Zharta Launches LP NFT Collateral System for DeFi Lending

Zharta Launches LP NFT Collateral System for DeFi Lending

🔄 LP NFTs Just Got Useful

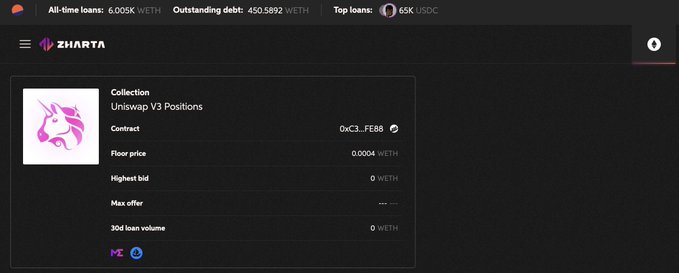

Zharta introduces a new DeFi lending feature that allows Uniswap LP NFTs to be used as collateral. Key features:

- Borrow USDC or WETH against Uniswap LP positions

- Continue earning yields while using LP as collateral

- Smart contract-based position understanding

- Natural hedging mechanism against impermanent loss

The system enables capital-efficient liquidity access while maintaining exposure to LP yields. Users can access instant liquidity without exiting their Uniswap positions.

Visit Zharta or access the lending platform directly.

Uniswap LPs are no longer idle 🔥 Zharta now supports LP NFTs as collateral, enabling structured liquidity access for capital-efficient DeFi users. Built for those underwriting risk, not avoiding it. @UniswapFND @Uniswap

You’ve been underusing your Uniswap LP positions. That ends now For years, LP tokens just… sat there. Earning fees, yes — but totally illiquid Capital locked. Strategy stalled Not anymore With LP-as-collateral, you can now borrow stablecoins against your LPs → Unlock

Turn LP NFTs into real collateral with Zharta: – Use your Uniswap LPs as structured backing – Borrow instantly in USDC or WETH – Keep earning while your collateral works This isn’t a workaround, it’s collateral logic for DeFi Welcome to a new standard in on-chain lending

🔍 A quick explainer on how hedging works on Zharta using your Uniswap LPs: 1️⃣ You lock your Uniswap LP NFT on Zharta as collateral 2️⃣ The smart contract understands your position 3️⃣ It then lets you borrow ETH or USDC against that LP, turning your passive LP into instant

Meet LP-backed lending on Zharta: – Turn your LP NFTs into collateral – Borrow instantly in USDC or WETH – Keep earning impermanent yield This isn’t hype, it’s a liquidity infrastructure move Welcome to the next step in DeFi lending

The Evolution of DeFi: Building Sustainable Systems Over Yield Chasing

The next phase of DeFi development is shifting focus from high-yield farming to building sustainable infrastructure. Key developments include: - Advanced collateral management systems - On-chain risk modeling capabilities - Capital-efficient protocol design This evolution emphasizes creating robust financial architecture that can: - Support institutional-grade complexity - Maintain DeFi's core principles - Enable true interoperability The industry is moving toward composable debt structures and programmable liquidity, prioritizing long-term sustainability over short-term gains. This marks a significant maturation of the DeFi ecosystem.

RWA Summit Cannes: Institutional Adoption Moves from Theory to Practice

The RWA Summit in Cannes marked a significant shift in the real-world asset tokenization landscape. Key developments: - Institutional adoption and RWA infrastructure moving from conceptual to execution phase - Strong focus on real estate as the leading RWA category - Growing presence of traditional financial institutions - Geographic expansion into LATAM, Africa, and Southeast Asia markets This follows the momentum from #Token2049, where RWA discussions dominated the agenda. Infrastructure development is accelerating across oracles, credit protocols, and compliance systems. *Market signals indicate increasing institutional interest in establishing robust rails for real capital deployment.*

Zharta Launches V2 NFT Lending Protocol with P2P Features

Zharta has launched its V2 NFT lending protocol with several key features: - **Peer-to-Peer Lending**: Users can now set custom loan conditions - **Refinance Tools**: Lenders can sell loans, borrowers can improve terms - **Mobile Access**: New app for on-the-go lending management - **Custom Offers**: Target specific NFT traits for precise lending - **Gas Efficiency**: Up to 50% savings on transaction fees The protocol maintains pro-rata interest and no auto-liquidations. Multi-chain expansion is planned, and a token launch with rewards for early adopters is upcoming. *Visit app.zharta.io/lending to get started*