DeFi

De.Fi is the inventors of First Crypto Antivirus & Scams/Hacks Finder, as well as:

- Inventors of Web3’s First SuperApp

- Inventors of Web3’s First SocialFi With 2M+ Users Signed Up

- Inventors of Crypto's First Audit & REKT Databases

- Inventors of Crypto's Most Advanced Revoking Tool

- & more.

Since launching in August 2020 De.Fi has already grown to over 5 million users in 2023 and $25 billion in user funds tracked.

Investors include top funds like HOF Capital & Fenbushi, top exchanges like OKX & Huobi, & angels like Justin Lee from Coinbase Ventures and John Izaguirre Former Binance Chain Director.

De.Fi CTO: Security Must Come Before Growth in 2026

Fri 6th Feb 2026

De.Fi's Chief Technology Officer issued a reminder about prioritizing security in blockchain development for 2026.

**Key Message:**

- Both builders and users need to maintain active security practices

- Security should be the foundation before pursuing growth

- First technical hire should be security-focused

The message echoes previous guidance from April 2025 emphasizing that projects without proper security measures shouldn't proceed. The CTO stressed that security infrastructure must be established before any marketing or expansion efforts.

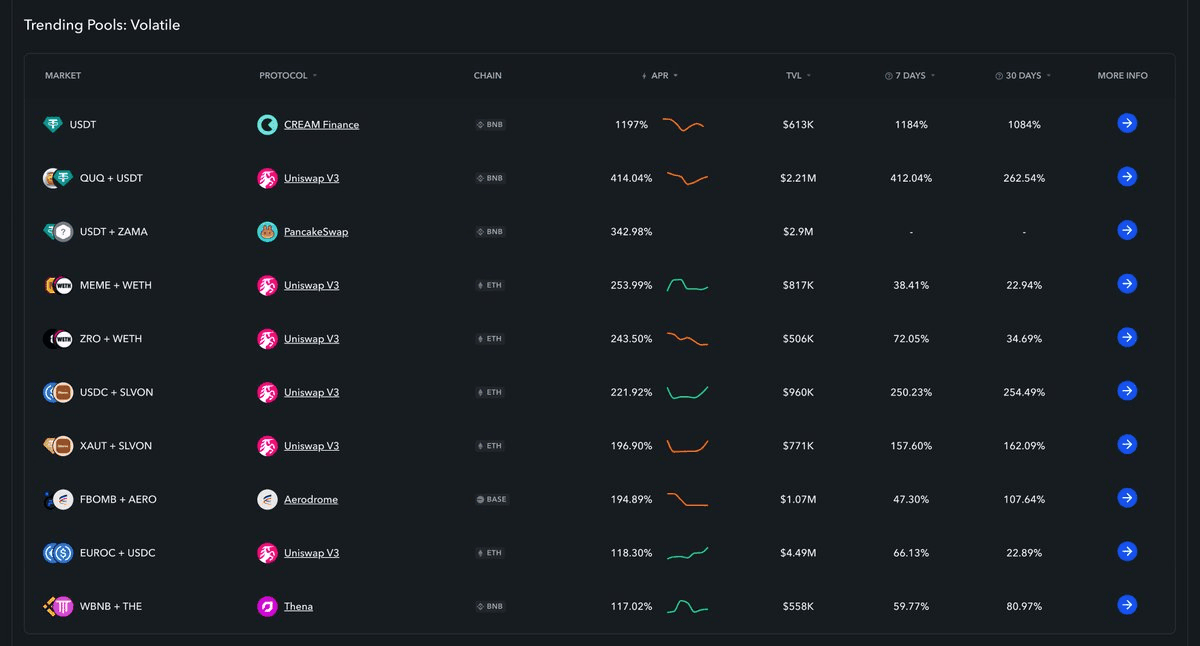

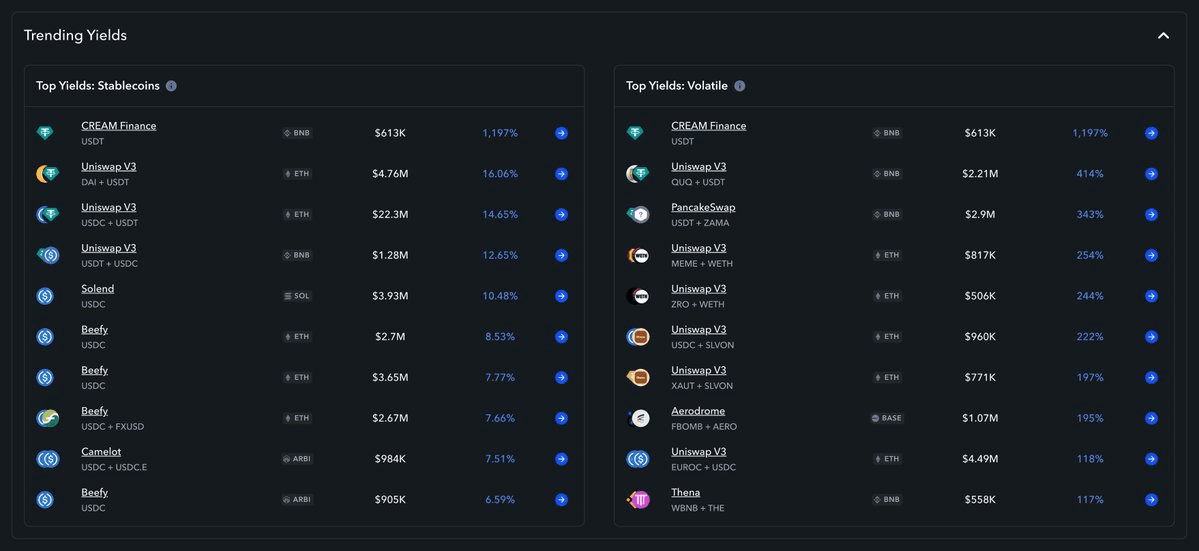

De.Fi Launches Explore Yields Analytics - Advanced DeFi Yield Intelligence Tool

Fri 6th Feb 2026

De.Fi has launched **Explore Yields Analytics**, a comprehensive tool designed to help users navigate DeFi yield opportunities with greater transparency and safety.

**Key Features:**

- **Top Yields Dashboard** - View top 10 stablecoin and volatile yield opportunities side-by-side, filterable by blockchain network. Only pools with TVL > $500k are displayed to avoid liquidity traps

- **Trending Pools** - Discover emerging opportunities based on 30-day TVL momentum using De.Fi's proprietary analytics algorithm

- **Advanced Analytics** - Click any opportunity to access historical APR charts, TVL trends, DeFi Scanner scores, contract explorer links, and validator data

- **Smart Filters** - Toggle across multiple chains including Ethereum and Fantom, with detailed protocol, chain, APR, and TVL data for each pool

The tool aims to provide context beyond simple APR numbers, helping users make informed decisions about yield farming opportunities across the DeFi ecosystem.

[Start exploring yields](http://de.fi/explore/analytics)

