In 2024, the role of a yield aggregator offers a unique vantage point on the evolving financial landscape. As decentralized finance (DeFi) continues to gain traction, yield aggregators play a crucial role in optimizing returns for users by dynamically allocating assets across various DeFi protocols and platforms. This perspective provides insights into the democratization of finance, where financial services are accessible to a broader audience, fostering inclusivity and empowment.

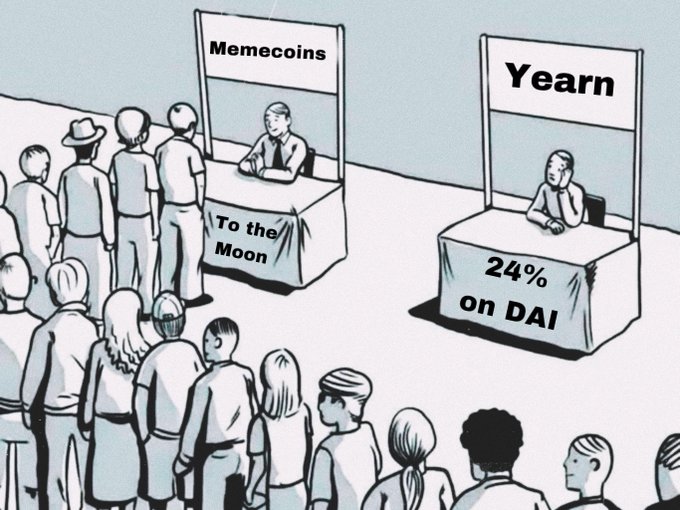

POV, you are a yield aggregator in 2024

Yearn Finance Activates Revenue Distribution for YFI Stakers

Yearn Finance has begun distributing revenues to YFI token holders who stake their tokens. Users can stake through three methods: - **Direct veYFI staking** - Lock YFI tokens to receive veYFI and earn rewards - **Liquid locker protocols** - Stake through platforms like 1up, Cove, or StakeDAO - **Boosted vault deposits** - Earn enhanced yields on vault deposits **How rewards work:** Every two weeks, veYFI holders vote to direct dYFI rewards to specific vaults. Your reward rate depends on your veYFI balance: - Minimum boost: 10% (1x) with no veYFI - Maximum boost: 100% (10x) with sufficient veYFI - Boost requirements vary by deposit size and vault Liquid lockers allow YFI holders to rent out their voting power to vault depositors, who pay a small fee in exchange for higher yields. Vault rewards auto-compound, while dYFI rewards require manual claiming through the liquid locker interface. Users can calculate optimal veYFI amounts using Yearn's boost calculator tool.

Yearn V3 Powers $18M+ in Fixed-Rate Lending Through Term Integration

Term Labs built fixed-rate lending vaults on Yearn V3's infrastructure, managing over $18M in automated yield. The integration demonstrates Yearn's modular vault framework in action. **How it works:** - Term focused solely on fixed-rate lending logic, plugging into Yearn's TokenizedStrategy - The framework handles all ERC-4626 mechanics: deposits, withdrawals, share accounting, and fees - Term's vaults automate auction participation, reinvest proceeds from maturing loans, and rebalance idle funds - Risk curators propose portfolio constraints enforced on-chain Yearn V3 supports diverse products on the same infrastructure - from Curve's donation-based scrvUSD ($36M) to Term's complex lending strategies. Protocols can inherit from BaseStrategy and delegate vault operations to TokenizedStrategy automatically. [Build on Yearn V3](http://partners.yearn.fi)

Term Labs Automates Fixed-Rate Lending Through Sealed-Bid Auctions and Yearn-Based Vaults

**Term Labs** operates sealed-bid double auctions for fixed-rate lending, where lenders and borrowers submit hashed bids and the protocol determines a single clearing rate. **The Challenge:** - Manual participation in auctions - Time-consuming position rolling - Inefficient idle capital management between cycles **The Solution:** Term's vaults built on [Yearn's framework](https://yearn.finance) automate the entire process: - Automatic auction participation - Reinvestment of proceeds from maturing loans - Rebalancing of idle funds into floating-rate lending protocols Risk curators propose portfolio constraints that smart contracts enforce on-chain, creating a more efficient and hands-off lending experience.

Yearn-Curated USDC Vault Earns A Rating on Morpho Platform

**Yearn's OEV-boosted USDC vault on Morpho has received an A rating**, joining highly-rated vaults from Stakehouse and Gauntlet. The vault utilizes **Oracle Extractable Value (OEV) technology** to recapture value that would otherwise be lost to MEV bots, redirecting it back to depositors as enhanced yield. **Key highlights:** - A-grade rating validates vault's risk management and performance - Part of Yearn's expanding curation services on Morpho - OEV-boosting technology provides sustainable yield enhancement - Previously surpassed $10M in deposits milestone Yearn continues to demonstrate its **best-in-class vault curation and monitoring capabilities** across the Morpho ecosystem, offering institutional-grade DeFi products with enhanced risk assessment.

Yearn Finance Recovers $2.39M in Coordinated yETH Asset Recovery Operation

**Yearn Finance successfully recovered 857.49 pxETH worth $2.39 million** through a coordinated effort with Plume and Dinero teams. **Key Details:** - Recovery operation targeted yETH-related assets - Transaction confirmed on Ethereum blockchain - **Recovery efforts continue actively** - All recovered assets will be returned to affected depositors **Important Security Note:** Users should remain vigilant against impersonators claiming to represent Yearn Finance. The recovery represents significant progress in addressing the exploit damage, with ongoing efforts to retrieve additional funds for affected users.