🔥 Trader Joe Activates DLMM Incentives on Monad

🔥 Trader Joe Activates DLMM Incentives on Monad

🚀 DLMM Rewards Live

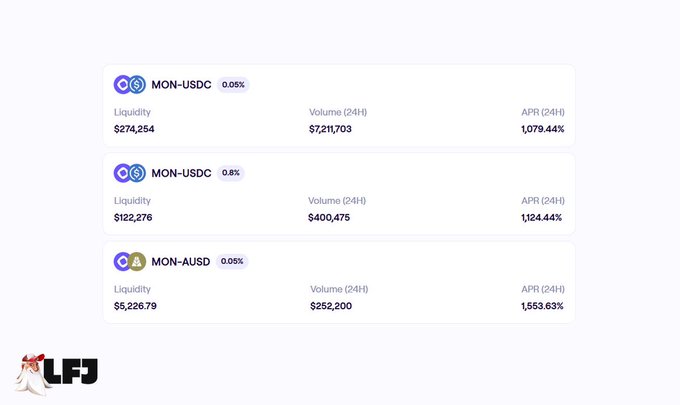

Trader Joe has activated incentives on its Liquidity Book DLMM pools on the Monad network.

Key Features:

- Liquidity providers earn both $MON and $JOE rewards plus trading fees

- MON/USDC pool generated $27.5K in fees this week

- Real-time, on-chain reward distribution mechanism

Performance Metrics:

- Pools achieved 10x utilization rates daily in Week 1

- Zero-slippage architecture captures maximum trade flow

- Significantly outperforms other Monad DEXs in volume-to-TVL ratio

How It Works:

- Rewards distributed based on proportional liquidity share

- Reward range moves with active price bin

- Keep liquidity active to maximize earnings

More incentive programs are planned for the future.

Liquidity Book DLMM = the best DEX on Monad for fee generation. ➔ Deploy your own custom liquidity position. ➔ Capture more trade flow with zero slippage tech ➔ Generate maximum fees APR's looking good + incentives arrive soon. Put your $MON to work on JOE

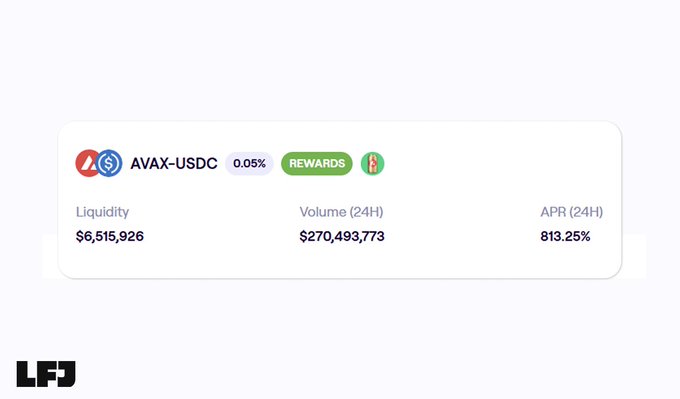

$6.5M liquidity generating $270M in volume + $140K in fees within 24 hours. That's a 41x utilization rate. Liquidity Book DLMM is the most CRACKED fee machine in crypto.

Liquidity in JOE DLMM pools this week averaged a 10x utilization rates (with some hitting as high as 25x). DLMM far outperforms other Monad DEXs in volume generated vs TVL. Translation 👉 LP your $MON on JOE for peak capital efficiency + maximum fee generation.

🔥 Monad DLMM Pools Hit 45,500% APR

**Monad's DLMM pools are delivering extraordinary yields** with some positions reaching 45,500% APR through concentrated liquidity strategies. **Key Details:** - 100,000 MON deployed in Dynamic Liquidity Market Maker pools - **Reward Range APR** calculated using tight 10 basis point ranges (3 bins) around active price - **Pool APR** averages total TVL against 24-hour fees plus rewards **How It Works:** - Actual APR depends on your deployed range tightness and liquidity distribution - As long as MON price stays within your range, yields can reach **4-digit APR levels** - Tighter ranges around current price maximize efficiency and returns **Boosted Pools Available:** - MON-USDC, AUSD-USDC, wstETH-MON - Various aprMON, gMON, sMON, and shMON pairs - Rewards distributed via Merkl - **claim directly from their dashboard** These yields reflect current low TVL conditions. Returns will adjust as more liquidity enters the ecosystem.

Trader Joe DLMM Shows Strong Growth with 136% Volume Surge

**Trader Joe's Dynamic Liquidity Market Maker (DLMM) posted impressive metrics:** - **TVL increased 36%** in 8 hours - **Volume surged 136%** during the same period - **APR jumped 73%** for liquidity providers The platform recently hit **$6.5M in daily volume** - the highest since April 2024, signaling renewed momentum. *DLMM's automated market making continues attracting liquidity as DeFi activity picks up.*

Monad Mainnet Launches: Community Debates Official Mascot Identity

**Monad's mainnet officially launched** three days ago, marking a significant milestone for the layer-1 blockchain network. The **MON token** is now live alongside the mainnet, following the Foundation's earlier announcement from November that promised a launch this month after the airdrop claim period. **Community focus has shifted** to an unexpected debate: determining Monad's official mascot. This question has emerged as a primary discussion point among users in the days following the mainnet launch. The successful deployment represents the culmination of Monad's development as a **high-performance blockchain** designed to compete in the layer-1 space.

Limit Orders V1 Winding Down, V2 Coming Soon

Trader Joe is phasing out V1 Limit Orders. Users can no longer set up new Limit Orders, but existing ones remain active. These can be cancelled or left to execute, with no rush to claim converted tokens. A V2 version of Limit Orders is in development and will be released after the deployment of a new Aggregator Router. This update aims to improve the trading experience on the platform. Users are advised to stay tuned for further announcements regarding the launch of Limit Orders V2.