Yearn Juiced Vaults Now Offer Bundled Protocol Cover

Yearn Juiced Vaults Now Offer Bundled Protocol Cover

🔐 Juiced Up Protection

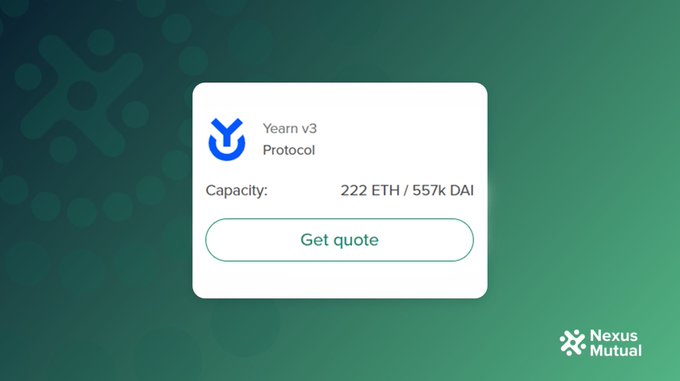

Yearn has partnered with Ajna to offer bundled protocol cover for users depositing into Yearn Juiced Vaults. This cover protects against smart contract risks across both the Yearn and Ajna protocols, including hacks/exploits, severe liquidation failures, and governance attacks. Users can purchase this bundled cover through the Nexus Mutual user interface.

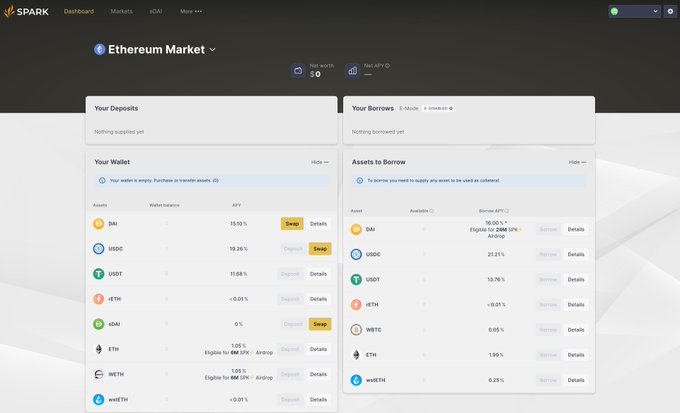

Since MakerDAO increased rates and the DSR has increased to 15%, rates for lenders have seen a boost in the Spark Ethereum market 📈 You can earn high rates on stables and protect yourself against lending market risks with Spark Protocol Cover 🛡️

