Velodrome Grows from $7.5B to $22.6B Volume in 2024

Velodrome Grows from $7.5B to $22.6B Volume in 2024

🚲 22 Billion Reasons to Look

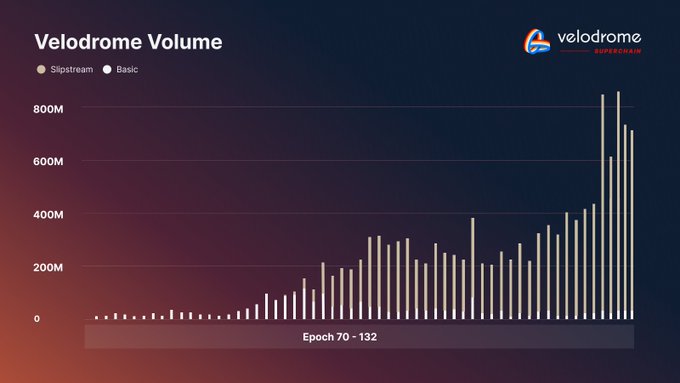

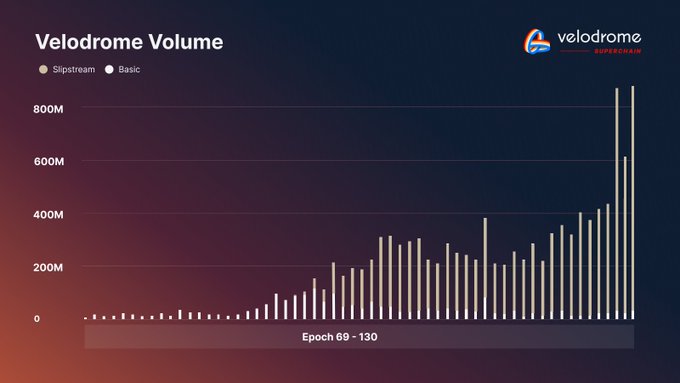

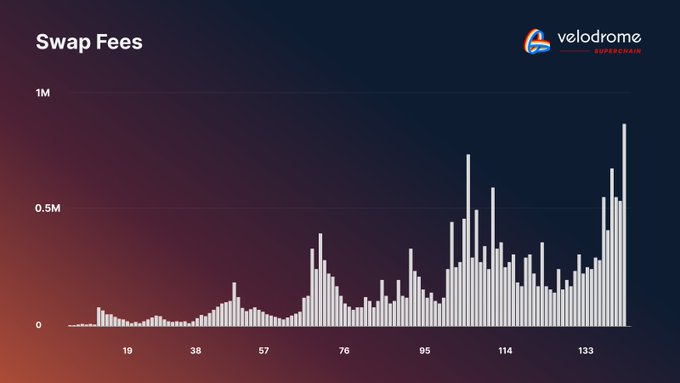

Velodrome demonstrated significant growth in 2024, with cumulative trading volume expanding from $7.5B to $22.6B. Key developments:

- Slipstream Integration: Consistently driving >90% of trading volume

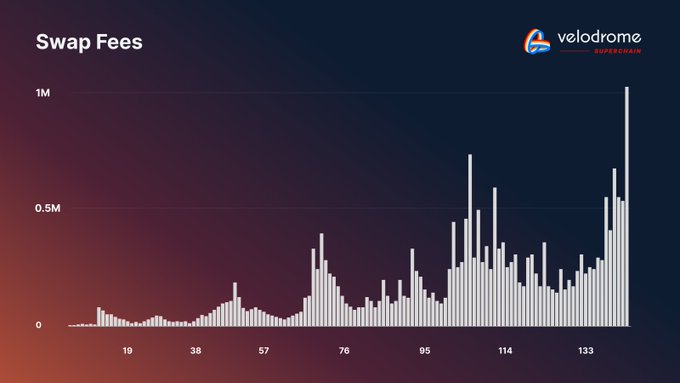

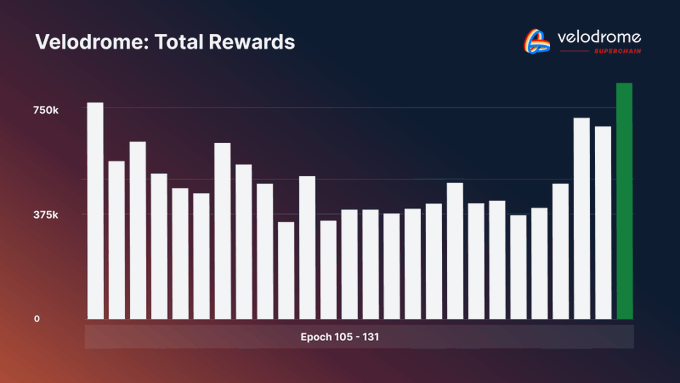

- Recent Performance: Latest epoch (135) delivered $727K in rewards with $418M volume

