LOCKON

LOCKON creates an environment for investors to maximize the potential of cryptocurrencies by providing an investment method that minimizes risk while pursuing high returns. lockon leverages the power of on-chain analytics to identify superior addresses and then uses the diverse tokens held by those addresses to INDEX is constructed. In addition, dynamic portfolio adjustments optimize the investment for ever-changing market conditions.

Through the LOCKON platform, investors can choose between two INDEX options, "Passive" and "Balance". These products accommodate different risk tolerances and investment objectives and tailor the portfolio to the investor's needs.

LOCKON Postpones TGE Due to Market Crash, Extends Airdrop Campaign

Mon 24th Nov 2025

**LOCKON has postponed its Token Generation Event (TGE)** due to recent market volatility, prioritizing optimal launch conditions.

The project was preparing key components including:

- Staking functionality development

- External security audits

- Launch infrastructure

**Key Changes:**

- Original TGE date postponed indefinitely

- Airdrop campaign period extended

- New timeline to be announced once finalized

The team emphasized this decision aims to **maximize long-term value** for both the project and participants. They cite unforeseen market conditions as the primary factor behind the delay.

This follows a pattern of TGE postponements in the space, with projects prioritizing security audits and favorable market conditions over rushed launches.

*Further updates and revised schedules will be shared once confirmed.*

LOCKON Develops INDEX Token Staking Feature

Thu 4th Sep 2025

LOCKON is developing a new **INDEX staking feature** that will allow users to earn additional rewards.

- Users can purchase and stake INDEX tokens

- Staking will provide extra reward opportunities

- Feature currently in development phase

This builds on LOCKON's existing INDEX products that use on-chain analytics to track superior crypto addresses. The platform offers "Passive" and "Balance" INDEX options for different risk profiles.

The staking feature represents an expansion of LOCKON's investment ecosystem beyond their current portfolio tracking services.

INDEX Update: New Token Support Goes Live

Thu 26th Jun 2025

The INDEX platform has completed its latest update, expanding token support capabilities. This follows a series of planned improvements, including the May rebalancing of tracked addresses.

Key updates:

- Enhanced token support system now operational

- Performance improvements being rolled out

- System optimization continuing in coming days

This update builds on previous enhancements from May 2025, which included address rebalancing and infrastructure improvements. Users can expect to see enhanced performance metrics as the system stabilizes.

LOCKON Finance Announces INDEX Rebalancing on Polygon

Mon 17th Feb 2025

LOCKON Finance has completed a rebalancing of tracking addresses for their INDEX products (LAI, LBI, LPI) on the Polygon network. This update reflects the platform's commitment to dynamic portfolio optimization.

- Rebalancing affects all three INDEX products

- Changes implemented on Polygon chain

- Updated tracking addresses now live

For detailed information about the new tracking addresses, visit [LOCKON's official platform](https://app.lockon.finance/indexes).

This rebalancing follows previous adjustments from October 2024, maintaining LOCKON's strategy of optimizing portfolios based on top-performing addresses.

LOCKON Launches New Multi-Chain Index Product LMA

Thu 26th Dec 2024

LOCKON has introduced LMA (LOCKON Multi Index Arbitrum), a new INDEX product that tracks high-performing addresses across multiple blockchains including Ethereum, Arbitrum, Polygon, BSC, and BASE.

Key features:

- Multi-chain portfolio replication

- Sharpe ratio of 12.11, outperforming existing products

- Aims for more stable performance vs single-chain analysis

Performance comparison (Sharpe ratios):

- LMA: 12.11

- LAA: 8.65

- LAI: 8.47

- BTC: 3.7

The higher Sharpe ratio indicates better risk-adjusted returns compared to both traditional crypto assets and LOCKON's existing products.

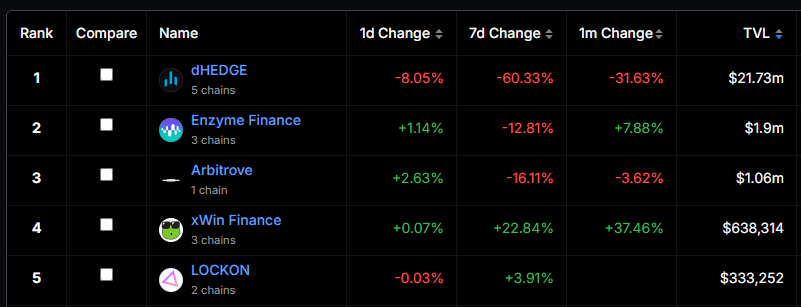

LOCKON's Arbitrum INDEX Listed on DefiLlama, Ranks 5th

Thu 26th Dec 2024

LOCKON's Arbitrum-based INDEX has achieved a significant milestone by being listed on DefiLlama, securing the 5th position in the INDEX category on Arbitrum. The INDEX, known as LAA, has demonstrated strong performance with a +29% increase over three months.

- Successfully listed on DefiLlama's INDEX tracking

- Ranks 5th among Arbitrum INDEX products

- Automated trading system follows top-performing addresses

- Recently executed strategic BTC to ETH rotation

The platform's automated system continues to adapt to market conditions through smart portfolio adjustments.

LOCKON Advancing Towards Multi-Chain Compatibility

Tue 15th Oct 2024

LOCKON is expanding its capabilities with multi-chain support. Currently focused on Polygon, the platform is set to integrate data from Ethereum, Arbitrum, BSC, and BASE.

Key points:

- Unified data across multiple chains

- Seamless operations on Arbitrum

- Enhanced operational efficiency expected

This update aligns with broader industry trends, as seen in Solana's recent move to enable asset transfers across 70+ chains including Arbitrum, Ethereum, and Polygon.

The multi-chain approach aims to provide users with a more comprehensive and efficient trading experience, potentially opening up new opportunities in the crypto market.