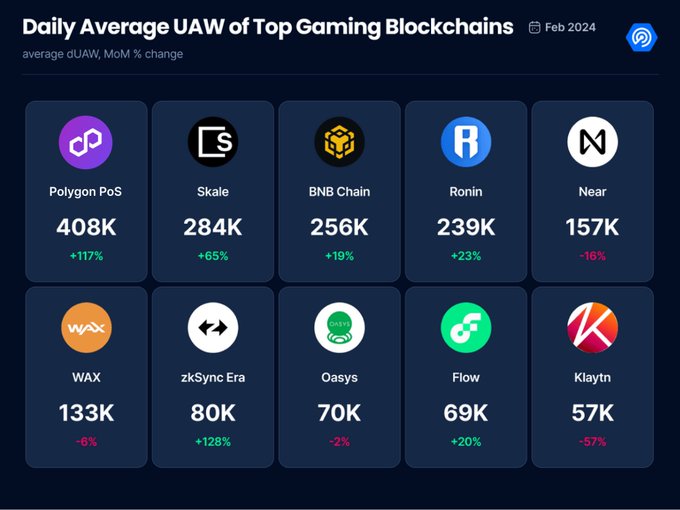

The web3 gaming sector is experiencing rapid growth, driven by the Polygon ecosystem. According to DappRadar, gaming dApps hit a record of 1.9 million daily unique active wallets in February, led by projects like Matr1x and Anichess on Polygon PoS. Incentives, improved user experiences, and the ability for players to own in-game assets are fueling this growth. Projects like Planet Mojo, Gas Hero, Immutable zkEVM, BoomLand Games, Blast Royale, and Space Nation are at the forefront of this trend. Developers are also creating custom gaming experiences using Polygon CDK, such as Wilder World's gasless MeowChain and Moonveil Studio's dedicated gaming chain. The diversity of games and growth across the Polygon ecosystem showcases the vision of user-first experiences where players are owners in a free market powered by blockchain.

Over 50 million users will be tapping into the largest web3 gaming ecosystem on Immutable zkEVM, powered by Polygon. @Immutable and @okxweb3 are joining forces to integrate Immutable zkEVM into the OKX Marketplace & OKX Wallet and introduce a GameFi launchpad. Not only will the

Immutable 🤝 @okx With OKX, we are unveiling a brand new GameFi launchpad to pave the way for the next billion users in web3 gaming. This partnership will integrate OKX Wallet and OKX NFT Marketplace into Immutable Passport and Immutable Orderbook, all on Immutable zkEVM. We

A gamer’s life. It travels worlds, without the ability to carry legacy, ownership, esteem. Until now. @Moonveil_Studio is launching a dedicated chain with Polygon CDK, powering an interoperable web3 gaming ecosystem. Moonveil will leverage an aggregated network so gamers can

We're proud to support the $100M Inevitable Games Fund, led by King River Capital and guided by @Immutable, to help enable the next steps of a flourishing gaming ecosystem. The Inevitable Games Fund leverages deep insights and resources to identify high-growth opportunities with

web3 gaming is accelerating FAST 🏎️ According to @DappRadar, gaming dApps hit a record of 1.9m daily unique active wallets (dUAW) in Feb. Led by @Matr1xOfficial and @AnichessGame, Polygon PoS was at the forefront of this user growth 👀

Comprehensive Onchain Transaction Toolkit Launches for AI Agents

A new all-in-one toolkit has been released for AI agents to execute blockchain transactions. The package includes: - Wallet functionality - Payment processing - Token swaps - Cross-chain bridging - Onchain identity management - x402 protocol integration The toolkit aims to simplify deployment for developers building autonomous agents in decentralized finance. Installation is designed to be straightforward, allowing teams to quickly integrate and launch agent-based applications. This release addresses the growing need for standardized infrastructure as AI agents become more prevalent in onchain operations.

Polygon Activates Lisovo Upgrade with $1M Gas Subsidy for AI Agents

Polygon's **Lisovo Upgrade** went live on March 4, 2026, introducing several infrastructure improvements focused on AI agent transactions and payment systems. **Key Features:** - **$1M gas subsidy program** for agent transactions, offering rebates on Polygon x402 facilitator transactions - **Dynamic fee adjustments** without requiring hard forks - **Enhanced security standards** aligned with latest Ethereum protocols - **Improved wallet compatibility** and smart contract support The upgrade aims to reduce operational costs for developers building autonomous agent systems. Agents can now execute buy, sell, and transaction operations with subsidized gas fees. Polygon's Trails infrastructure supports natural language commands for cross-chain operations, enabling agents to swap tokens and move assets between networks without custom code. More details: [Polygon Blog](https://polygon.technology/blog/polygon-upgrade-activates-1m-gas-subsidy-for-agent-payments-enhances-fee-stability)

150 Million Visa Merchants Now Accept Stablecoins on Polygon

**Major Payment Milestone Achieved** Visa merchants worldwide—150 million locations—now accept stablecoin payments through Oobit on Polygon, marking a significant expansion of crypto payment infrastructure. **Key Details:** - Payments work both in-store and online - Built on Polygon's fast, low-cost settlement layer - Follows 36.4% year-over-year growth in onchain activity **Network Performance:** Polygon stakers currently earn 8.33% APR, with 5.12% coming from actual network usage—demonstrating real economic activity beyond protocol rewards. This integration connects blockchain payment rails directly to everyday commerce, making stablecoins spendable at any Visa-accepting merchant globally.

Polygon Leads Transaction Volume as USDC Surpasses 20M Transactions

**Polygon has secured the top position in transaction volume** as February comes to a close, marking a significant milestone in the network's growth trajectory. **Key Highlights:** - USDC crossed 20 million transactions over the weekend - a first-time achievement for the stablecoin on the network - Polygon maintains its position as the fastest growing chain for payment transactions - The network continues to dominate as the #1 chain for USDC activity This data reinforces Polygon's role as a leading infrastructure for stablecoin payments and everyday transactions in the crypto ecosystem.

🔥 Polygon Burns Record 28.2M POL Tokens in February

**Record-Breaking Month for Polygon** Polygon achieved a new milestone by burning 28.2 million POL tokens in February 2026 - the highest monthly burn in the network's history. **How the Burn Mechanism Works** - Every transaction on Polygon generates fees - Base fees are permanently burned (removed from circulation) - Priority fees are distributed to validators, block producers, and stakers - More network activity = more fees = more tokens burned **Deflationary Trajectory** The network has now burned over 100 million POL tokens total, driven by genuine usage rather than artificial mechanisms. With current burn rates exceeding token issuance, Polygon's supply is experiencing deflation at approximately -1.00% annualized. This creates a simple equation: **Usage → Fees → Burns → Supply Deflation** The February burn rate represents a significant acceleration in network activity and demonstrates the effectiveness of Polygon's fee structure in creating long-term deflationary pressure on POL supply.