- Record Breaking: Second-highest rewards ever recorded in Epoch 134 ($1.117M)

- Superchain Expansion: Successfully deployed on multiple chains including Fraxtal, Mode, and Lisk

The protocol maintains its public goods focus, returning 100% of value to voters and LPs.

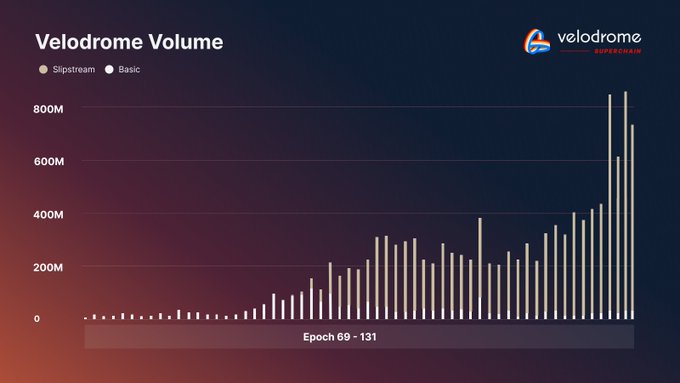

Epoch 132 Recap 🚴♂️ Velodrome had its third-highest volume epoch, hitting $669m, with Slipstream accounting for 96% of that. veVELO voters received ~$642k in total rewards. Velodrome is a public goods protocol, returning 100% of the value to voters and LPs.

