VELO Fed Transitions to Community-Controlled Emissions

VELO Fed Transitions to Community-Controlled Emissions

🏦 veVELO Holders Get The Keys

Velodrome's VELO Fed is implementing a major governance change, shifting from fixed emission schedules to community control. veVELO token holders will now have direct influence over weekly emission rates through voting.

Key changes:

- Emissions can be adjusted up/down by 0.01% weekly

- Initial transition phase maintains 0.3% weekly rate

- Rate caps: min 0.01% to max 1% weekly

- Designed to support Superchain expansion

The system aims to create a more responsive monetary policy while maintaining stability during the protocol's growth phase across multiple chains.

Less than 2 weeks after launching on @Celo: Velodrome now boasts the #1 pool in the ecosystem—leading the way in volume over 24 hours. Velodrome: the liquidity hub of the Superchain

🚴Velodrome 🤝 Celo Last week, @Celo officially joined the @Optimism Superchain ecosystem as an Ethereum L2. Today, Velodrome brings its durable liquidity infrastructure to the Celo ecosystem. Read more 👇

Epoch 142 Recap 🚴 Volume jumped nearly $75M from last epoch, closing at $342M. Meanwhile, over $282k was distributed in voting rewards.

The VELO Fed has Arrived 🚴 Since the launch of Velodrome V2, VELO emissions have followed an immutable schedule. With epoch 149, that changes. More on what this means and what to expect during the transition period👇 medium.com/@VelodromeFi/t…

Epoch 145 Recap 🚴 The epoch closed with over $290M in volume. Voting rewards distributed to veVELO voters reached $279k, bringing the year-to-date total over $3.9M.

