On April 26, 2024, an announcement was made regarding an upcoming upgrade to the controller system. This upgrade will enable the controller to understand and interact with decentralized exchange (DEX) aggregators without the need for smart wallets. This development aims to enhance the functionality and accessibility of future markets.

A little upgrade for future markets: Controller to understand things like DEX aggregators without use of smart wallets. github.com/curvefi/curve-… curvemonitor.com/#/dao/proposal…

Curve Finance Releases Week 49 Yield Report and Key Metrics

**Curve Finance** has published its weekly yield report for Week 49 of 2025, continuing its regular series of performance updates. The report covers: - **Current yield opportunities** across Curve's liquidity pools - Key performance metrics for the week - Pool-specific data and analytics This marks another installment in Curve's consistent weekly reporting, following their November monthly recap and previous weekly yield updates. The platform continues to provide transparency around yield farming opportunities and protocol performance through these regular data releases. [View the full Week 49 report](https://news.curve.finance/curve-best-yields-key-metrics-week-49-2025/)

🔄 Curve Launches First Foreign Exchange Pool with CHF/USD Trading

**Curve Finance introduces foreign exchange trading** with its first pilot CHF/USD liquidity pool on Ethereum. The pool combines: - **$ZCHF** from Frankencoin - **crvUSD** for the USD side - **CRV emissions** offering up to 100% APR **FXSwap algorithm powers the pool**, designed specifically for efficient trading of low-volatility assets like foreign currencies. This marks Curve's expansion into **on-chain foreign exchange markets**, targeting deep liquidity for currency pairs beyond traditional crypto assets. [Access the CHF/USD pool](https://www.curve.finance/dex/ethereum/pools/factory-twocrypto-276/deposit)

Curve Finance Reports Strong Yields in Week 40 Performance Update

Curve Finance released its weekly performance report for Week 40 of 2025, highlighting **strong yield opportunities** across its liquidity pools. The DeFi protocol continues its regular updates on key metrics and best-performing pools, providing users with data-driven insights for yield farming strategies. - Weekly yield tracking helps users identify optimal liquidity provision opportunities - Performance metrics guide investment decisions across Curve's ecosystem - Regular reporting maintains transparency in the protocol's operations This marks another consistent week of yield reporting from Curve Finance, following similar positive updates in previous weeks. The protocol's focus on **advanced bonding curves** continues to generate competitive returns for liquidity providers. [View full yield report](https://news.curve.finance/curve-best-yields-key-metrics-week-40-2025/)

Curve Finance Maintains Strong Yield Performance in Week 3

Curve Finance continues to demonstrate consistent yield performance in the third week of 2025, maintaining the positive trend observed since the start of the year. Key metrics: - Weekly yield reports show sustained stability - Multiple pools maintaining competitive returns - Trend continues from previous weeks' positive performance This marks the third consecutive week of notable yields in 2025, following the reporting structure implemented in December 2024. *Note*: Detailed pool-specific data available in the full report.

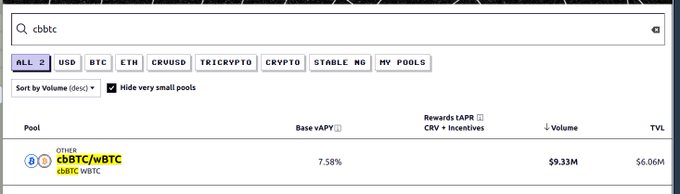

Coinbase cbBTC Swap Demand Surges

The demand for swapping Coinbase's cbBTC continues to rise, with notable metrics: - **Pool utilization** reaches 150% - **Unincentivized APR** stands at 7.6% This trend has persisted for at least two days, indicating sustained interest in cbBTC swaps. The high pool utilization suggests increased trading activity, while the attractive APR may draw more liquidity providers to the pool. Traders and investors should monitor these metrics closely, as they may impact swap costs and potential earnings from providing liquidity.