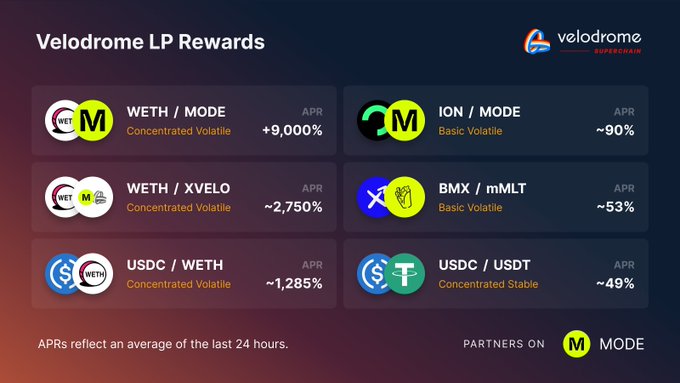

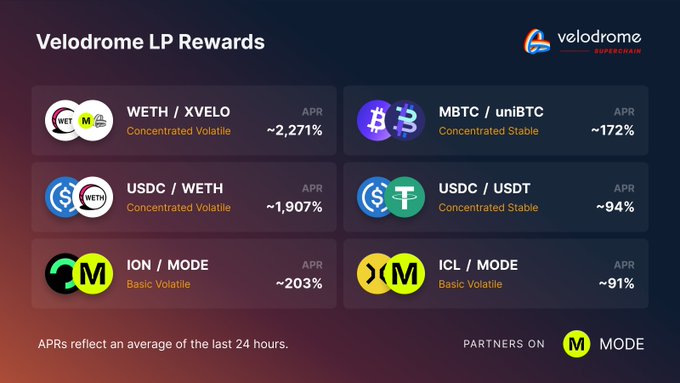

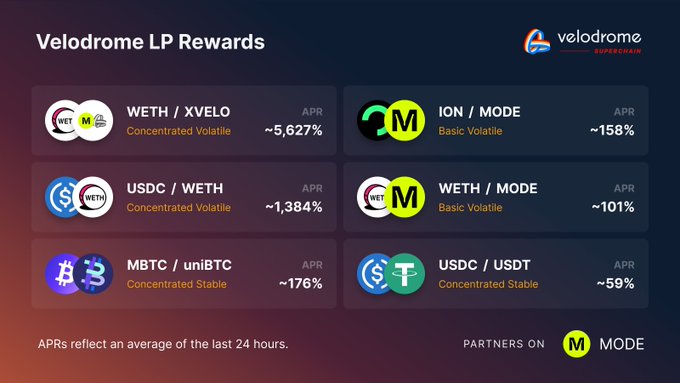

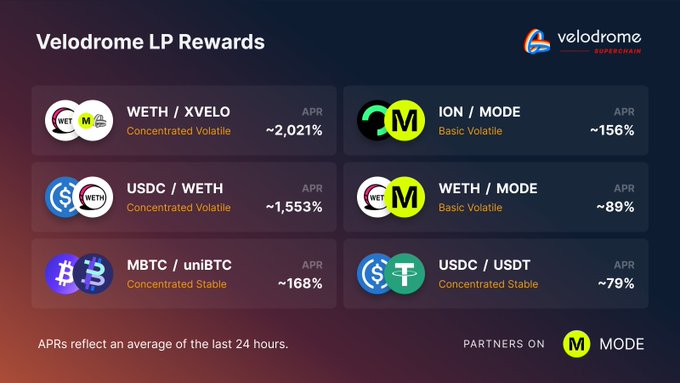

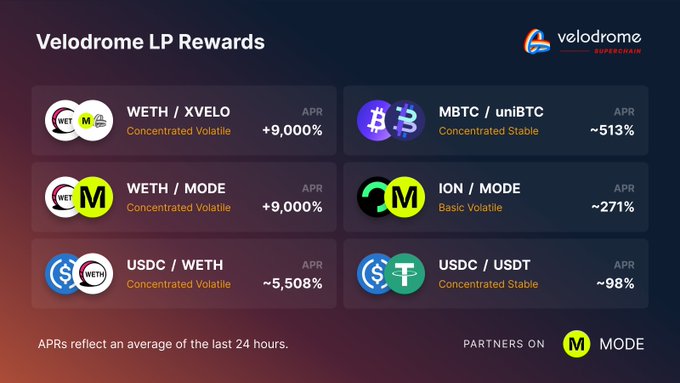

Mode TVL up 43% 🟡🚴♂️ With Superchain 1.0 interoperability now available on @modenetwork, the 3rd-largest Superchain with over $160M in TVL, Velodrome’s TVL increased by 43% in the last 7 days. Serviced by @hyperlane's Superlane, veVELO voters can direct xVELO emissions

Velodrome Superchain 1.0 is LIVE on @modenetwork 🔴🟡🚴 Velodrome is now a crosschain MetaDEX. With this massive upgrade, veVELO voters will enable deep liquidity growth across the Superchain.

Velodrome TVL on @modenetwork is up 443% 🚴♂️🟡 Velodrome MODE's TVL increased by 443% since launching just 1 month ago, highlighting the MetaDEX's efficiency for protocols, LPs, and traders.

Velodrome Superchain 1.0 is LIVE on @modenetwork 🔴🟡🚴 Velodrome is now a crosschain MetaDEX. With this massive upgrade, veVELO voters will enable deep liquidity growth across the Superchain.

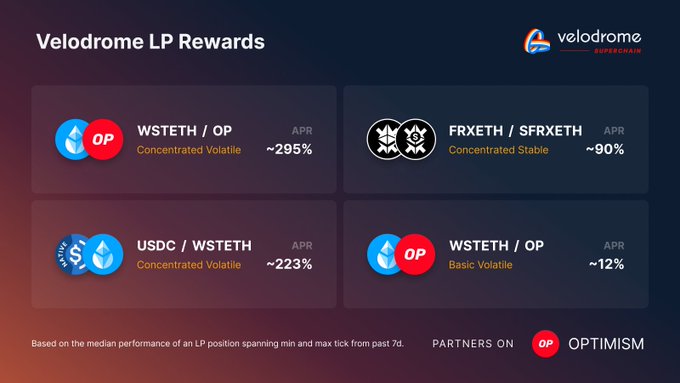

Velodrome Slipstream LP Rewards Update 🚴♂️ • $WSTETH - $OP: ~295% • $USDC - $WSTETH: ~223% • $FRXETH - $SFRXETH: ~90% • $WSTETH - $OP: ~12% These pools are all receiving OP voting incentives boosts from the Yield-bearing Assets campaign. More liquidity is on the way.🔴

Yield Bearing Asset OP Grant on Velodrome 🚴🔴 Optimism has awarded Velodrome a 200,000 OP grant to supercharge liquidity for Yield-Bearing Assets (YBAs) across the @optimism Mainnet.

