YieldNest Introduces Capital Productivity Layer for Restaking

YieldNest Introduces Capital Productivity Layer for Restaking

🔄 Restaking Gets Productive

YieldNest is launching a new approach to restaking that focuses on capital productivity rather than just security. Their MAX LRTs are multi-strategy vaults that combine ETH staking, EigenLayer restaking, DeFi yield, lending, and Layer 2 solutions. The system uses AI rebalancing to automatically direct ETH to optimal strategies based on yield, liquidity, and risk factors. Rather than letting assets sit idle waiting for AVS rewards, YieldNest actively seeks current yield opportunities while maintaining flexibility for future restaking rewards. The platform aims to solve the challenge of sustainable scaling through active strategy optimization and modular architecture.

Happy Friday! Despite market challenges, yields provide a valuable hedge against volatility. 🔹 TVL: $21.11M (+2.72%) 🔹 Top MAX LRT: $ynETHx 🔹 New DeFi Integrations & APY Opportunities Let’s break it all down👇

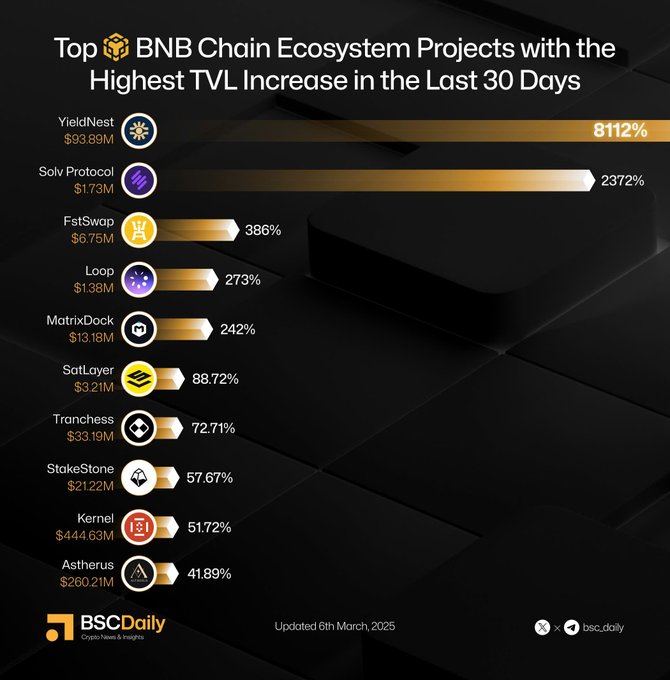

YieldNest’s TVL increased over 8000%. This is the HIGHEST growth in the @BNBCHAIN ecosystem in the last 30 days, currently sitting at $113M. Bigger things incoming. 👀

✨Top @BNBCHAIN Ecosystem Projects with the Highest DeFi TVL Increase in the Last 30 Days 📸Highlighted Protocols: @YieldNestFi @SolvProtocol @FstSwapFinance @loopfixyz @matrixdock @satlayer @Tranchess @Stake_Stone @kernel_dao @AstherusHub

Tired of low yields & endless protocol-hopping? Dive into our latest article on MAX LRTs—where restaking meets DeFi in a single, high-reward token. Discover how to unlock high APYs, risk-adjusted returns, and a simpler path to DeFi success. medium.com/@yieldnest/max…

Tweet not found

The embedded tweet could not be found…

Building the future of DeFi yield isn’t just about adding strategies, it’s about implementing the right architecture. Here’s how YieldNest’s MAX LRTs are designed to unify, automate, and optimize yield across DeFi and restaking. 🧵

1/ 💥[BIG NEWS] Airdrop Incoming! We are getting ready to reward our most engaged community members, partners and active DeFi participants. Whether you’ve been stacking Seeds or holding key partner assets, you might be eligible for exclusive $YND rewards.

In 2025, the @YieldNest TVL has surged by 57.14%, reaching $21.11 million 🚀 With ynETHx, ynBNBx, and high-yield MAX LRTs, there’s no limit to these yields. Check out: app.yieldnest.finance

1/ 🔥 The upgrade for $ynETHx is live! With our first-ever MAX LRT— it's possible to unlock a true “deposit-and-forget” experience. Make sure you upgrade your existing ynETH or ynLSDe to tap into MAX yields!

