UniDex V4 Vault Offers High APR for Stable Coin Liquidity Providers

UniDex V4 Vault Offers High APR for Stable Coin Liquidity Providers

🚀 Stable coins on steroids?

UniDex's V4 Vault is offering attractive opportunities for stable coin holders:

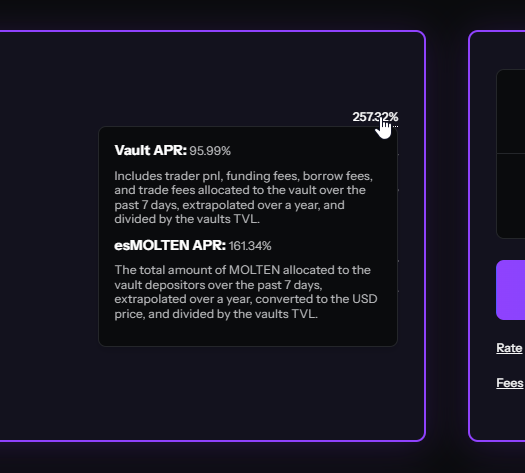

- High APR: The vault has reached up to 257% APR

- Multiple benefits:

- Extra yield on stable coins

- Market making against perpetual traders

- Yield from various yield-bearing stable coins

Recent updates:

- Boosted fee share for Perp LPs: Increased from 20% to 50%

- Current APR for USDC liquidity providers: Over 98%

How to participate: 1. Mint USD.m tokens on leverage.unidex.exchange/pooling 2. Stake USD.m on leverage.unidex.exchange/usdmstaking

For more information, check UniDex's documentation and social media threads.

V4 Vault on #UniDex hitting a high of 257% APR! Looking to earn extra yield on your stables? Market make against perp traders like HLP? Gain yield from multiple yield bearing stable coins? Put your stables to work 👇 leverage.unidex.exchange/pooling

UniDex Launches Major DEX Updates Including RWA Trading and Lending Integration

UniDex has rolled out significant platform improvements: - Enhanced RWA trading with increased liquidity for pairs including WTI/USD, NZD/USD, USD/JPY - New lending aggregation feature integrating Aave and Fluid protocols - Streamlined onboarding process matching CEX standards while maintaining decentralization - Added Market Scanner page for opportunity identification - Funding rate scanner to compare rates between UniDex and Binance - Configurable ticker display for market monitoring - New trading competition announced with XP-based rewards Platform now offers up to 170% APR on MOLTEN/S pair via SHADOW Exchange. [Try lending features](https://leverage.unidex.exchange/lending) [Explore funding arbitrage](http://leverage.unidex.exchange/funding-arb)

UniDex Trading Competition Concludes, Results Pending

The $5,000 UniDex Trading Competition has officially ended. The competition, which ran from February to April 2025, offered prizes based on percentage PnL and trading volume. - Competition details: - Prize pool: $5,000 - Metrics: PnL & Volume performance - Platform: [UniDex leverage trading](https://leverage.unidex.exchange/leaderboard) Results are currently being verified by the team. Winner announcements and reward distributions will follow shortly.

UniDex Integrates ZeroDev's CAB for Cross-Chain Trading

UniDex has integrated ZeroDev's infrastructure to enhance its trading capabilities. The key development is the implementation of CAB (Cross-Account Balances), which enables: - Seamless trading across multiple chains - Ability to access any perpetual protocol - Trading without moving assets between chains This integration builds upon UniDex's V4 ecosystem, which allows developers to: - Create alternative frontends - Develop trading bots - Build strategy vaults Developers can earn rewards from trading fees generated through their applications built on UniDex's platform. *For technical details and integration guides, visit the [SDK/API documentation](https://docs.unidex.exchange/api-reference/introduction)*

UniDex $5k Trading Competition Winners Announced

The recent UniDex $5k Trading Competition has concluded, with winners to be announced after rule compliance verification. - Competition ran from February 16-28, 2025 - Total prize pool: $5,000 - Winner verification in progress *Coming Soon*: A new trading competition will be launched in the coming weeks. Stay tuned for the official announcement with complete details and participation guidelines. Want to participate in the next round? Follow UniDex's social channels for immediate updates.

UniDex Rolls Out Major Platform Updates

UniDex has deployed several significant platform improvements: - Instant account funding and deposits from Base network - Enhanced UI with new glass-style tooltips for better context - Redesigned pair selector with categories and favorites menu *Recent Platform Developments:* - Increased pooler returns from 20% to 50% following community vote - Bug fixes and performance improvements - Testing phase for margin adjustment features - Integration with Across Protocol for faster cross-chain bridging - Reduced borrow fees for traders Visit leverage.unidex.exchange to explore the new features.