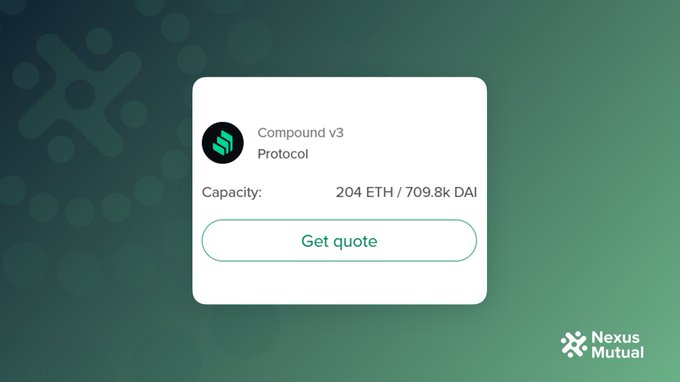

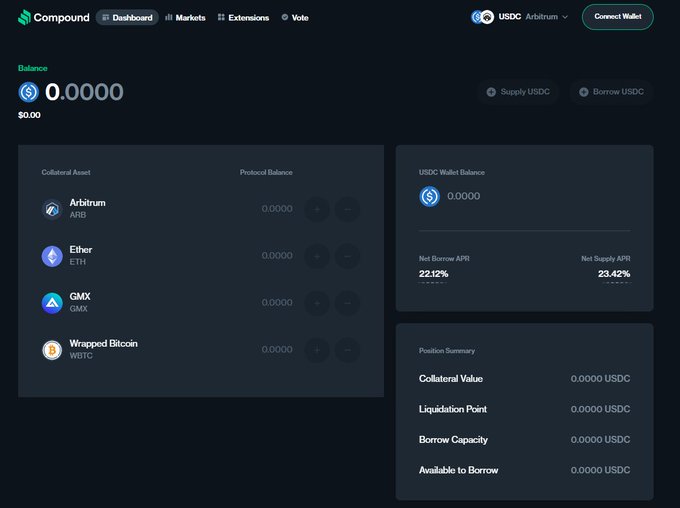

Yield on L2s is heating up! If you're earning on your $USDC in Compound V3, you can protect your USDC and ETH with Compound V3 Protocol Cover 🛡️ ➡️ Buy on Arbitrum through OpenCover: opencover.com/app/?invite=Ne… ➡️ Buy on mainnet in the Nexus Mutual UI: app.nexusmutual.io/cover/buy/get-…

Looks like there's massive demand for native $USDC on Compound V3's @arbitrum market 👀 📈 23.42% vAPR, 20.82% in interest + 2.61% in $COMP incentives The Compound v3 IR Curve is definitely giving people a reason to deposit!

Stablecoin yields in the Aave markets range from 15–33% vAPY 📈 If you're depositing in the Aave markets to earn yield, be sure to protect your stables against DeFi's biggests risks with Protocol Cover 🛡️

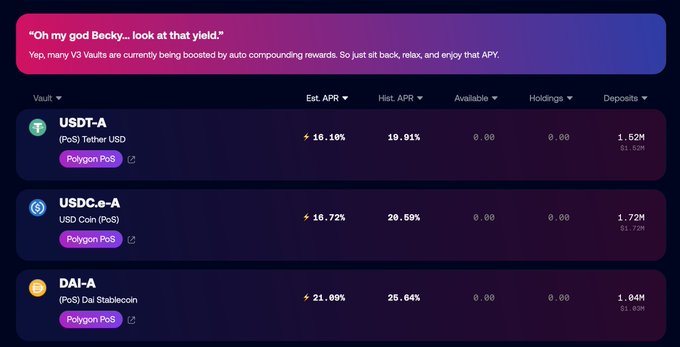

Yearn v3 is bringing the double-digit yields to Polygon 🚂 We're bringing comprehensive protection against hacks/exploits to Yearn v3 💪 Safeguard your Yearn v3 deposits with Protocol Cover: ➡️ Yearn v3: app.nexusmutual.io/cover/buy/get-…

All aboard the v3 yield train, choo choo 🚂 USDC: 18.3% DAI: 22.2% USDT: 20.7% (p.s careful with your ears on this one)

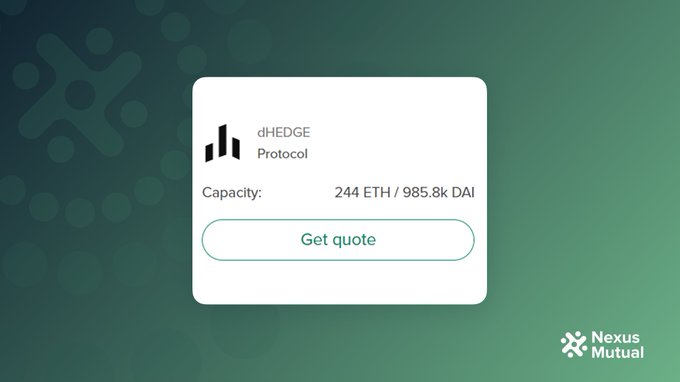

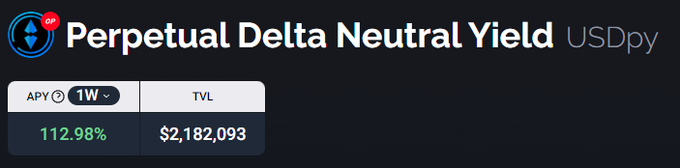

Looks like you can deposit in the dHedge USDpy Vault in the Toros UI and earn 50.47% APY (based on 30d annualized yield) 🔥 When you protect your deposit with dHedge Protocol Cover, you're still earning 46.95% APY 🛡️

The Perpetual Delta Neutral Yield Vault build on dHedge has been performing well in the last week and month ↗️ 7d APY annualized is 112.98% ↗️ 30d APY annualized is 50.47% Worth checking out 👀 toros.finance/vault/0xb9243c…

