wstETH Stability Pool Delivers Highest Stable Yield in DeFi Through Liquidation Proceeds

wstETH Stability Pool Delivers Highest Stable Yield in DeFi Through Liquidation Proceeds

💰 DeFi's Secret Yield

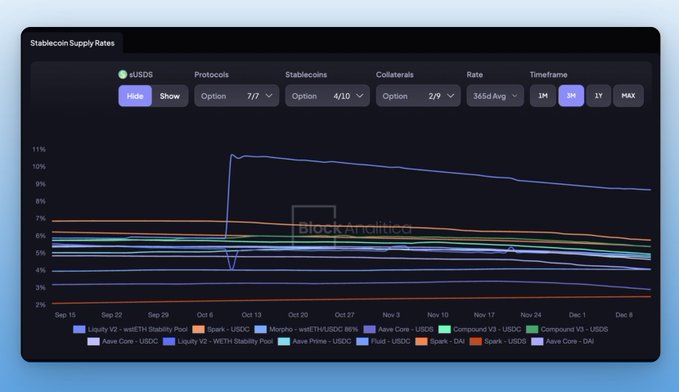

wstETH Stability Pool achieved the highest stable yield across all DeFi protocols based on yearly averages.

Key yield sources:

- Regular borrower interest payments

- Liquidation proceeds from market downturns

- Depositors acquire discounted ETH and LSTs during price drops

Pool advantages:

- Funds remain in pool, not lent out

- Hold truly decentralized stablecoin

- 24/7 withdrawal availability

- No lending counterparty risk

Liquidation events create yield spikes - while irregular, they provide substantial returns when markets decline sharply.

Earn more with Stability Pools. Using the yearly average yield, the wstETH Stability Pool offered the highest stable yield in all of DeFi. What's the spike? Those are liquidation proceeds. Stability Pool depositors buy cheap ETH (and LSTs) when prices drop sharply. These

Stable Yields Expands Token Selection with Two New Additions

Stable Yields has added two new tokens to its platform. Users can visit stableyields.info to discover which tokens have been integrated. This follows recent activity in the stablecoin yield space, where ynUSDx recently reached approximately 12% APY through YieldNest's platform. **Key Points:** - Two tokens now available on [Stable Yields](https://www.stableyields.info/) - Platform continues expanding its token offerings - Comes amid competitive stablecoin yield environment Visit the platform to explore the new token options and compare yields.

Liquity V2 Reaches $2M Revenue Milestone

Liquity V2 has achieved $2 million in total revenue, marking a significant milestone for the protocol. This represents substantial growth from the $500k revenue mark reached in August 2025, demonstrating consistent adoption and usage of the platform over recent months. The achievement reflects continued demand for Liquity's decentralized borrowing protocol and its V2 features.

Uniswap V4 Offers 10% APR for BOLD/USDC Liquidity Providers Plus Swap Fees

Liquidity providers can now earn **10% APR** by supplying BOLD/USDC pairs on [Uniswap V4](https://uniswap.org). **Key Details:** - Yield is paid out in BOLD tokens - Additional earnings from swap fees on top of base APR - Part of broader BOLD ecosystem offering 7%+ returns across multiple venues - Approximately $11M in liquidity across BOLD/stablecoin pairs enables large swaps **Alternative Options:** - LP BOLD/USDC on Ekubo Protocol or Uniswap: 8-11% APR in BOLD - Deposit BOLD into Stability Pools, sBOLD, or yBOLD for auto-compounding (~8% APR) The BOLD ecosystem positions itself as a low-risk yield opportunity for stablecoin holders.

Liquity Stability Pools Hit 18% APR with ETH and BOLD Rewards

Liquity's Stability Pools on Mainnet are delivering strong returns for depositors: - **7% APR** since inception - **18% APR** over the past 30 days - Yields paid in both **$BOLD** and **$ETH** The protocol positions itself as offering top risk-adjusted yields in DeFi while enabling users to dollar-cost average into ETH. Previous data from January showed the Stability Pool yield via Yearn's yBOLD at 8.7% APR, with hints of potential 3% APR boosts from fork rewards. Depositors can access these yields through Liquity's Stability Pools, which provide returns while supporting the protocol's stablecoin mechanism.

Vitalik Backs Ethereum-Native Stablecoins Push

Vitalik Buterin is supporting efforts to strengthen Ethereum-native stablecoins, according to a recent announcement from Liquity Protocol. The initiative aims to bolster stablecoins built directly on Ethereum's infrastructure, rather than relying on centralized or off-chain alternatives. This aligns with broader efforts to enhance Ethereum's ecosystem independence and resilience. The move comes as the Ethereum Foundation recently restructured its leadership to better support ecosystem growth, signaling renewed focus on core infrastructure development. [View the announcement](https://x.com/LiquityProtocol/status/2025965791976341561)