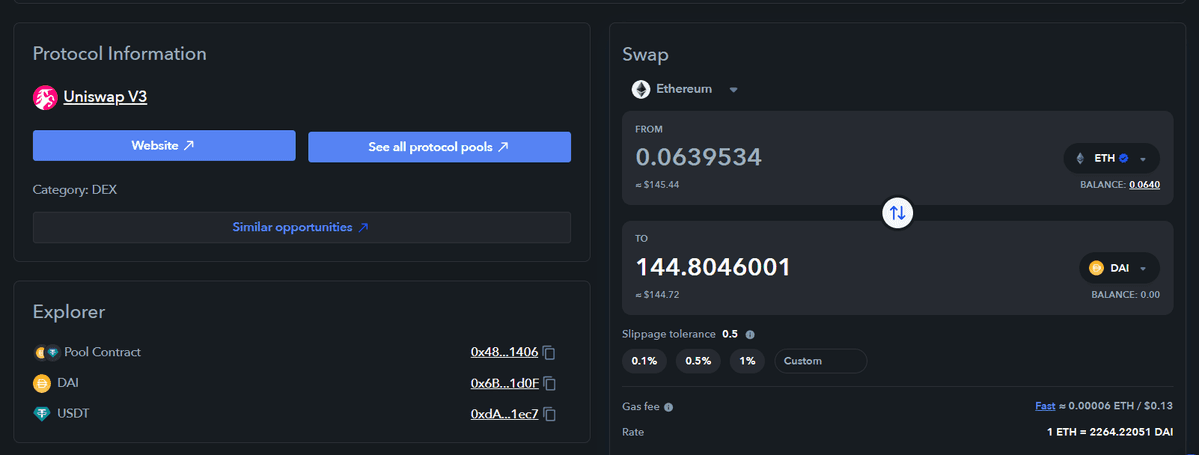

DeFi Platform Introduces Unified Interface for Pool Management and Trading

Fri 6th Feb 2026

A DeFi platform has launched an integrated interface that consolidates multiple functions on pool pages:

**Key Features:**

- Built-in token swaps directly on pool pages (e.g., ETH to DAI on Uniswap V3)

- Instant access to contract addresses for verification

- One-click navigation to similar opportunities and protocol resources

**Benefits:**

- Eliminates tab switching during trading workflows

- Combines research, validation, and execution in a single interface

- Streamlines the user experience for DeFi operations

The update builds on previous embedded onchain actions that allowed users to swap, buy, send, place limit orders, and provide liquidity without leaving token and pool detail pages.

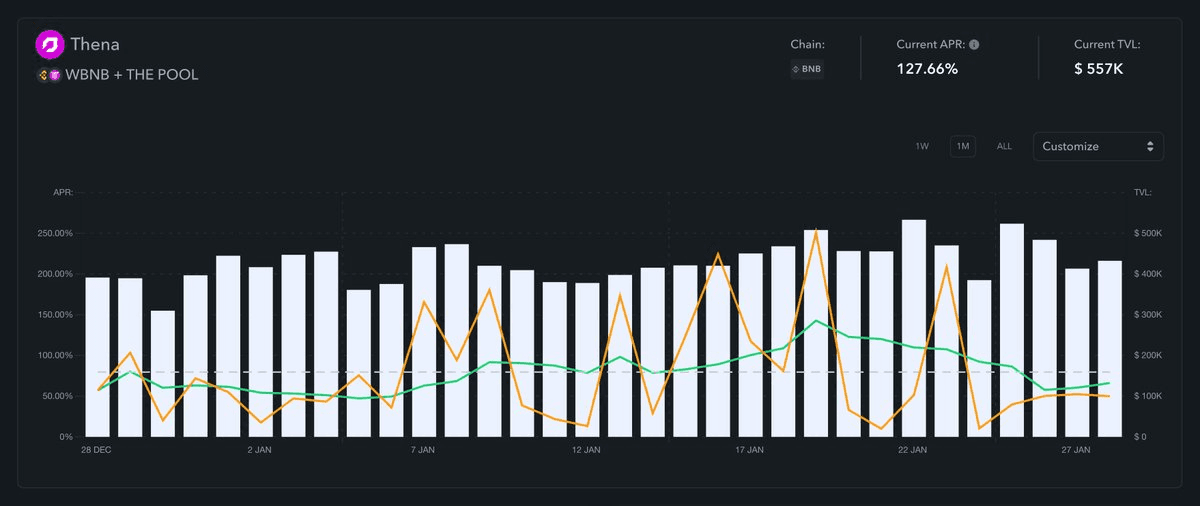

De.Fi Advanced View Adds Historical Performance Tracking and Security Metrics

Fri 6th Feb 2026

De.Fi has launched an Advanced View feature that provides users with comprehensive pool analytics:

**Key Features:**

- Historical APR performance tracking

- TVL (Total Value Locked) growth trends over time

- De.Fi Scanner Score for security assessment

- Direct explorer links for contracts and tokens

- Validator details for applicable pools

The tool enables one-click access to critical data points, allowing users to analyze investment opportunities quickly. Users can tap any pool to view historical charts, contract information, and security scores in seconds.