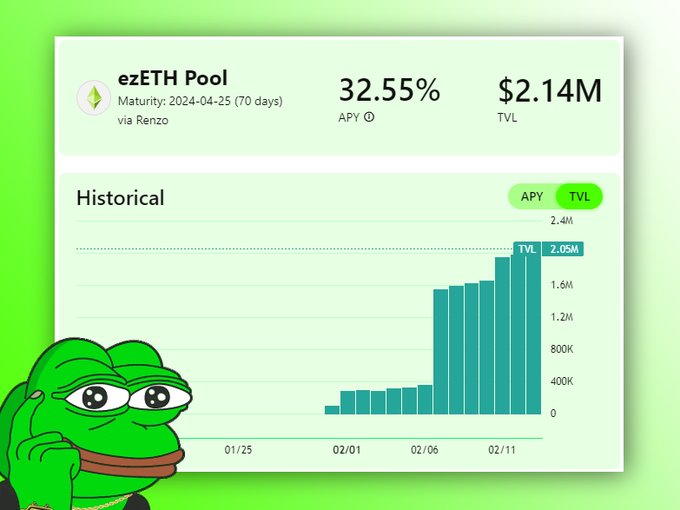

💡 Listing Spotlight: Equilibria $ezETH holders boosting their yields with @pendle_fi and @Equilibriafi can now protect their deposits with Protocol Cover 🛡️ ➡️ Equilibria Protocol Cover: app.nexusmutual.io/cover/buy/get-… ➡️ Pendle Protocol Cover: app.nexusmutual.io/cover/buy/get-… Learn more 👇

@RenzoProtocol's $ezETH Boosted pool on Equilibria is waiting for you, offering numerous advantages! ▶️ Boosted +32% APY ▶️ EigenLayer Points ▶️ Farm ezPoints ▶️ $ETH Staking Yields Deposit now: equilibria.fi/stake $ezETH; Ez Yield, Ez boosted APY with Equilibria! 👌

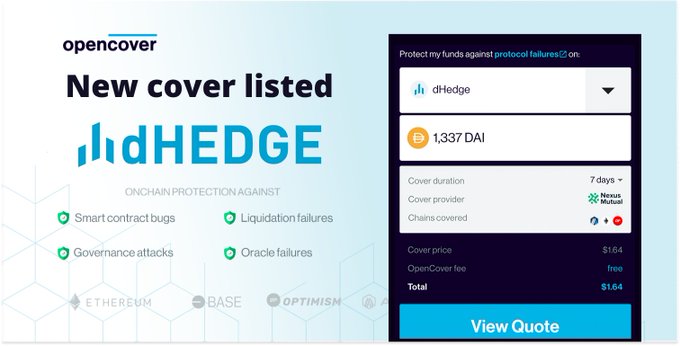

If you're a @dHedgeOrg user, don't miss the opportunity to get $10,000 of Protocol Cover for FREE from @OpenCoverDeFi! OpenCover brings Nexus Mutual's Protocol Cover to L2s, so you can buy the same comprehensive cover & enjoy low transaction fees on Optimism, Arbitrum or Base 👇

We just made over $400,000 of dHedge cover capacity valid on @Polygon and @Optimism, with lower gas fees on L2. And we're giving out $150,000 of free dHedge cover today (up to $10,000 in protection per person) 👉 opencover.com/dhedge

🛡️ NEW COVER LISTED 🛡️ @dHedge is officially available on OpenCover! Keep your dHedge assets protected with @NexusMutual. Save $50+ in L1 fees and streamline cover management 🚀 The best part is we're offering you your first cover, up to $10,000 in protection!👇 (1/3)