Velodrome Superchain 1.0 launched last month on @modenetwork, delivering impressive results: • WETH-USDC is the top volume pair on Mode • >50% of the chain's total trading volume • TVL up by 50% Data from @dexscreener & @DefiLlama. Much more to come for Mode's eco. 🟡

Velodrome Superchain 1.0 is LIVE on @modenetwork 🔴🟡🚴 Velodrome is now a crosschain MetaDEX. With this massive upgrade, veVELO voters will enable deep liquidity growth across the Superchain.

⛓️ Linking Together: How Interoperability Takes DeFi to the Next Level ⛓️ Velodrome + @Optimism are working together to ease a critical tension in DeFi via the Superchain.

⛓️🔴 Beyond Optimistic about the Superchain 🔴⛓️ Together with the cross-chain liquidity that Velodrome LPs provide, the @Optimism Superchain addresses the apex problem of DeFi—usability and friction—while holding true to the values of decentralization.

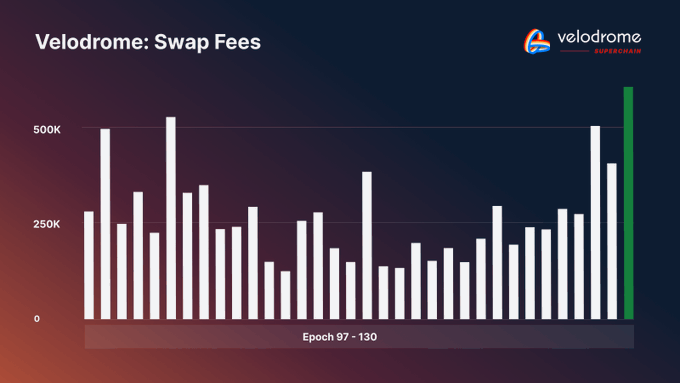

Full Speed on the Velodrome 🏁🚴♂️ Epoch 129 saw the largest Total Rewards (fees + incentives) in 26 epochs at $714,225 for veVELO voters, propelled by record Slipstream swap fees of $442,371. Volume also soared to its second-highest ever at $614M.

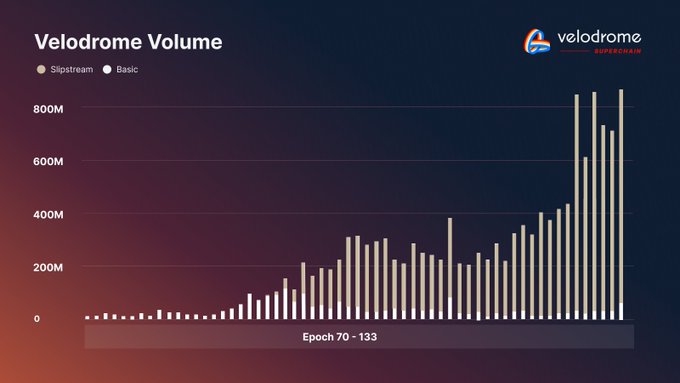

$20 billion in volume 🚴🏼 Velodrome has surpassed $20 billion in cumulative volume. Last epoch, it recorded its third-highest weekly volume at $708 million, marking a new milestone in its growth. Velodrome is expanding the liquidity layer across the Optimism Superchain. 🔴

Volume Explosion 🚴♂️💨 Velodrome hit $858.4M volume during epoch 130 - an all-time high! Slipstream drove 95% of the volume, with veVELO voters earning ~$699K. Liquidity now spans the Superchain, rewarding LPs on @modenetwork, @LiskHQ, & @fraxfinance's Fraxtal.

Epoch 131 Recap 🚴♂️ Velodrome volume reached its third-highest volume ever, securing $708m this epoch, with Slipstream accounting for 96% of that. veVELO voters received ~$840k in total rewards. Velodrome is a public goods protocol, returning 100% of the value to voters and LPs.