1/ Defying the current market conditions, YieldNest’s TVL has surged to more than $114M! 🔥 ⚡ Whatever the weather, this shows that DeFi can still thrive, even in harsh conditions. Talking about unstoppable momentum towards TGE!

✅ DeFi mindshare is back on the rise. ✅ YieldNest hitting TVL all-time highs. It's DeFi SZN.

The best DeFi yields aren't confined to a single protocol; they span across ecosystems. However, most yield products lock you into one strategy. That's why YieldNest's MAX LRTs embrace composability, allowing your assets to move with the yield, not against it. Here's how. 👇

Most protocols are focused on security, but very few consider capital productivity. Just restaking isn’t enough. Here’s how YieldNest is building the missing layer in the restaking ecosystem. 👇

Spectra Launches on BNB Chain with YieldNest Integration

Spectra has launched on BNB Chain in partnership with K3 Capital, featuring integration with YieldNest's ynBNBx pool. The launch is backed by K3's $4M seed investment. Key Features: - Fixed Rate tool for BNB yields - Enhanced yield via Yield Leverage - Principal Token looping on lending platforms - Liquidity Provision to Spectra pool The integration offers secure, auto-compounding yield on BNB through YieldNest's infrastructure. Users can access these features through [Spectra's platform](http://app.spectra.finance/fixed-rate/) or [YieldNest's interface](https://app.yieldnest.finance/token/ynBNBx). Ready to maximize your BNB yields? Explore the new features today.

YieldNest Introduces MAX LRTs: Combining Restaking and DeFi

YieldNest launches MAX LRTs, a new DeFi solution that merges restaking with traditional DeFi yields in a single token. Key features: - Auto-compounded returns - 24/7 AI-powered security monitoring - Integration with real estate assets via $ynRWAx - Simplified yield optimization The platform aims to eliminate the need for protocol-hopping while maintaining competitive APYs. Their upcoming $ynRWAx token will connect real estate assets to DeFi infrastructure, offering transparent, verifiable returns. Learn more: [YieldNest Article](https://medium.com/@yieldnest/maximize-yields-with-yieldnest-9fde88986a58)

YieldNest TGE Launch Announcement

YieldNest is launching its Token Generation Event (TGE), marking a significant milestone in DeFi's liquid restaking landscape. The protocol introduces risk-adjusted restaking strategies through a simplified interface, focusing on: - One-stop-shop for nLRT and LRT products - Optimized yield opportunities - Streamlined restaking experience *Participants should conduct their own research and understand associated risks before participating in the TGE.* For detailed information and participation guidelines, follow YieldNest's official channels.

YieldNest Showcases Strategic Partnerships Ahead of TGE

YieldNest has announced its comprehensive partnership network ahead of its Token Generation Event (TGE). The protocol has established collaborations across multiple blockchain ecosystems: - **BNB Chain Partnerships**: Including BNB Chain, Kernel DAO, THENA, and PancakeSwap for BNB restaking solutions - **Ethereum Ecosystem**: Partnerships with Curve, Lido, Frax Finance, and EigenLayer for advanced restaking capabilities - **Security Partners**: Collaborations with Hypernative, LlamaRisk, Immunefi, and ChainSecurity for protocol safety - **Infrastructure**: Working with Aragon for governance, StakeDAO for liquid staking, and Enso Network for DeFi integrations These partnerships aim to enhance YieldNest's DeFi offerings and security infrastructure. [Learn more about the TGE](https://gov.yieldnest.finance/c/strategie/11)

Ethereum PoS Transition Shows Significant Impact on Network Economics and Security

Ethereum's shift to Proof-of-Stake continues to demonstrate measurable benefits. Since The Merge in September 2022: - Supply reduced by 417,413 ETH - 1,509,991 ETH burned in 540 days - Enhanced network security through staking mechanism - Improved MEV (Maximal Extractable Value) handling The transition marks a significant milestone in Ethereum's evolution toward greater efficiency and decentralization. Data from ultrasound.money confirms the deflationary effect on ETH supply, validating the network's economic model.