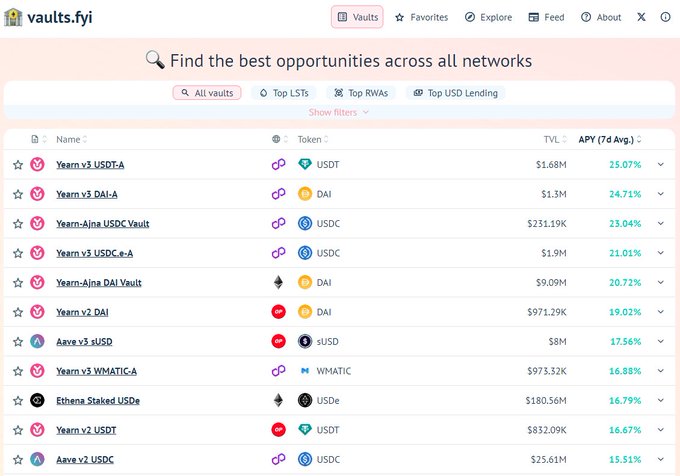

Our Head of Community's DeFi rates overview is worth a read! Protect yourself against hacks while earning those high APYs 🛡️ Protocol Cover is available for Yearn v3, Aave v2, Aave v3 + many others! ➡️ Nexus Mutual: app.nexusmutual.io/cover ➡️ OpenCover: opencover.com/app/?invite=LN…

📈 State of DeFi Yields I've been using vaults.fyi to check base rates on stables. It's clear there's more leverage at play and yields are rising across the board. Simple strategies can net 20%+ APY in the current market. Leading Accessible Yields @yearnfi is

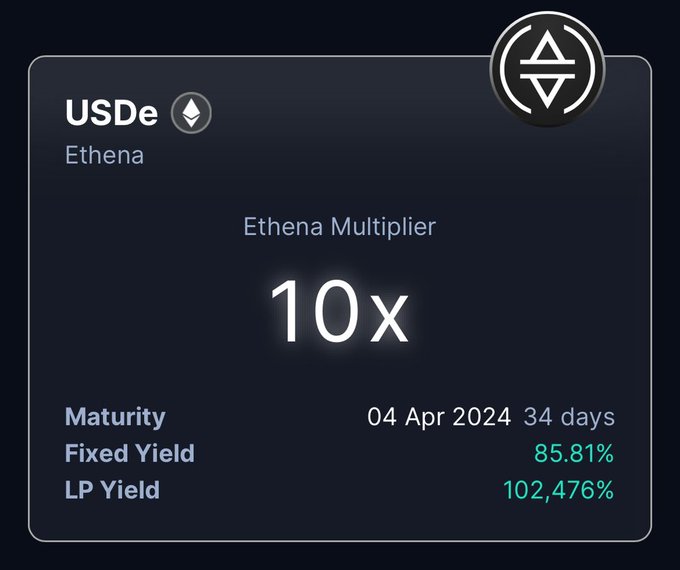

Are you earning the 85%+ fixed yield on your $USDe? Be sure to protect your $USDe deposit with Pendle Protocol Cover 🛡️ ➡️ Buy in Nexus Mutual UI: app.nexusmutual.io/cover/buy/get-… ➡️ Buy on an L2 with OpenCover: opencover.com/app/?invite=Ne… Safeguard against DeFi's greatest risks 🐢

When the Shards hunters are out to play, everyone feasts 😋 High demand for @ethena Shards are driving up swap fees and Fixed Yield for USDe. The question is are you already at the table? 🍽️

💡 Listing Spotlight: Yearn v3 Looking to earn on @0xPolygon with Yearn v3? We've got you covered 💪 Protect your deposits with Yearn v3 Protocol Cover: 🛡️ Yearn v3: app.nexusmutual.io/cover/buy/get-…

Superbowl this, Superbowl that, how about you earn some SUPERB yields on stables, only on Yearn v3. yearn.fi/v3