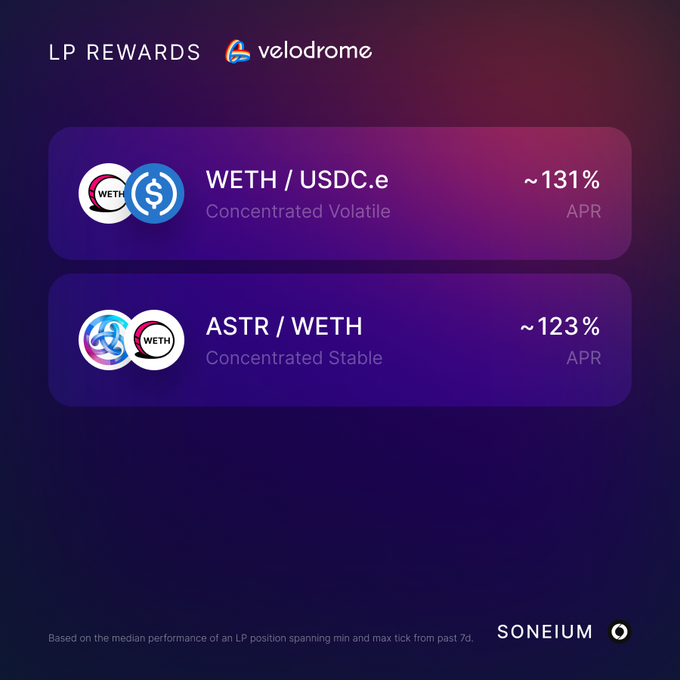

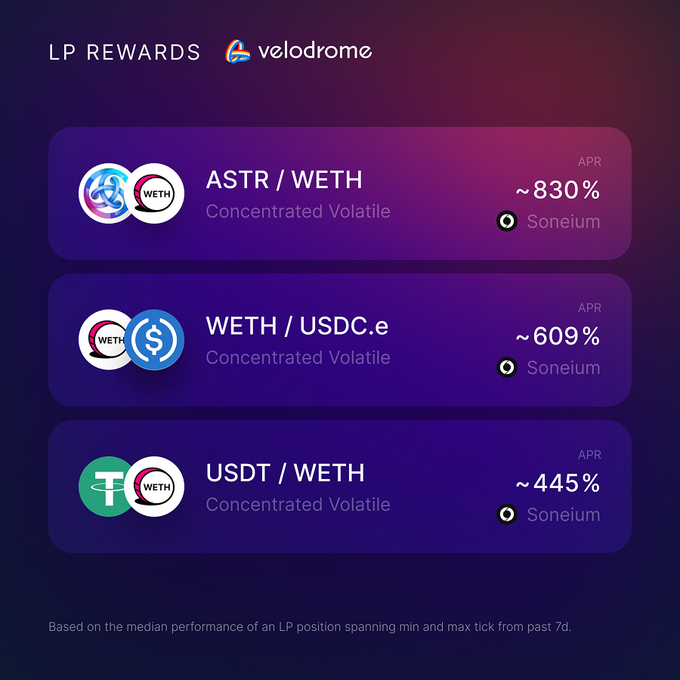

Velodrome Slipstream LP Rewards - @inkonchain • $USDT0 - $kBTC: ~331% • $USDT0 - $WETH: ~126% • $WETH- $kBTC: ~107% Check out every new LP opportunity on Velodrome's Liquidity page.

Capital efficiency on OP Mainnet: in the last 24hrs, Velodrome captured $1.74 in volume for every $1 in TVL. The competition: $0.99 Markets change. Slipstream efficiency doesn’t.

Epoch 140 Recap 🚴 Last epoch ended with ~$530M in volume, a 100M+ increase from the prior week. Fees also lapped the previous epoch, increasing by ~$100k to $394k.

The growth of @inkonchain is accelerating, and Velodrome is helping set the pace: 🐙 Ink nears 1M addresses onchain 🚴 Velodrome consistently ranks as top DEX 👀 Slipstream captured 90% of 24hr DEX vol.

The VELO Fed is designed to put power in the hands of veVELO voters, allowing them to directly impact the rate of weekly VELO emissions. Read more about the transition plan as we prepare to enter this new era👇

The VELO Fed has Arrived 🚴 Since the launch of Velodrome V2, VELO emissions have followed an immutable schedule. With epoch 149, that changes. More on what this means and what to expect during the transition period👇 medium.com/@VelodromeFi/t…

A few highlights from the last week: • Velodrome Launches on Celo 🚀 • Velodrome Launches on Superseed🚀 • The VELO Fed Has Arrived 🏦 • Velodrome dominates as @inkonchain surges • XOP: Unlocking OP Rewards on the Superchain • Awarded as a top Onchain Builder 🔨 • ACS

$25 Billion in Cumulative Volume 🚴♂️ Velodrome’s cumulative volume has grown from $7B to $25B in just one year—a 3.5x increase.

Leading the Superchain 🚴 In the last 24 hours, Velodrome has captured more volume than all other DEXs combined — across all chains we've deployed on. Slipstream remains dominant, no matter where it competes.

Stablecoin Exposure on the Superchain🚴 Velodrome Stablecoin volume has surpassed 3.5 Billion YTD — with stable to stable swaps accounting for $300M so far in 2025. Velodrome — the home for stables on the Superchain.

Epoch 148 Recap 🚴 📈 $182M vol (33% increase from last epoch) 🗳️ ~$120k distributed in voting rewards 🔒 6M+ more $VELO locked than emitted Velodrome—the liquidity hub of the Superchain

kBTC on Velodrome 🚴♂️ With $kBTC, Bitcoin comes to @inkonchain, wrapped, backed, and issued by @krakenfx. Pools are now live, with emissions incoming 🗳️

14-Day High Yesterday, Velodrome's Slipstream volume and fees hit their highest levels in two weeks: $73k in fees and $137.7M in volume (on Optimism alone).

Velodrome Slipstream LP Rewards - kBTC on Ink • $WETH - $kBTC: ~111% • $USDT0 - $kBTC: ~106% Migrate from Kraken & put your $kBTC to work💪 LP on Ink today: tinyurl.com/yas8pndn

kBTC on Velodrome 🚴♂️ With $kBTC, Bitcoin comes to @inkonchain, wrapped, backed, and issued by @krakenfx. Pools are now live, with emissions incoming 🗳️

Epoch 141 Recap 🚴 While volume dipped, total Voting Rewards jumped over $100k from the prior epoch, ending the week at $453k.

