Alpaca Finance

Alpaca Finance is the first leveraged yield farming protocol built on the Binance Smart Chain. We are a fair launch project with no pre-sale, no investor, and no pre-mine. It is truly a product built by the people, for the people.

Why did we build Alpaca Finance?

As Binance Smart Chain (BSC) becomes more popular, we see a gap in applications offered on BSC compared to other chains such as Ethereum. One of the key missing pieces is an on-chain leverage protocol!

Pioneered by Compound during the DeFi Summer, yield farming has become a popular way for projects to bootstrap their liquidity and acquire new users. Alpaca Finance seeks to expand on the success of these trailblazers by providing value to the BSC community through leveraged yield farming.

We believe Alpaca Finance will give farmers a chance to enhance their yield — which so far has only been a whale game on Ethereum where the gas fee is just too damn high!

Our Protocol: As a user, you can participate in Alpaca Finance in four different ways:

- Lender

- Yield Farmer

- Bounty hunter

- Liquidator

Alpaca Finance Announces Shutdown After 4-Year Journey

DOJ Cleared to Sell Seized Bitcoins, UK Updates Staking Rules, Coinbase Gets Appeal

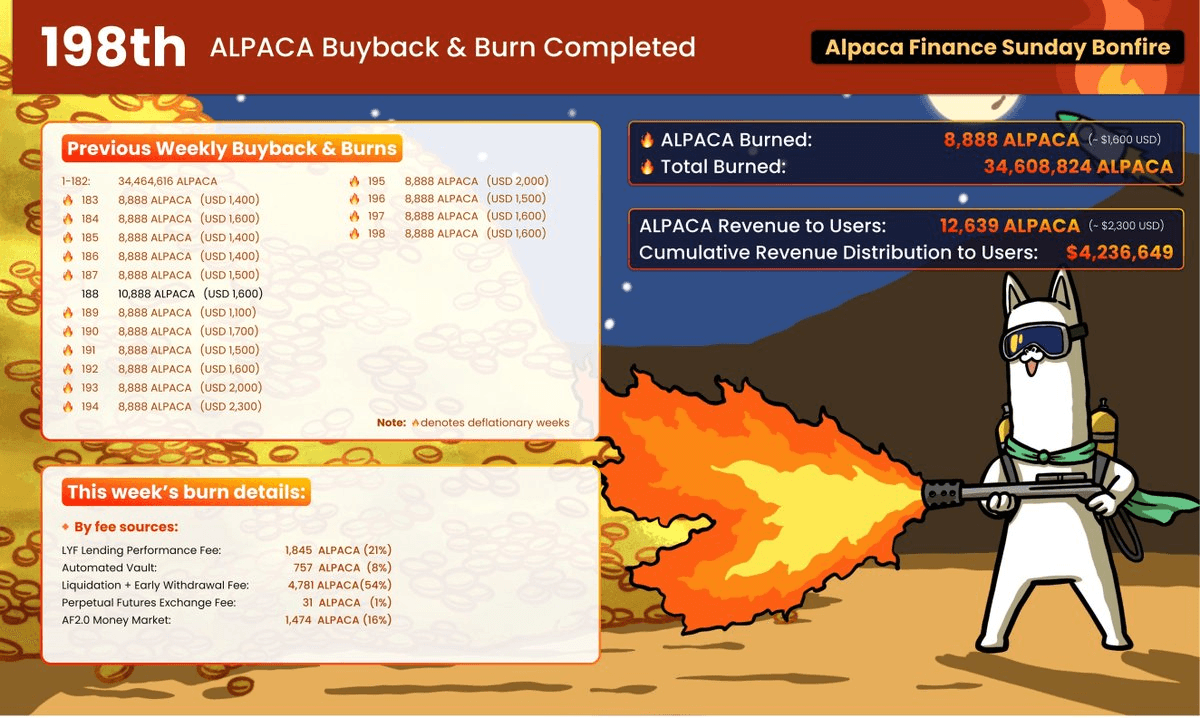

Alpaca Finance Completes 199th Weekly Token Burn