zkSync Ecosystem Shows Strong Revival with 114% APY Attracting Liquidity Providers

zkSync Ecosystem Shows Strong Revival with 114% APY Attracting Liquidity Providers

🔥 zkSync's 114% Surprise

zkSync is experiencing a significant resurgence as liquidity providers flock to the platform, drawn by attractive yields.

Key developments:

- ZK token showing renewed strength and momentum

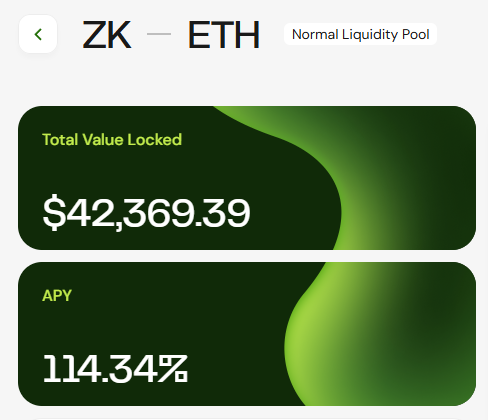

- 114% APY available for liquidity providers

- Over $7 million in liquidity for USDC-USDT stable pool

- Nearly $1 million in the ZK-ETH pool

Market response: The high annual percentage yields are signaling strong demand and confidence returning to the zkSync ecosystem. Liquidity providers are positioning themselves to capitalize on these attractive returns.

Looking ahead: The momentum appears to be building with zkSync Ignite continuing to drive growth and adoption across the platform.

Consider monitoring zkSync's ecosystem development and liquidity trends for potential opportunities.

Koi Finance Burns 20% of Total Token Supply Following Governance Vote

Following a successful governance proposal, Koi Finance has executed a significant tokenomics adjustment by burning 20% of its total token supply. The tokens were bridged from zkSync to Ethereum L1 where the burn was completed. The move follows a February proposal that outlined major tokenomics changes including: - Burning up to 20% of supply - Phasing out veKOI rewards - Implementing single-token governance - Shifting focus to long-term growth The burn transaction can be verified on [Etherscan](https://etherscan.io/tx/0x76cce493859f81e4af6a707d9a712f74549e8e093e15b95ba3311576e2e52777)

ZK/ETH Liquidity Pool Maintains High Returns

The ZK/ETH liquidity pool continues showing strong performance metrics: - Current liquidity: $747K - 24hr fee earnings: $2,600 - Current APY: 128% This maintains the positive trend from March 13th when the pool generated $2,361 in fees with $760K liquidity at 113% APY. *Note: High APY rates are variable and not guaranteed to continue at these levels.*