This update builds on De.Fi's existing suite of security and analytics tools, adding deeper insights for DeFi investors making portfolio decisions.

De.Fi Dashboard Adds Cross-Chain Filtering and Historical APR Charts

Fri 6th Feb 2026

De.Fi has enhanced its dashboard with new comparison tools designed to streamline decision-making for DeFi users.

**Key Features:**

- **Cross-chain filtering** across all data tables

- **One-click access** to historical APR charts

- **Integrated validator and protocol data** viewable without leaving the dashboard

The update focuses on structured data presentation to enable direct comparisons rather than guesswork when evaluating DeFi opportunities.

De.Fi Ranks Trending Pools by 30-Day TVL Movement to Spot Early Momentum

Fri 6th Feb 2026

De.Fi's trending pools feature helps users identify emerging opportunities through data-driven analysis.

**Key Features:**

- Pools ranked by 30-day Total Value Locked (TVL) movement

- Uses De.Fi's internal analytics system

- Designed to spot momentum before it becomes widely recognized

**Purpose:**

The tool aims to help users discover rising pools early, before broader market attention drives up competition and potentially reduces returns.

De.Fi positions this as a signal-based approach rather than hype-driven recommendations.

De.Fi Upgrades Yield Discovery with Enhanced Pool Filtering and TVL Minimums

Fri 6th Feb 2026

De.Fi has streamlined its yield discovery interface with clearer presentation of opportunities:

**Key Features:**

- Top 10 stable and volatile pools displayed side by side

- Direct visibility of protocol, chain, APR, and TVL data

- Chain-specific filters for targeted opportunity discovery

- $500k minimum TVL requirement to filter out low-liquidity pools

The update removes friction from the yield hunting process by eliminating the need to dig through multiple layers of data. Users can now quickly compare stable versus volatile options while ensuring adequate liquidity depth through the TVL threshold.

🔒 CTO Reveals Why Most Production Security Failures Could Have Been Prevented

Thu 15th Jan 2026

De.Fi's CTO Artem published insights on production security failures and why they're largely preventable.

**Key takeaway:** Security reviews should be mandatory, not optional.

This follows a pattern of technical insights shared by the CTO, building on previous threads about security best practices in web3 development.

The thread addresses common vulnerabilities that lead to production failures and offers practical guidance for development teams.

De.Fi Launches Smart Send and Swap Features

Mon 15th Dec 2025

**De.Fi introduces enhanced sending and swapping capabilities** through their platform at de.fi/send and de.fi/swap.

The Web3 security company, known for their crypto antivirus and scam detection tools, is expanding their SuperApp functionality with **smarter transaction features**.

- New send feature at [de.fi/send](http://de.fi/send)

- Enhanced swap functionality at [de.fi/swap](http://de.fi/swap)

De.Fi has built a reputation as Web3's first SuperApp with over 5 million users and $25 billion in tracked funds. Their platform combines security tools with practical DeFi features.

**Try the new smart sending and swapping tools** to streamline your crypto transactions.

DeFi Send Expanding Beyond Crypto with NFT Transfer Feature

Thu 4th Dec 2025

**DeFi Send is adding NFT transfers** to its multi-chain platform, expanding beyond cryptocurrency transactions.

The service currently supports:

- **Cross-chain transfers** across 8 blockchains

- Transfers to wallets, domains, or identities

- **Zero extra fees** for transactions

- Custom slippage tolerance and instant execution

The upcoming **NFT transfer feature** will allow users to manage both crypto and NFTs in one unified platform, making digital asset management more streamlined.

DeFi Send positions itself as a cost-effective alternative to traditional transfer methods, eliminating additional fees while maintaining fast execution speeds.