Understanding EVM: The Engine Behind DeFi Interoperability

Understanding EVM: The Engine Behind DeFi Interoperability

🤖 EVMs Secret Sauce Revealed

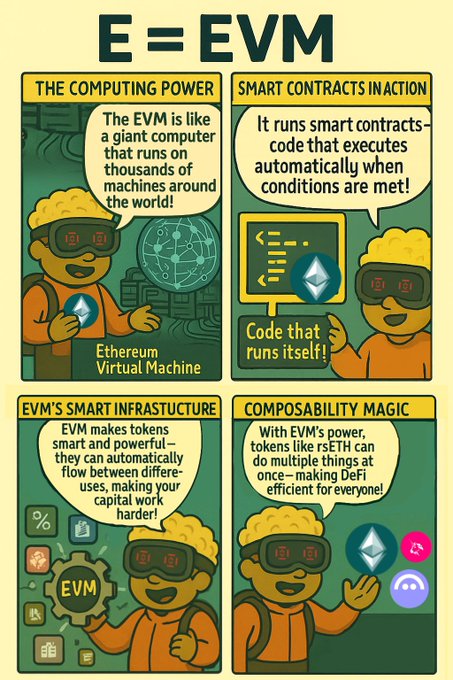

The Ethereum Virtual Machine (EVM) serves as the foundational technology enabling liquid restaking tokens like rsETH to function across multiple DeFi platforms.

- EVM acts as a universal translator, allowing protocols like Uniswap, Aave, and Compound to interact seamlessly

- This standardization enables users to utilize their rsETH tokens as collateral across various DeFi applications

- The technology ensures consistent execution of smart contracts regardless of the platform

Key Benefit: Users can leverage their liquid restaking positions across the entire DeFi ecosystem without friction.

Ever wonder how your rsETH works seamlessly across @Uniswap, @aave, @growcompound, and dozens of other DeFi platforms? In today's comic, let's explore EVM -- the universal engine that powers the entire DeFi ecosystem. E is for EVM 🌱

rsETH Enables Multi-Job Staking on KelpDAO

KelpDAO's rsETH token now supports simultaneous participation in multiple validator jobs, enhancing earning potential for stakers. This development marks a significant evolution in liquid restaking capabilities. Key points: - Users can engage in multiple validator roles concurrently - Available through KelpDAO's restaking platform - Built on Eigenlayer infrastructure Explore restaking opportunities at [KelpDAO's Kelp platform](https://kerneldao.com/kelp/restake/?utm_source=social)

hgETH Strategy Update: Total Reward Rate Jumps to 15.7%

KelpDAO's hgETH portfolio saw significant improvements this week: - Total reward rate increased from 10.2% to 15.7% - Major allocation increase on Aave v3 - Upshift.fi, TacBuild, and Euler Finance all delivering 15%+ rewards Portfolio Highlights: - Aave v3: 42% allocation, 12% rewards - Euler Finance: Leading with 22% rewards - Multiple protocols maintaining strong 15% rates Technical integrations are in development to enhance holder benefits. [Mint hgETH](https://kelpdao.xyz/gain/growth-vault/?utm_source=highguide)

Movement Labs Migrates rsETH-wETH Pool to Meridian Money

Movement Labs announces migration of rsETH-wETH liquidity pair from Liquidswap to Meridian Money's metastable pool. Liquidity providers must follow a 4-step process to maintain MOVE rewards: - Withdraw LP tokens from current Liquidswap vault - Break LP position into individual tokens - Deposit into Meridian metastable pool - Stake new LP tokens for MOVE rewards This update follows previous DeFi Spring Wave Two initiative that offered ~22% reward rates with $21M+ TVL for rsETH-WETH pairs. **Important Links:** - [Canopy Hub Withdrawal](https://app.canopyhub.xyz/explore?id=0xefa4b39d3cd87b5f24d53d4d54879c90787f282e05d701dfe66942378deeba61) - [New Staking Portal](https://app.canopyhub.xyz/explore?id=0x24b7a15cce2a31e7f9c09811f5596b6a1d3a84325a3f224f30f7cb16b7006307)

Pendle Finance's agETH Pool Reaches $7M TVL

The agETH pool on Pendle Finance has reached approximately $7M in Total Value Locked (TVL). Users can earn multiple reward streams: - 3.5x Kernel Points - Programmatic EIGEN rewards - Leveraged Restaking rewards **Pro Tip**: Enhance your rewards by utilizing YT, LP, and PT tokens within the agETH pool. Access the pool at [Pendle Finance](https://app.pendle.finance/trade/pools/0xbe8549a20257917a0a9ef8911daf18190a8842a4/zap/in?chain=ethereum)