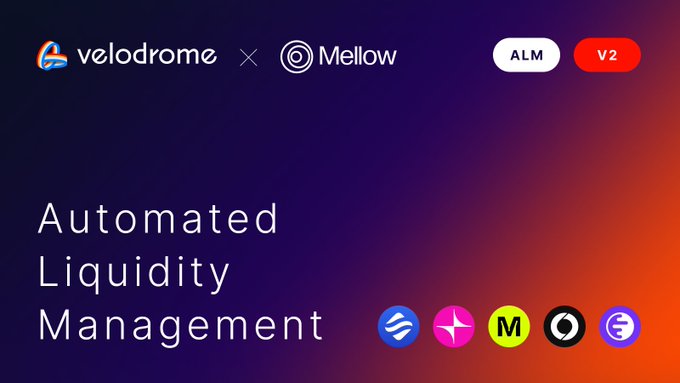

LP Hands-Free Across the Superchain 🔴 ⛓️ The best in ALM is now available for top pools on @soneium @swellchain @modenetwork @inkonchain and @unichain.

Epoch 146 Recap 🚴 The epoch closed with over $179M in volume. Voting rewards distributed to veVELO voters reached $227k, bringing the YTD total beyond $4 million.

Epoch 147 Recap 🚴 The epoch closed with over $136M in volume. Voting rewards distributed to veVELO voters reached $165k, bringing the all-time total beyond $68 million.

Epoch 139 🚴 The epoch closed with ~$420M in volume, bringing the lifetime total beyond $25B. Velodrome is now the top DEX on @optimism @modenetwork @inkonchain @soneium @LiskHQ and @Metal_L2

Epoch 144 Recap 🚴 The epoch closed with over $378M in volume. Voting rewards distributed to veVELO voters increased by more than $75k from the previous epoch, passing $300k.

Epoch 143 Recap 🚴 Volume jumped from $341M in the previous epoch to $488M. Voting rewards similarly increased—from $245k to $319k.

Epoch 149 Recap 🚴 Last epoch marked a new milestone—$28 Billion in cumulative volume. Voting rewards distributed to veVELO voters reached $126k as protocol volume jumped 20% from the prior epoch.

SuperStacks Program Launches with Velodrome on Optimism Superchain

Velodrome and Optimism have launched SuperStacks, a new interoperability rewards program running April 16 - June 30. Users can earn XP (redeemable for $OP) by providing liquidity in eligible pools across the Superchain. **Eligible Pools:** - USDT0/WETH (OP Mainnet) - USDT0/USDT (OP Mainnet) - USDT0/WETH (Ink) - WETH/kBTC (Ink) - USDT0/ETH (Soneium) Rewards are based on liquidity amount, duration, and surprise factors. Learn more at [SuperStacks Dashboard](http://app.optimism.io/superstacks)

UX Upgrade Makes Providing Liquidity More User-Friendly

A significant update to the liquidity provision interface introduces several user-focused improvements: - New intuitive, guided deposit experience - Pool type filtering between Concentrated and Basic options - APR comparison tools across ranges and ALM - Mobile-optimized interface for LP management **Step-by-Step Process:** 1. Access Liquidity>Deposit Liquidity 2. Pick token pair and chain 3. Select pool type 4. Configure price range 5. Complete deposit 6. Stake position **ALM Feature Highlight:** Automated Liquidity Management (ALM) offers hands-free LP management with dynamic market adaptation.

Velodrome Achieves Major Milestone with 55% Supply Lock

Velodrome Finance has reached a significant milestone with approximately 55% of its $VELO supply now locked. Key metrics: - Average lock duration: 3.6 years - 91% of locks are auto-max locked - 6% of votable $veVELO supply in Velodrome Relay Auto-max locking automatically extends locks weekly to the maximum duration of 4 years, effectively removing tokens from circulation until deactivated. The Velodrome Relay system automates voting, reward claims, and compounds returns into max-locked $VELO positions. [Check current lock statistics](https://velodrome.finance/locks)

Weekly Highlights: Soneium Ecosystem Growth and Volume Surge

- ETH & BTC trading volumes show remarkable 13X year-over-year growth - Optimism Mainnet sees improved capital efficiency - Soneium launches ACS Season 5 with new campaign and badge system - Platform achieves new ATH of $9.66M in dapp volume - Notable metrics: * 74% increase in Unique Active Wallets * 25% growth in transactions - SakeFi and KyoFinance lead volume activity - KyoFinance introduces OP rewards for LP incentives - New staking opportunities and quest system implemented for enhanced earning potential Track ecosystem metrics: [DappRadar Rankings](https://dappradar.com/rankings/protocol/soneium)