MANTRA

MANTRA is a regulated DEX on MANTRA Chain, a security first RWA Layer 1 Blockchain, capable of adherence and enforcement of real world regulatory requirements. The MANTRA DEX will offer 24/7 trading of a wide selection of digital assets from alt coins to tokenized RWAs on a self-custodial exchange. There are several yield-bearing DeFi products featuring a Central Limit Order Book (CLOB) that will offer swap functionalities and tokenized trading of traditional financial products such as debt, commodities, and other real world assets (RWAs).

MANTRA Opens Fifth OM Token Tranche Claim Window Until February 22

Fri 6th Feb 2026

**Fifth $OM Tranche Now Claimable**

MANTRA has opened the fifth $OM upgrade tranche for claiming through their platform at [mantra.zone](http://mantra.zone). Users can access claims by clicking the 'Overview' section.

**Limited Time Window**

- Claims window: February 8-22, 2026 (2 weeks only)

- Deadline driven by upcoming $MANTRA upgrade scheduled for March 2, 2026

- This shortened claim period is specifically due to the network upgrade requirements

**Action Required**

Eligible users should visit [mantra.zone](http://mantra.zone) and complete their claims before the February 22 deadline to avoid missing this tranche allocation.

The compressed timeline reflects technical preparations for the March network upgrade.

BlackRock CEO Declares 2026 the Year of Global Asset Tokenization

Mon 9th Feb 2026

**BlackRock CEO Larry Fink** made a significant statement in Saudi Arabia about the pace of financial asset tokenization.

**Key Points:**

- Fink emphasized that the industry isn't discussing quickly enough how **every financial asset will be tokenized**

- Until recently, only the **Middle East, particularly Dubai**, has been moving rapidly on tokenization

- **2026 is positioned as the year** when tokenization acceleration goes worldwide

This marks a shift from regional adoption to global implementation of blockchain-based financial infrastructure.

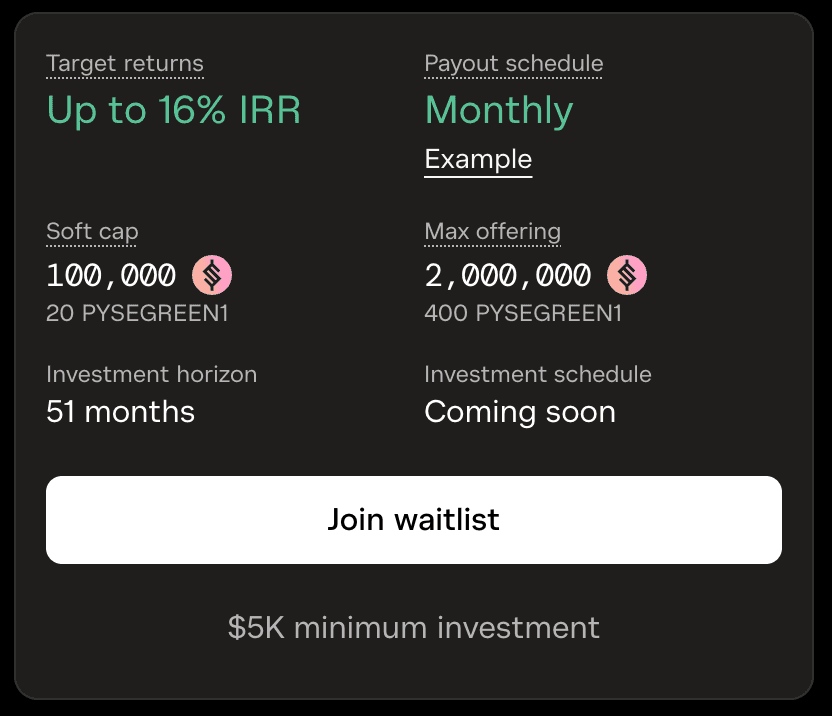

Dubai-Regulated E-Bike Fleet Token Opens to Investors February 10th

Fri 30th Jan 2026

**PYSE Green Velocity 1** launches February 10th for institutional and KYC-verified investors through MANTRA Finance, following approval from Dubai's Virtual Assets Regulatory Authority (VARA).

**Key Details:**

- Offers Shariah-compliant exposure to lease income from commercial electric motorbikes

- Serves Dubai's food delivery and e-commerce sectors

- Over $250,000 already committed by institutional investors

- Limited allocation available for MANTRA community and public participants

- Represents Dubai's continued leadership in bringing real-world assets (RWAs) onchain

The offering marks the first RWA product in Dubai to receive a VARA Non-Objection Certificate (NOC), demonstrating the emirate's position as a fast-moving jurisdiction for tokenized assets.

Interested investors can join the waitlist for access to this regulated investment opportunity in Dubai's growing electric vehicle infrastructure.

MANTRA Proposal 28 Open for Community Voting

Mon 26th Jan 2026

MANTRA Chain has an active governance proposal (Prop 28) currently open for community voting.

