonstrated its ability to generate positive returns in a declining market by actively managing positions rather than holding static assets. The strategy's selectivity—executing only 8% of identified opportunities—suggests a disciplined approach to trade execution.

🤖 Open-Source Bot Automates Stablecoin Peg Maintenance

Fri 30th Jan 2026

**Stabiliser**, an open-source bot built on Tycho, automates peg maintenance for stablecoin teams and arbitrage traders.

The tool handles the repetitive work of:

- Integrating with DEXs

- Monitoring price feeds

- Managing trade execution

- Tracking performance metrics

Built entirely in Rust, Stabiliser watches a reference price and automatically trades on DEX pools to push prices back toward the peg. This eliminates the need for teams to build custom keeper bots from scratch.

[View documentation](https://tycho-stabiliser.gitbook.io/docs/) | [Track performance](https://stabiliser.vercel.app)

DEXs Enter Bidding War for Your Trades

Mon 17th Nov 2025

**DEXs are now competing in auction-style bidding wars** for your trade orderflow, fundamentally changing how decentralized exchanges operate.

**The New DEX Auction Model**

To win trades, DEXs must:

- Know market rates they can bid

- Monitor competitor quotes

- Bid strategically without overpaying

- **Keep bids private**

**Strategic Adaptations**

- DEXs colocate with solvers to dynamically outbid competitors

- Increased programmability through v4 hooks and concentrated liquidity

- LPs help fine-tune pools for maximum volume and profit

**Price Freshness Tactics**

DEXs align with fast traders through:

- **Angstrom**: Auctions trading rights at block tops

- **Uniswap Protocol Fee Discount**: Fee-free trading auctions

Both incentivize traders to update pool prices to latest market rates.

**Competitive Secrecy**

DEXs now:

- Keep code private

- Share quotes only with select aggregators and builders

- Make competition harder for rivals

This represents just the beginning of evolving DEX competition strategies.

[Read full analysis](https://www.propellerheads.xyz/blog/how-to-win-as-a-dex)

🔧 Wraxyn Opens Up About Tycho Edge

Mon 17th Nov 2025

**Wraxyn breaks silence** on using Tycho as their competitive advantage for solver operations.

Most Tycho users keep their usage private, but Wraxyn decided to share how they leverage the platform to:

- **Win more volume** on UniswapX

- **Optimize performance** on CoWSwap

- **Gain solver advantages** through Tycho's edge

**Why Tycho matters:**

Tycho standardizes data from multiple DEXs like Curve and Balancer, following ERC 7815 standards. This eliminates the need for solvers to adapt routing logic to different DEX interfaces.

**Key benefits:**

- Seamless data streaming

- Unified DEX interface

- Simplified solver operations

Wraxyn's transparency offers rare insight into how professional solvers gain competitive advantages in the MEV landscape.

Tycho Enables Instant Eulerswap Integration for Solvers

Thu 9th Oct 2025

**Tycho now supports Eulerswap routing** without weeks of integration work. Solvers can access the Uniswap v4 hook by simply adding 'uniswap_v4_hooks' with euler_hook_filter to their client config.

**Key advantages:**

- **50x effective depth** on stable pairs through just-in-time borrowing from Euler Finance vaults

- **Reduced slippage** for large swaps on stablecoin pairs

- **Automatic dependency management** via Tycho's Dynamic Contract Indexing (DCI)

Eulerswap borrows output tokens from lending vaults during swaps, creating deeper liquidity for pegged assets. This makes it particularly competitive for stablecoin trading.

Tycho's DCI handles complex contract dependencies automatically, eliminating manual integration work. The system traces vaults, oracles, and hooks server-side, streaming data to clients for in-memory swap simulation.

This marks the first of many hooks Tycho will support, with plans to include Balancer v3, Fluid, and other Uniswap v4 hooks.

[Get started with integration docs](https://docs.propellerheads.xyz/tycho)

Turbine Launches as First Trustless Peer Exchange

Thu 9th Oct 2025

**Turbine** is positioning itself as the first trustless peer-to-peer exchange platform.

The platform aims to enable direct peer-to-peer trading without requiring intermediaries or centralized control. This approach could address common issues in traditional exchanges like:

- Counterparty risk

- Custody concerns

- Centralized points of failure

By operating in a trustless manner, users would maintain control of their assets throughout the trading process. The peer-to-peer model suggests direct matching between traders rather than relying on market makers or liquidity pools.

This development follows growing interest in decentralized trading infrastructure that prioritizes user sovereignty and reduces reliance on centralized entities.

