Wagmi Achieves Market Leadership on Sonic with Strong GMI Performance

Wagmi Achieves Market Leadership on Sonic with Strong GMI Performance

🚀 57% APR Just Dropped

Wagmi has established itself as the leading CLAMM DEX on Sonic Labs, with significant achievements in early 2025:

- GMI yield increased to 57.88% APR on Sonic

- All GMI-supported strategies reached full capacity

- $4.3M protocol-owned liquidity handling 80% of Sonic EVM volume

Recent milestones include:

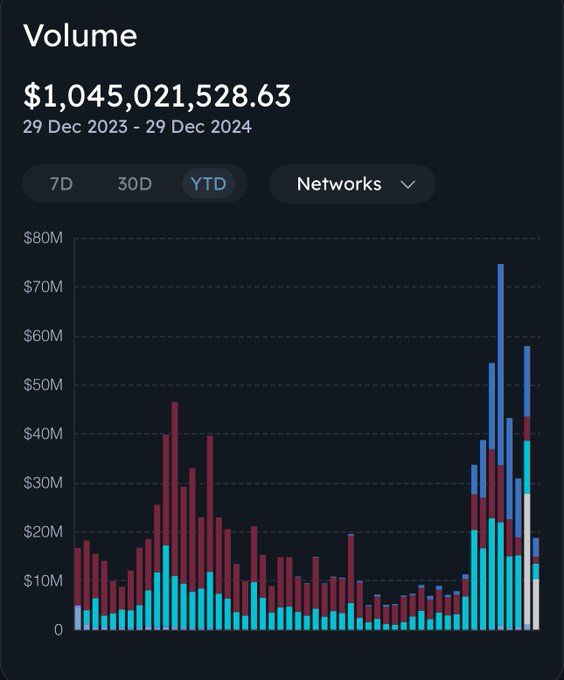

- Over $1B in total trading volume for 2024

- Generated $1M+ in fees for GMI holders

- New integration with KyberNetwork

- Rabby wallet integration for direct token swaps

- Launch of S/USDC strategy with $2M cap

- Analytics platform expansion to Sonic EVM

Current Status: Wagmi leads price execution quality on the network while maintaining strong yield generation.

Our analytics page now supports Sonic EVM! analytics.wagmi.com

GMI has been boosted on Sonic with an APR of 57.88% in real yield. All GMI-supported strategies are completely filled up. $4.3M of protocol-owned liquidity is processing 80% of the total volume on Sonic EVM. Wagmi is now the #1 CLAMM DEX on @SonicLabs , delivering the best

We’ve introduced a new strategy on Sonic EVM: $S/ $USDC The maximum cap is set at $2,000,000. You can also enter GMI with the freshly deployed strategy. app.wagmi.com/liquidity/stra… Bridge $ETH and $USDC to Sonic EVM using the official Gateway: gateway.soniclabs.com

Wagmi is now integrated with @KyberNetwork, enabling enhanced liquidity aggregation and seamless trading on Sonic EVM.

You can now swap $S, $USDC, or any token on @SonicLabs using @Rabby_io directly through the wallet's swap function! Since Wagmi has the deepest liquidity on Sonic, most swaps will route through Wagmi, generating additional fees for GMI holders and LPers.

Wagmi has processed over $1,000,000,000 in volume YTD. What’s more important than this metric is over $1,000,000 in fees generated for GMI holders. There is still small room for GMI on @SonicLabs to join and generate attractive yield. app.wagmi.com/dashboard/gmi

Bridge Updates: WAGMI Token Now Bridgeable Between Ethereum and Solana

The new bridge interface is now operational at bridge.wagmi.com, enabling users to transfer $WAGMI tokens between Ethereum Mainnet and Solana networks. Additionally, the $ANON token can now be bridged across multiple networks: - Solana - Ethereum Mainnet - Metis - Kava - Base - IOTA - Arbitrum *More networks are planned for future integration.*

Wagmi Achieves $1B Trading Volume Milestone, Generates $1M+ in Holder Fees

**Key Highlights:** - Wagmi has surpassed $1 billion in trading volume year-to-date - Platform generated over $1 million in fees for GMI token holders - Limited spots still available for new GMI holders via SonicLabs The platform shows consistent growth, with notable daily volumes reaching $2.2M on Metis L2. This activity translates to substantial fee generation for liquidity providers, particularly benefiting GMI holders. *Want to participate?* Check current opportunities at app.wagmi.com/dashboard/gmi

Wagmi Integrates KyberNetwork on Sonic EVM

Wagmi has expanded its ecosystem by integrating with KyberNetwork on Sonic EVM, marking a significant development in DeFi trading capabilities. - Integration enables enhanced liquidity aggregation - Provides seamless trading experience - Follows recent analytics page support for Sonic EVM KyberSwap's deployment includes: - Aggregator & Limit-Order functionality - Access to 17+ liquidity sources - Optimized trading rates This integration strengthens Sonic's growing DeFi ecosystem, offering users more trading options and improved liquidity.

New Strategy Launched on Sonic EVM with $2M Cap

A new liquidity strategy has been introduced on Sonic EVM for the $S/$USDC pair with these key features: - Maximum cap set at $2 million - Available through WAGMI platform - Supports GMI entry with new deployment Users can participate by: 1. Bridging $ETH and $USDC via official Sonic Gateway 2. Accessing strategy through WAGMI's liquidity interface WAGMI on Sonic Labs continues to provide deep liquidity for $S/$USDC trading.