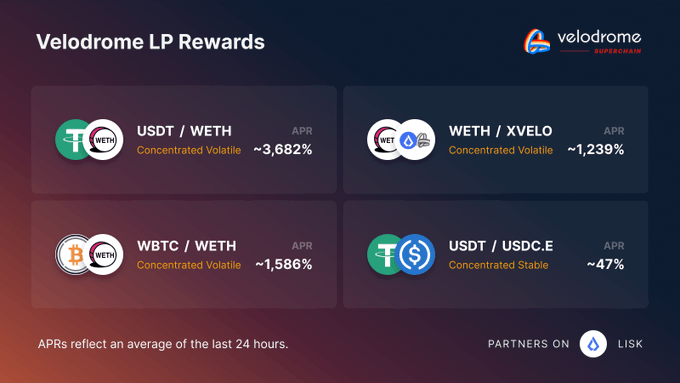

Velodrome is LIVE on Fraxtal ¤⛓️¤ Velodrome’s Tour Across continues to @fraxfinance's Fraxtal, a leading Layer 2 on @optimism Superchain. 🚴♂️ Velodrome expands to support Fraxtal’s growing DeFi ecosystem. Read on to learn more 👇

Highest Volume Ever During Epoch 133 🚴 Velodrome had its highest volume epoch, hitting $874m, with Slipstream accounting for 92% of that. veVELO voters received ~$638k in total rewards. Velodrome is a public goods protocol, returning 100% of the value to voters and LPs.

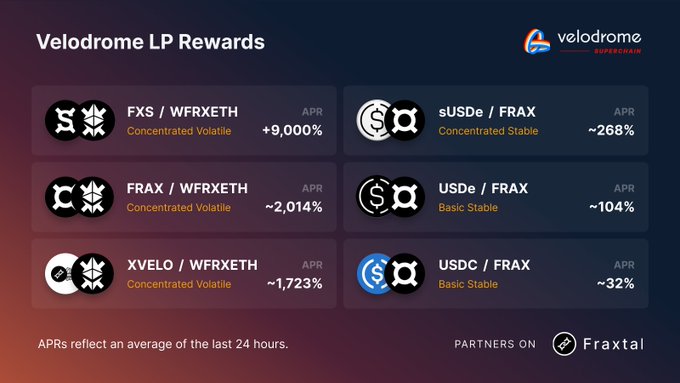

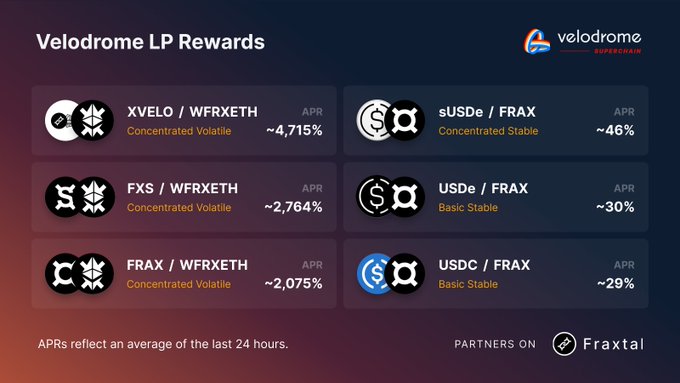

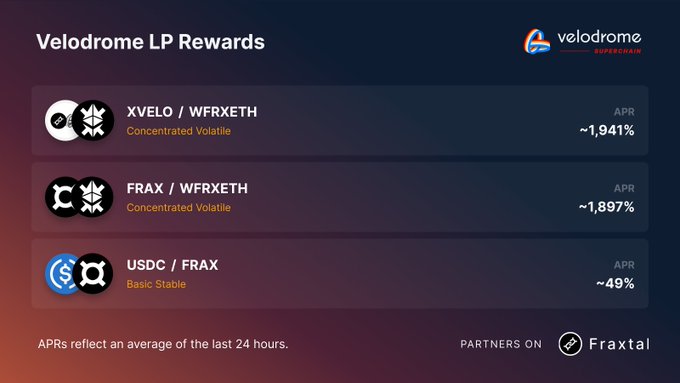

xVELO LP Rewards are LIVE on @fraxfinance's Fraxtal ¤⛓️¤ Following the epoch flip, LPs can now earn xVELO rewards thanks to Superlane interoperability. • $XVELO - $WFRXETH : ~1,941% • $FRAX - $WFRXETH: ~1,897% • $USDC - $FRAX: ~49% Bridges to Fraxtal in the QT below.

Ready to get started? xVELO rewards are live for LPs in ecosystem pools. Check out the list of bridges available to LP and start earning VELO on @fraxfinance's Fraxtal: docs.frax.com/fraxtal/tools/…

All-time High Swap Fees on Velodrome ✨ 🚴 $1.1m in swap fees were accrued during epoch 133, the highest ever. Swap fees are distributed one week in arrears, meaning these fees, along with incentives, will be waiting for veVELO voters next week. Liquidity Hub of the Superchain.