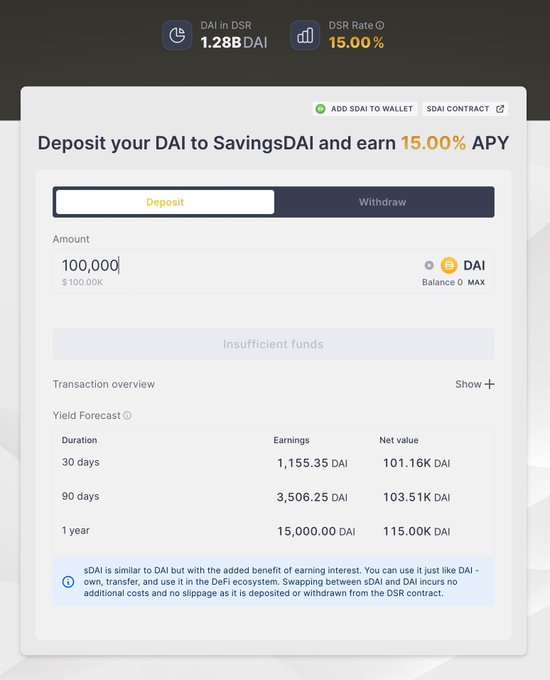

Now that MakerDAO has raised the DAI Savings Rate (DSR) to 15% APY, $DAI holders can deposit and earn double digit yields 💸 We've got DSR depositors covered, too ✌️ You can purchase DSR Protocol Cover for only 1.16% annually 🛡️

First Comprehensive Onchain Risk Taxonomy Launches with Expert Webinar

The **Onchain Risk Map** has launched as the first comprehensive taxonomy for crypto and DeFi risk assessment. Built in collaboration with OpenCover, this common-good framework provides risk professionals and onchain users with a systematic approach to understanding digital asset risks. The framework categorizes onchain risk across **six core dimensions**: - Custody - Transactions - Protocols - Digital Assets - Staking - Systemic Risk A launch webinar is scheduled for **February 11 at 17:00 CET**, featuring experts including Jeremiah, tokendata, and s3mtur4n. The session will include a detailed walkthrough and Q&A, streaming live on X and LinkedIn. This institutional framework aims to help both professionals and everyday users navigate the complex risk landscape of decentralized finance more effectively.

DeFi Risk Briefing: Protecting Institutional Capital in Crypto

A DeFi risk management discussion is scheduled for January 22nd, featuring industry experts Hugh Karp and tokendata. The briefing will cover: - Vault security and architecture - Institutional participation in DeFi - Recent hacks and vulnerabilities - Claims processes and risk mitigation The session aims to address the critical challenge of maintaining institutional confidence in decentralized finance as traditional players enter the space. [Join the discussion](https://x.com/i/spaces/1ynJOMBYWLAKR)

Nexus Mutual Releases Q4 Report on DeFi Risk and Claims

Nexus Mutual has published **The Nexus Review**, their Q4 and 2025 wrap-up report covering DeFi risk management and claims processing. The report, introduced by Hugh Karp, emphasizes the protocol's consistent approach to onchain risk. Key areas covered include: - DeFi risk assessment and management - Claims processing and payouts - Vault operations - Institutional adoption trends The full report is available at [docs.nexusmutual.io](https://docs.nexusmutual.io/bookshelf/NM_Q4_REPORT.pdf)

Multi Protocol Cover Extends DeFi Protection Across Multiple Platforms

**Multi Protocol Cover** now offers comprehensive protection for DeFi strategies spanning multiple protocols. This consolidated coverage extends beyond single protocol protection, safeguarding users against: - Smart contract hacks and exploits - Oracle failures - Cross-protocol risks The service builds on existing single protocol coverage for platforms like Aave and Uniswap, now providing **unified protection** for complex multi-protocol strategies. [Watch the walkthrough](https://youtu.be/yITiIAgGsd0?si=_9tzenRdBEMruoit) to understand how consolidated coverage works across different protocols.

Nexus Mutual Proposes USDC Yield Vault for Real-World Insurance Returns

**Nexus Mutual members are voting on a proposal to create a USDC-denominated yield-bearing vault** that would bring real-world insurance returns to crypto capital. The proposal, known as NMPIP (Nexus Mutual Protocol Improvement Proposal), is currently open for voting on Snapshot for 3 days. **Key details:** - Vault would operate under the Nexus Mutual umbrella - Focus on generating yield through real-world insurance activities - Requires technical, legal, and operational development work - Would involve collaboration between DAO R&D team and Foundation teams If approved, development teams will begin the complex process of building the infrastructure needed to bridge traditional insurance returns with crypto capital. The initiative represents Nexus Mutual's expansion beyond pure crypto insurance into broader financial products. [Full forum discussion](https://forum.nexusmutual.io/t/nmpip-real-world-insurance-vault-bringing-insurance-returns-to-crypto-capital/1818)