**Key Details:**

- Voting is live on Mintscan

- Community members can review proposal details and cast their votes

- [Access Prop 28 voting](https://www.mintscan.io/mantra/proposals/28)

This represents an opportunity for MANTRA token holders to participate in protocol governance decisions on the RWA-focused Layer 1 blockchain.

🚴 $250K Institutional Capital Commits to PYSE Green Velocity E-Bike Fleet

Fri 30th Jan 2026

MANTRA Finance's first regulated RWA product has secured over $250,000 in private institutional commitments. The **PYSE Green Velocity 1** offering tokenizes lease income from commercial e-bikes operated by UAE's leading food and e-commerce companies.

**Key Details:**

- Limited allocation remains for MANTRA community and public investors

- Compliant with VARA regulations

- Investors gain fractional ownership of operational lease income

- E-bike fleet serves major UAE delivery platforms

This marks MANTRA's entry into regulated real-world asset tokenization, bridging traditional fleet financing with blockchain infrastructure.

[Join the waitlist](https://mantra.finance/pyse)

🏦 Fund Tokenization Transforms PE, ETFs & Hedge Funds

Mon 24th Nov 2025

**Fund tokenization is reshaping traditional finance** through streamlined operations and enhanced accessibility.

**Key transformations include:**

- **Fractional ownership** - Breaking down investment barriers

- **Onchain liquidity** - 24/7 trading capabilities

- **Automated compliance** - Reducing operational overhead

- **Global access** - Expanding investor reach

**Impact across sectors:**

- Private equity funds gain operational efficiency

- ETFs benefit from enhanced liquidity mechanisms

- Hedge funds access new distribution channels

This shift builds on recent momentum, including Apex Global's Globacap acquisition for U.S. fund tokenization and Hong Kong's live settlement pilots with tokenized money-market funds.

**The technology enables:**

- Secure, scalable financial operations

- Reduced settlement times

- Lower operational costs

- Enhanced transparency

Tokenization represents a fundamental change in how funds operate, moving from traditional structures to blockchain-based systems that offer greater efficiency and accessibility.

[Read the full analysis](mantrachain.io/resources/ann)

🇦🇪 Abu Dhabi Awaits

Thu 4th Dec 2025

The MANTRA team heads to Abu Dhabi Finance Week 2025, one of the year's most significant Web3 and traditional finance gatherings.

**Key Focus Areas:**

- Partner meetings and strategic collaborations

- **Tokenization developments** and future roadmap

- Bridging Web3 and traditional finance sectors

ADFW25 represents a crucial moment where **capital movement strategies** for the coming year take shape. The event brings together industry leaders to discuss the convergence of blockchain technology with established financial systems.

The team will explore new opportunities in the **real-world asset tokenization** space, aligning with current market trends toward regulated digital asset trading.

MANTRA Chain Launches First MantraUSD Mint and New DeFi Infrastructure

Mon 1st Dec 2025

**MANTRA Chain achieved major milestones in December 2025:**

- **First mint of MantraUSD** - marking a significant step in their stablecoin ecosystem

- **Proposal 26 passes** - community governance continues to drive platform development

- **New infrastructure goes live** - four major dApps launched:

- LotusDex

- Brickken

- Element Market

- NestiFi

These developments represent **real-world utility scaling** as MANTRA expands its regulated DeFi ecosystem. The platform continues building infrastructure for tokenized real-world assets (RWAs) with 24/7 trading capabilities.

The new dApps add trading, marketplace, and DeFi functionality to the security-first Layer 1 blockchain designed for regulatory compliance.

MANTRA Chain Migration Deadline Approaches: 46 Days Left for ERC20 OM Token Holders

Mon 24th Nov 2025

**MANTRA Chain migration deadline reminder**: ERC20 $OM token holders have **46 days remaining** to migrate their tokens before the January 15, 2026 cutoff.

**Key details:**

- ERC20 $OM support will completely cease on January 15, 2026

- Migration must be completed before this date to avoid losing access

- Process is straightforward through official migration portal

**Migration resources:**

- Migrate tokens: [mantra.zone/migrate](https://mantra.zone/migrate)

- Learn more: [MANTRA Chain announcements](https://mantrachain.io/resources/announcements/erc20-om-deprecation)

- Check CEX migration status at [mantra.zone](https://mantra.zone)

**Action required**: Token holders should migrate immediately to avoid potential loss of access to their $OM tokens after the deadline.

MANTRA CEO Returns to Token2049 Stage for Sequel Fireside Chat

Thu 2nd Oct 2025

**MANTRA CEO JP Mullin** is set to appear at Token2049 today alongside Henri Arslanian for a follow-up to their previous Dubai fireside chat.

The session promises **honest takes and key milestones** for MANTRA Chain's development. This marks a return engagement following their previous appearance at Token2049 Dubai in April.

- Focus on **unfiltered discussion** about the project's progress

- Updates on **MANTRA Chain roadmap** and future plans

- Continuation of their candid conversation format

The appearance comes as MANTRA continues building its regulated DeFi infrastructure and RWA tokenization platform.