$60 Million in Voting Rewards 🗳️ Velodrome has reached $60 million in cumulative total rewards (swap fees and incentives) for veVELO voters. A major milestone as Velodrome continues its expansion across the #Superchain. 🔴

Second-highest Ever Swap Fees 🚴 Velodrome's swap fees surged in epoch 130, reaching $604k - the second-highest ever recorded and the highest in 33 epochs. Velodrome is the liquidity hub for the Superchain 🔴, with all rewards from all chains accruing back to veVELO voters.

Velodrome Slipstream LP Rewards Update 🚴 • $USDC - $VELO: ~995% • $USDC- $TBTC: ~614% • $USDC - $WLD: ~383% • $USDC - $WSTETH: ~225% • $WSTETH - $OP: ~167% • $WSTETH - $EZETH: ~8% A mix of YBA coins benefiting from our campaign and some other notable tokens.

Yield Bearing Asset OP Grant on Velodrome 🚴🔴 Optimism has awarded Velodrome a 200,000 OP grant to supercharge liquidity for Yield-Bearing Assets (YBAs) across the @optimism Mainnet.

In just three days, Velodrome has broken its all time weekly fee record, collecting over $800,000 in fees. Fees will continue to accrue until Wednesday, when they will be deposited as incentives for $veVELO voters. The Superchain is accelerating...🚴💨✨

Total Rewards Updates 🚴💨 Epoch 131 recorded Total Rewards (fees + incentives) of $840K—the highest in 26 epochs. This underscores Velodrome's momentum following deployments on Fraxtal's @fraxfinance, @modenetwork, and @LiskHQ.

Ethereum Scales While App Layer Expands with Aero Launch

**Ethereum continues its scaling journey** while simultaneously expanding its application ecosystem. - The network is making progress on both infrastructure and user-facing applications - **Aero is scheduled to launch in Q2 2026** - This represents continued development in Ethereum's multi-layered approach The dual focus on scaling and app development shows Ethereum's comprehensive growth strategy beyond just transaction throughput improvements.

Velodrome Offers High-Yield LP Rewards on Ink Chain with Returns Up to 490%

**Velodrome Slipstream** is offering substantial liquidity provider rewards on Ink chain with three main pools: - **$USDT0 - $WETH**: ~490% APY - **$kBTC - $USDG**: ~435% APY - **$WETH - $kBTC**: ~212% APY Users can deposit directly on [@inkonchain](https://inkonchain.com) to start earning these yields immediately. These rates represent significant opportunities for liquidity providers looking to maximize returns on their crypto assets through automated market making. *Ready to explore high-yield DeFi opportunities? Check Velodrome's liquidity page for all available pools.*

🚀 Aero Upgrade Coming

**Velodrome & Aerodrome voters earned $200 million in rewards this year** - a significant milestone for decentralized exchange participants. **MetaDEX03 will upgrade Aero's economic engine** in Q2 2026, promising enhanced functionality for the trading platform. The announcement positions these developments as proof that **crypto can extend beyond gaming and speculation** into substantial economic utility. For detailed information: [Aero FAQ](https://paragraph.com/@aerodrome-foundation/aero-faq)

Velodrome and Aerodrome Communities Unite Under New r/Aero Subreddit

**Velodrome and Aerodrome communities are merging** under a new unified Reddit community as both protocols prepare for the upcoming Aero transition. **Key Changes:** - Old unofficial subreddit has been retired - New [r/Aero](https://www.reddit.com/r/aero/) community launched - Brings together users from both Velodrome & Aerodrome protocols **What This Means:** The consolidation reflects the protocols' evolution toward Aero next year, creating a single hub for community discussions and updates. **Join the new community** at [r/Aero](https://www.reddit.com/r/aero/) to stay connected with the latest developments.

Velodrome Hits All-Time Volume High on Unichain with $167M

**Velodrome achieved record-breaking performance** in Epoch 182, with volumes on Unichain reaching all-time highs of $167M. Key metrics from the latest epoch: - **$343M+ total volume** across the Superchain - **$198M in volume** generated beyond OP Mainnet - **$217K distributed** in voting rewards to participants - Maintained **#1 DEX position** across 8 different chains The milestone pushed Velodrome's **year-to-date volume past $2B**, demonstrating sustained growth in the decentralized exchange space. This performance builds on previous efficiency gains, where Velodrome's top Unichain pool generated comparable volume to competitors using just 1% of their total value locked.