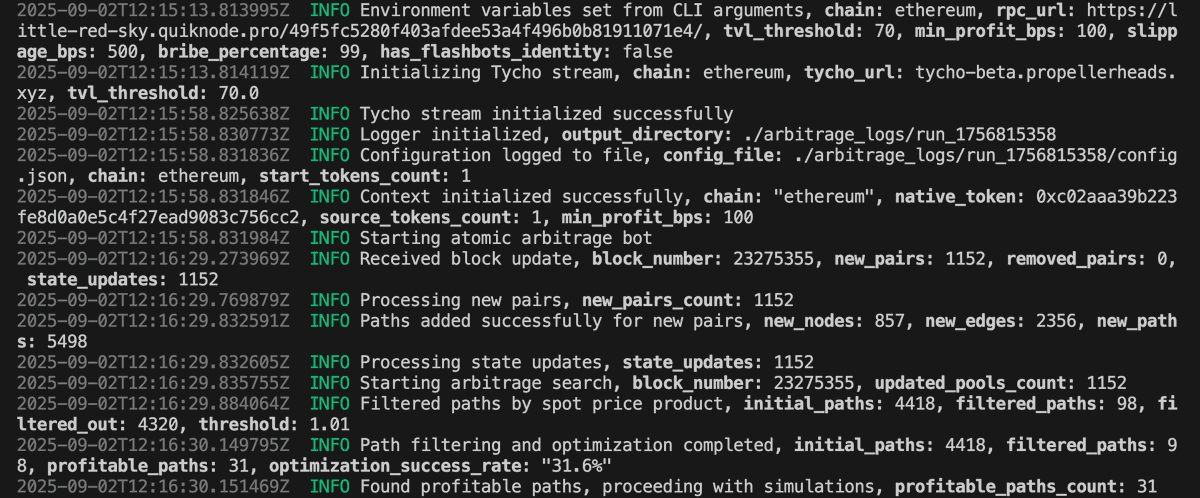

Triangle: Open-Source Arbitrage Bot Template Launches

Mon 8th Sep 2025

**Triangle**, a Rust-based arbitrage bot template, eliminates weeks of infrastructure setup for atomic arbitrage trading.

Built by @0xytocinX on Tycho, this **fully open-source** solution provides:

- Real-time DEX state monitoring

- Battle-tested simulation engine

- Audited router contract

- Modular pathfinding algorithms

The bot automatically builds liquidity graphs, identifies profitable opportunities, and submits trading bundles.

**Key features:**

- Configurable bribing logic

- Adjustable slippage settings

- Support for backrunning trades

- BuilderNet deployment options

Previously, building arbitrage bots required maintaining nodes across chains, debugging DEX logic for months, and implementing complex routing contracts.

Triangle streamlines this process into a simple clone-and-configure workflow.

**Get started:**

```

git clone https://github.com/nonechuckX/tycho-arbitrage

```

Full specifications: [TAP-4.md](https://github.com/propeller-heads/tycho-x/blob/main/TAP-4.md)

Join [tycho.build](http://tycho.build) for bot support and community resources.

**Important:** Educational purposes only. Code is unaudited - use at your own risk.

Tycho Integration Enables Multi-DEX Volume Flow Through Unichain Hooks

Thu 19th Jun 2025

Tycho introduces a solution for low solver volume in Unichain hooks by enabling integration with major DEXs like UniswapX, CowSwap, and 1inch.

Key features:

- Single integration reaches all Tycho solvers and market makers

- ~25ms block processing speed

- Automatic routing through new liquidity sources

- Open source library for simplified DEX integration

DEX builders and lending protocols can now receive flow without individual solver pitching. Integration documentation available at [Tycho docs](https://docs.propellerheads.xyz/tycho).

Workshop demonstration available at [YouTube](http://youtube.com/watch?v=TN6MfNFvfx8)

Announcing $30,000 in Bounties for Open-Source Trading Bots

Thu 8th May 2025

Three bounties of $30,000 total are available for building essential DeFi trading tools:

- **Atomic Searcher**: Find and execute profitable trades within blocks

- **Market Maker**: Monitor and maintain price ranges on DEXs

- **Cross-Chain Arbitrage Bot**: Execute profitable trades across two chains

Each project aims to make DeFi more efficient by helping teams bring liquidity and trading expertise onchain.

*Project Specifications:*

- [Atomic Searcher](https://github.com/propeller-heads/tycho-x/blob/main/TAP-4.md)

- [Market Maker](https://github.com/propeller-heads/tycho-x/blob/main/TAP-5.md)

- [Cross-Chain Bot](https://github.com/propeller-heads/tycho-x/blob/main/TAP-6.md)

Contact tanay_j on Telegram to participate.

Tycho Launches Local DEX TVL Tracking with $8k Bounty for UI Development

Thu 20th Mar 2025

Tycho introduces a new solution for tracking token, pool, and DEX Total Value Locked (TVL) with 100% local, trustless operation and zero latency. This tool is crucial for risk assessment in lending, managing direct incentives, and investment tracking.

- Built on Substreams by StreamingFast

- Currently supports Uniswap v2/v3 and Balancer weighted pools

- Upcoming support for Balancer v3, Curve, and Uniswap v4

An $8,000 USDC bounty is available for developers to build an open-source local DEX Explorer. Interested developers can find specifications on GitHub and contact tanay_j on Telegram.

[View Full Article](http://www.propellerheads.xyz/blog/track-onchain-liquidity-locally)