Origin Ether

Origin Ether was launched in May 2023 and is an ERC20 LST aggregator that generates yield while sitting in your wallet by tapping into blue-chip protocols. OETH is backed 1:1 by ETH, WETH, stETH, rETH, and frxETH at all times; holders can go in and out of OETH as they please. Similar to stETH, OETH yield is paid out daily and automatically (sometimes multiple times per day) through a positive rebase in the form of additional OETH, proportional to the amount of OETH held.

OETH yield comes from a combination of:

- Deploying collateral across Curve, Convex, Morpho, Balancer, and Aura

- LST validator rewards

- A 50bip exit fee is charged to those who choose to exit OETH via the dapp (completely avoidable if using a DEX), this fee goes back to OETH holders

- OETH sitting in non-upgradable contracts does not rebase, instead the interest generated from those tokens is provided to those that can rebase

These 4 yield generating functions combined enable OETH to generate higher yields than holding or farming any single LST manually. The current collateral allocation and yield strategies can be seen via the OETH.com analytics page. Future OETH collateral and yield strategies are governed by OGV stakers .

Origin Dollar Upgrade Enables Automated Multichain USDC Yield Aggregation

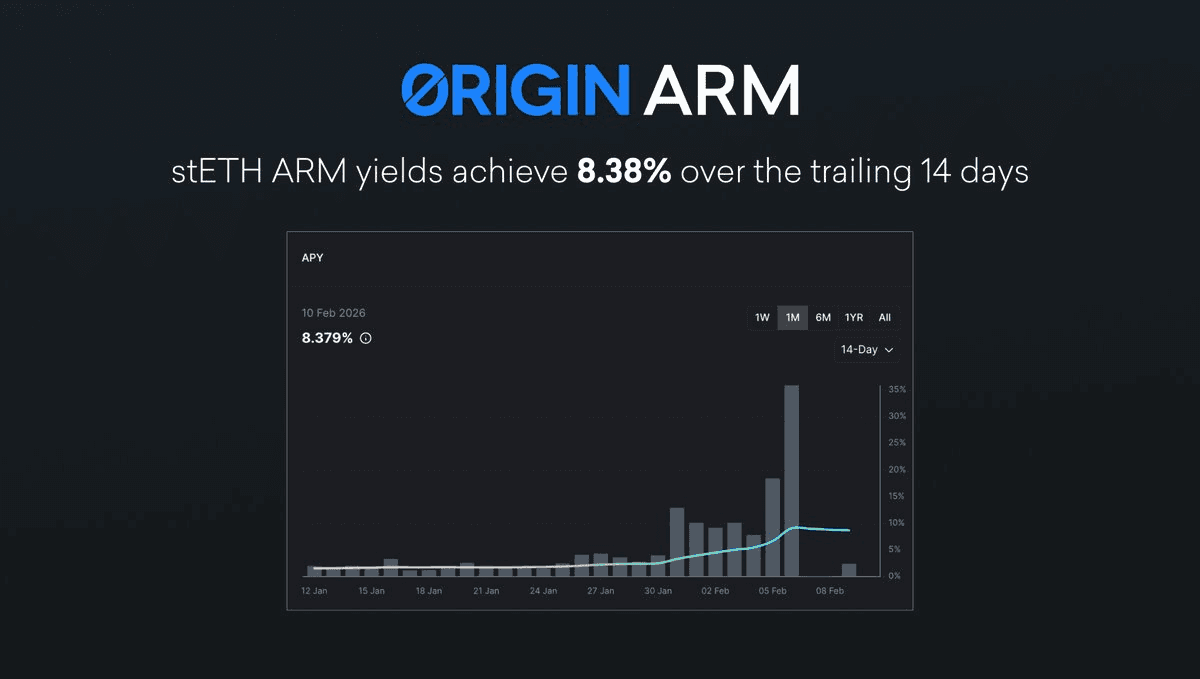

🎯 ARM Vault Captures 8.38% APY from stETH Price Volatility

Origin Launches ARM-WETH-stETH Pool on Curve with 11% APY

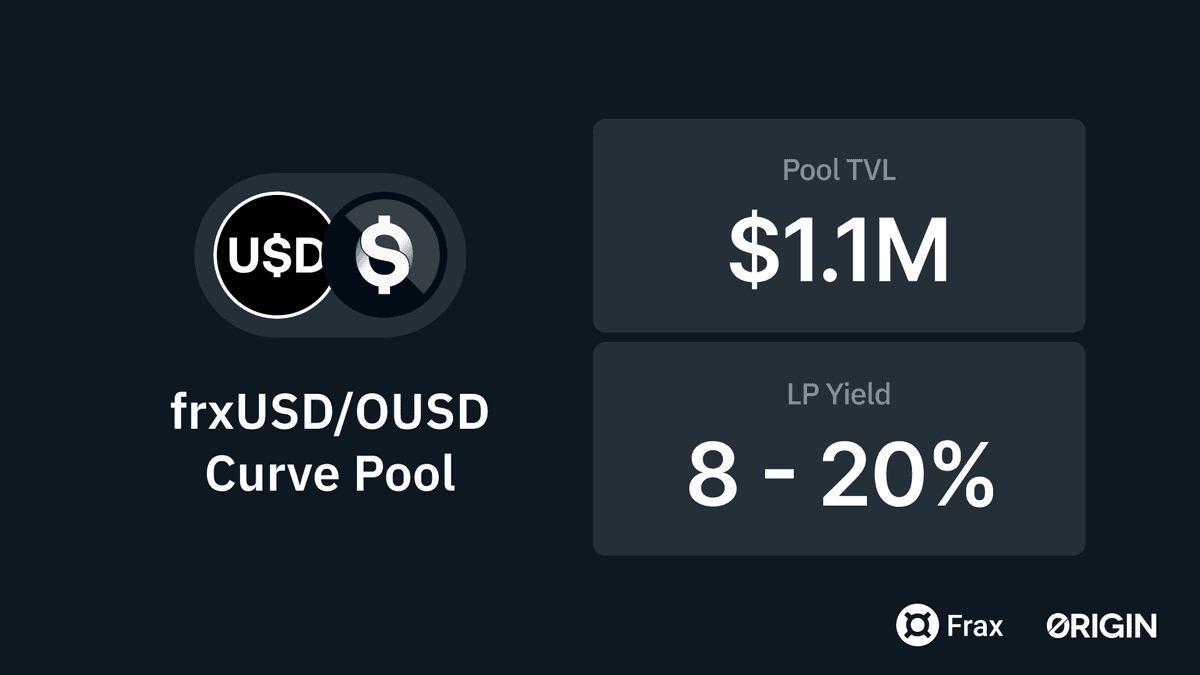

OUSD Expands Curve Integration with New Stablecoin Pools

🔥 stETH Volatility Trading

💰 Negative Rates Alert

Origin Protocol Hits 50M Token Buyback Milestone with 33% APY Staking Rewards

Origin Protocol November Update: Record Buybacks and Major OETH Upgrade

Origin Dollar Earns Low Risk Rating from BlueChip

Origin Protocol August Update: Record Staking Yields and Institutional Growth