Venus Protocol's XVS Vault on ZKSync Sees Rapid Growth

Venus Protocol's XVS Vault on ZKSync Sees Rapid Growth

🚀 XVS Vault Skyrockets

Venus Protocol's XVS Vault on ZKSync has demonstrated significant growth:

- Over 140K XVS staked by September's end

- Zero withdrawals recorded

- Average weekly growth of 150%

- 47K XVS added per week

This growth follows Venus Protocol's earlier success on ZKSync:

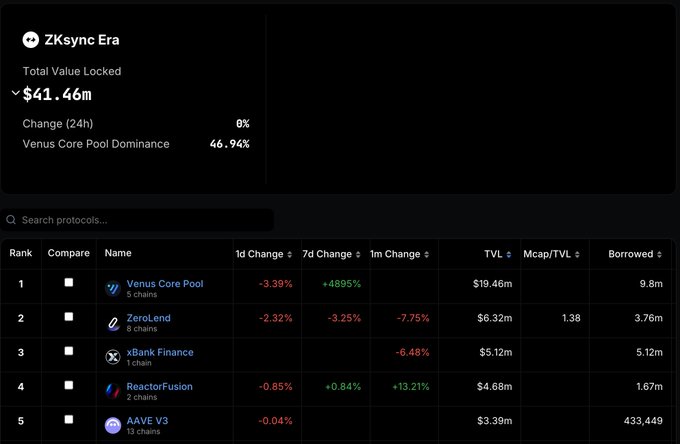

- TVL grew 4895% to $19M in one week

- Became leading lending protocol on ZKSync

- Captured 47% of ZKSync's total lending TVL

Venus Protocol has also shown strong performance in other areas:

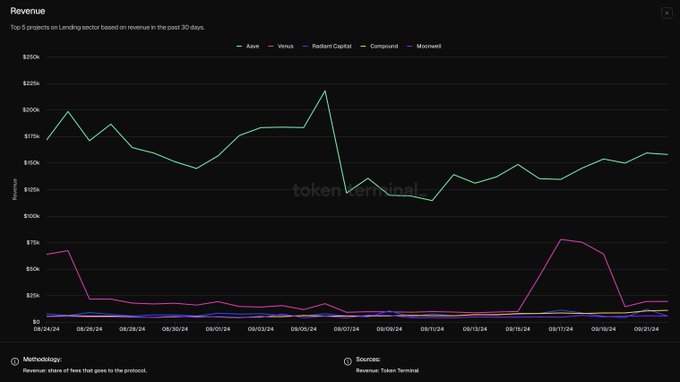

- Highest daily average revenue growth among top 5 TVL protocols

- 8.7% growth over 30 days, generating $732K

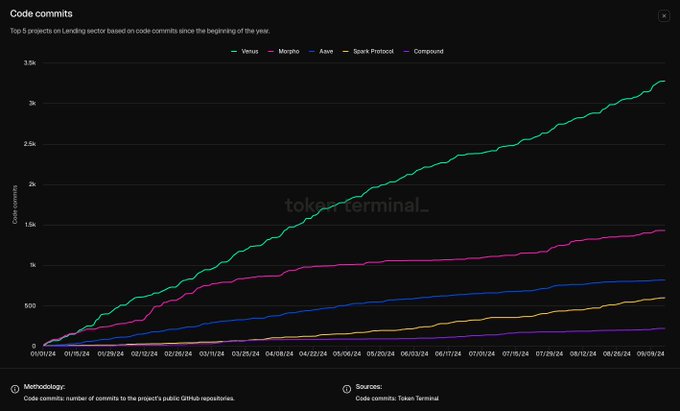

- 3.3K commits in 2024, surpassing top 5 lending protocols combined

Venus Protocol has recorded the highest daily average revenue growth compared to the top 5 protocols by TVL over the last 30 days, with more than 8.7%. During this period, Venus has generated $732K in total. Data from @tokenterminal #VenusProtocol #DeFi #multichain

Venus Protocol's XVS Vault on ZKSync reached more than 140K XVS staked by the end of September, with zero withdrawals. The vault saw an average weekly growth of 150%, adding 47K XVS per week. Data from @DuneAnalytics ℹ️ dune.com/xvslove_team/v… #VenusProtocol #DeFi #XVS #zkSync

With 3.3K commits to this date in 2024, Venus Protocol has more than the top 5 lending protocols by TVL combined, making up 52% of the total. Data from @tokenterminal #VenusProtocol #DeFi #Lending

After one week on @ZKsync, Venus Protocol’s TVL has grown by 4895% to $19M, securing its position as the leading lending protocol and capturing 47% of ZKsync's total lending TVL. Data from @defillama #VenusProtocol #DeFi #zkSync #Lending

Venus Flux Launches with $1M Stablecoin Supply Incentive Program

**Venus Flux is now live** on BNB Chain with a $1 million reward pool for stablecoin suppliers. **Program Details:** - Total rewards: $1,000,000 - Duration: 60 days - Reward calculation: Your share = Your supply × Time - Early suppliers and larger deposits earn more Venus Flux aims to create a unified liquidity layer on BNB Chain, improving capital efficiency for users and builders. The launch follows an AMA hosted by Venus Protocol and Fluid, featuring representatives from both projects and BNB Chain. Participants can supply stablecoins to earn their proportional share of the reward pool. The incentive structure favors those who supply early and maintain larger positions throughout the 60-day period. [Learn how to participate](https://twitter.com/VenusProtocol)

UTech Stables Launches Season 2 U Carnival on Binance Wallet

UTech Stables has launched Season 2 of its U Carnival campaign on Binance Wallet. **Key Details:** - Minimum deposit requirement: 100 $U tokens - Total reward pool: $1,200,000 - Boosted APR: Over 9% on both Venus Protocol and Lista DAO Users can participate by depositing $U tokens through Binance Wallet to earn yields and share in the reward distribution. More information: [Binance U Carnival Event](https://www.binance.com/en-AU/events/w3e-u-carnival)

Venus Protocol Closes 5th Anniversary Quiz Contest with 500 USDT Prize Pool

Venus Protocol's **5th anniversary quiz contest** ends today, offering participants a final chance to compete for prizes. **Contest Details:** - 500 USDT total prize pool - Ten winners will share the rewards - Perfect scores required to qualify - Winners announced tomorrow Participants must submit all correct answers by the deadline to be eligible for the prize distribution.

Venus Protocol $40,000 WBNB Pool Incentive Program Ends Today

**Final opportunity** to participate in Venus Protocol's $40,000 incentive program for the $WBNB pool on Merkl. **Key requirements:** - Hold at least 50 $XVS tokens in your wallet - Supply or borrow in the $WBNB pool - Program ends today (November 29, 2025) **Benefits available:** - Boosted supply rates for lenders - Subsidized borrowing costs - Share of $40,000 total rewards The 5-day program launched on November 25 and provides incentives on both supply and borrow sides of the pool. [Access the program](https://app.merkl.xyz/?search=Venus) | [Venus WBNB Pool](https://app.venus.io/#/pool/0xfD36E2c2a6789Db23113685031d7F16329158384/market/0x6bCa74586218dB34cdB402295796b79663d816e9?chainId=56&tab=supply)

Venus Joins BNB Chain DeFi Festival with $1M Prize Pool

**Venus Protocol** has joined the BNB Chain DeFi festival alongside SolvProtocol and BounceBit. The collaboration features a **combined $1M prize pool** available through Binance Wallet. - Festival brings together major DeFi protocols on BNB Chain - Prize distribution details to be announced soon - Participants can access rewards via Binance Wallet More announcements expected on how users can claim their share of the substantial reward pool.