Yield Trends in DeFi 2025: Lazy Summer Protocol Analysis

Yield Trends in DeFi 2025: Lazy Summer Protocol Analysis

🦥 DeFi Gets Lazy

DeFi has evolved significantly since 2020, shifting from experimental projects to structured platforms focused on risk management and automation.

Key developments:

- 36 different yield strategies now available in the ecosystem

- Automated exposure through Lazy Summer Protocol

- Focus on sustainable, hands-off investment approaches

- Enhanced protocol stability and risk assessment

The market shows increased demand for passive investment options that require minimal management after initial deposit. Users now prioritize time efficiency and risk-adjusted returns over high-yield, high-maintenance strategies.

this is DeFi today - yuge potential, but overwhelming. Here we have a list of 36 different strategies that all fluctuate in yield. Lazy Summer gives automated exposure to similar strategies, so you never lift a finger after deposit.

Yield Bearing Stablecoins List Q2 + Yield Sources - Rates as of 7 April '25 I manually scanned each product's interface and cross-checked it with external sources - @DefiLlama or available yield markets such as @spectra_finance's stablecoin category. [list of X handles below]

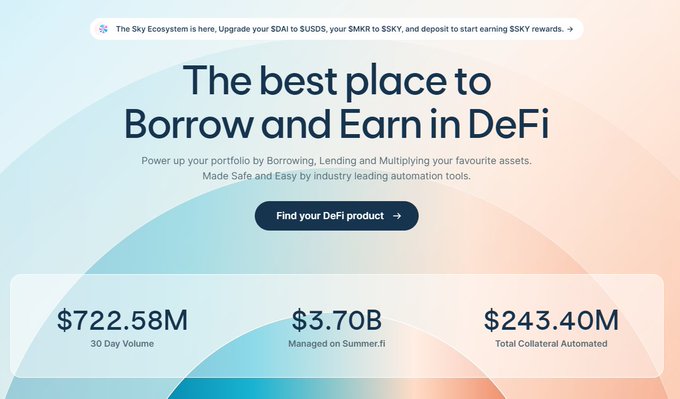

DeFi Market Watch: Ethereum Activity Surges Despite TVL Decline

Despite a 27% decrease in DeFi TVL during Q1, Ethereum shows robust network activity with $2.2M in fees on April 7, outpacing Solana's $960K. This indicates sustained engagement with on-chain services. Key developments: - Restaking protocols and LSTs gaining traction - Yield opportunities re-emerging across DeFi - Network activity remains strong despite TVL fluctuations [Summer.fi](http://summer.fi) provides a unified dashboard for managing DeFi positions across multiple protocols, offering automation and monitoring tools for experienced users navigating the evolving landscape.

Summer.fi Announces AI Integration for Strategy Validation

Summer.fi has reached a significant milestone in implementing AI technology for DeFi strategy validation. The platform is integrating intelligent systems to enhance safety and efficiency in decentralized finance operations. - New AI features will improve automated strategy validation - Implementation planned for rollout in 2025 - Technology aims to create more secure and efficient DeFi operations This development follows industry trends, with platforms like Alethea AI demonstrating the potential of AI integration in DeFi for enhanced user engagement and self-adjusting financial contracts. *Want to learn more?* Visit Summer.fi to explore their upcoming AI-powered features.

September Rewind: Summer.fi Updates and Milestones

Summer.fi had a busy September with several key updates: - Released Lazy Summer protocol Litepaper, a permissionless passive earn product coming in Q1 2025 - Launched second phase of $RAYS program with new points for active users - Integrated @SkyEcosystem (formerly MakerDAO) features - One user surpassed 1M $RAYS milestone Key features: - Token upgrades and diverse earning opportunities available - Strategy insights accessible at summer.fi/rays - Community support via Discord at chat.summer.fi Stay tuned for more developments as Lazy Summer protocol approaches.

New $rsETH Market with Higher LTV on Summer.fi

Summer.fi has introduced a new $rsETH market with improved terms: - Higher Loan-to-Value (LTV) ratio of 94% (up from 86%) - Additional benefits include: - Summer.fi $RAYS - 3x Kelp Miles - $USDC incentives from KelpDAO This new offering enhances the Earn pairs suite, providing users with more attractive options for yield generation. For more information or to ask questions, join the Summer.fi Discord community at chat.summer.fi.