Yearn Ends dYFI Incentives as Major Governance Overhaul Takes Effect

Yearn Ends dYFI Incentives as Major Governance Overhaul Takes Effect

🔄 Yearn's Big Switch

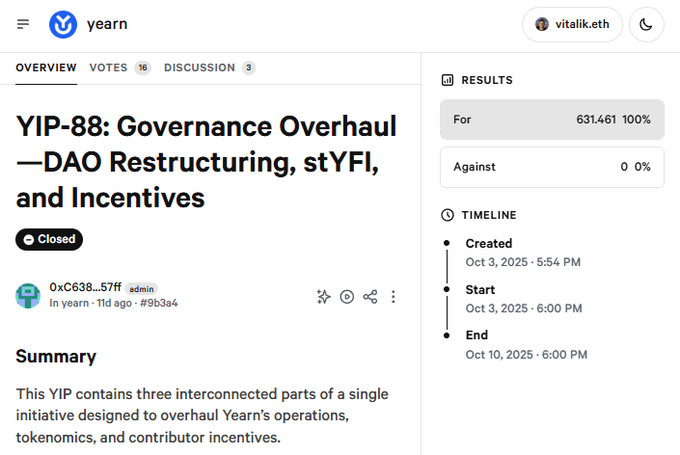

Yearn's dYFI incentives officially ended as the protocol transitions to its new governance system following the passage of YIP-88.

Key Changes:

- veYFI gauges are retired and won't earn native yield during transition

- veYFI being replaced with stYFI - a simplified system with shorter lock times

- stYFI will earn APR in yield-bearing stablecoins

What's NOT Changing:

- Yearn Vaults continue operating normally

- Users don't need to take any action

- Vault depositors keep earning yield as usual

Important Notes:

- Previously earned dYFI rewards can still be claimed

- dYFI liquidity may be low due to ended incentives

- Users can redeem dYFI to YFI by providing ETH at veyfi.yearn.fi/redeem

The transition represents a major overhaul of Yearn's governance structure, moving toward a more streamlined staking system.

YIP-88 has passed! It is a massive overhaul of Yearn's governance and operations. But what does that mean for Yearn and for you, Anon? Important information below. Lets dive in 🧵👇 1/6

dYFI incentives have ended as Yearn transitions to the new system. Read more about it here.

🚨 As part of the transition, dYFI incentives will official end this Thursday, Oct. 16th. veYFI gauges will be retired and veYFI will not earn a native yield until the new system is in place. veYFI will continue to earn any exit rewards during this time. 2/6

Yearn Launches OEV-Boosted USDC Vault with API3 Oracles

Yearn Finance has launched a new USDC vault that leverages API3's Oracle Extractable Value (OEV) network to boost yields. The vault represents a shift in how liquidation value is captured in DeFi lending markets. Previously, liquidator bots competed through gas price auctions, with most value going to validators. API3's OEV network changes this by: - Obscuring oracle data - Auctioning data to liquidators - Redirecting value from validators to protocols Key Benefits: - Enhanced yield potential - Exclusive use of API3 oracles - Increased oracle diversity [Learn More](https://forum.morpho.org/t/new-oev-boosted-vaults-by-yearn-api3/1833)

yBOLD: A New Yield-Bearing Asset Built on Yearn V3

Yearn Finance announces yBOLD, a yield-bearing version of BOLD built on Yearn V3. Key features include: - Oracle-free architecture - Permissionless access - Automatic yield optimization - Zero entry/withdrawal fees - Integration with Yearn's Dutch Auctions The upgrade enables users to earn yields while maintaining BOLD exposure. Additionally, @asymmetryfin is developing sUSDaf, among other yield-bearing Liquity V2 projects in development. Previous implementations showed potential for: - Use as productive collateral on platforms like Euler - Advanced yield strategies via Spectra and Pendle - Exposure to 15+ fork rewards through Stability Pool deposits

Yearn Finance Launches Horizon Vaults on Base

Yearn Finance has launched Horizon Vaults on Base network, offering professional-grade yield opportunities for multiple assets: - Supported tokens: WETH, USDC, cbBTC, cbETH - Built for precision yield optimization - Designed for professional traders and institutions - Available on Base network for faster transactions Access the new vaults at [Yearn Finance](https://yearn.fi/v3?search=horizon) *Note: These vaults represent Yearn's strategic expansion to Base network, focusing on institutional-grade yield generation.*

Yearn Finance Launches New Morpho Labs Integration

Yearn Finance has unveiled a new vault integration with Morpho Labs, offering users an optimized yield-generating solution. Key features: - Auto-compounding returns - Maintained liquidity - Optimized yield strategies The vault represents a significant upgrade to Yearn's existing ETH yield offerings, building on their previous Pendle yPT vaults. [Access the new vault here](https://yearn.fi/v3/1/0x09580f2305a335218bdB2EB828387d52ED8Fc2F4)