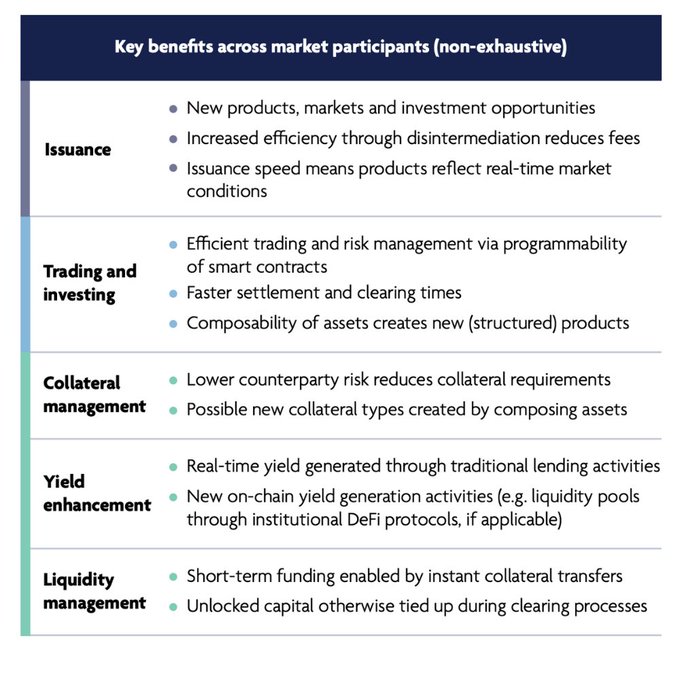

A report by @UKFtweets and @OliverWyman highlights the benefits of tokenized assets, such as instant transfers and reduced risks in clearing, settlement, and counterparty performance.

Tokenized assets are superior to traditional asset formats. “In their token form, securities can be transferred near instantly, significantly shortening the traditional clearing and settlement cycles, and settled atomically […] reducing counterparty risk, bankruptcy risk, and

Chainlink SVR Expands to Five Major Blockchains Including Arbitrum and Base

Chainlink's Secure Value Recapture (SVR) oracle solution is now operational across five major blockchain networks: Arbitrum, Base, BNB Chain, Ethereum, and Hyperliquid's HyperEVM. More chains are planned for future integration. **What is SVR?** SVR enables DeFi protocols to recapture oracle extractable value (OEV) from liquidations, converting what was previously lost MEV into protocol revenue. The captured value is split between the protocol and Chainlink. **Proven Track Record** The Aave DAO recently expanded its SVR usage from 3% to 27% of its Ethereum TVL following a successful pilot. During testing, SVR liquidated at-risk positions without any bad-debt accrual, now covering major assets including AAVE, LINK, WBTC, USDC, and various wrapped ETH tokens across Aave v3 markets. DeFi protocols interested in implementing SVR can access [documentation](https://docs.chain.link/data-feeds/svr-feeds) to explore integration options.

Chainlink Acquires Atlas Order Flow Auction Protocol to Expand SVR Revenue Solution

Chainlink has acquired Atlas, an order flow auction protocol developed by FastLane. The acquisition brings Atlas under exclusive support for Chainlink's Smartly Validated Responses (SVR), described as the most widely adopted Oracle Extractable Value (OEV) recapture solution. **Key Details:** - Atlas will now exclusively support Chainlink SVR - The move aims to increase revenue for DeFi protocols by expanding SVR to new ecosystems - SVR helps protocols recapture value that would otherwise be extracted by third parties **Current Availability:** Chainlink SVR is currently live on: - Arbitrum - Base - BNB Chain - Ethereum - Hyperliquid HyperEVM Additional blockchain integrations are planned. DeFi protocols interested in implementing SVR to recapture OEV and boost revenue can reach out through [Chainlink's documentation](https://docs.chain.link/data-feeds/svr-feeds). The acquisition represents Chainlink's continued expansion of infrastructure solutions designed to help DeFi protocols capture more value from their operations.

Chainlink Launches 24/5 U.S. Equities Streams to Bring $80T Market Onchain

Chainlink has launched **24/5 U.S. Equities Streams**, enabling the ~$80 trillion U.S. equities market to move onchain. **Key developments:** - The new infrastructure provides continuous access to equity market data, operating 24 hours a day, 5 days a week - [Orderly Network](https://twitter.com/OrderlyNetwork), an omnichain perpetual DEX infrastructure, is integrating these streams to enable developers to launch secure equity perpetuals markets across multiple chains - This builds on Chainlink's track record of enabling over $24 trillion in transaction value The launch represents a significant step in bringing traditional financial markets onchain, allowing developers to build applications that bridge conventional equities with blockchain infrastructure.

Polymarket Launches 15-Minute Markets with Chainlink Integration

**Polymarket has officially launched 15-minute prediction markets** powered by Chainlink's infrastructure on Polygon mainnet. The integration combines **Chainlink Data Streams and Automation** to enable: - Near-instant market settlement - Enhanced security through defense-in-depth architecture - Support for hundreds of crypto trading pairs Starting with asset pricing, this marks the beginning of an expanded collaboration between the two platforms. UMA's existing role on Polymarket remains unchanged, with Chainlink serving as an additional infrastructure layer specifically for this new market category.

🔗 Chainlink's Vision for True Cross-Chain Interoperability

Chainlink has outlined its approach to end-to-end blockchain interoperability that extends beyond basic cross-chain token transfers. The platform addresses five critical components: - **Data integration** across different sources - **Compliance** with regulatory requirements - **Privacy** protections for sensitive information - **Legacy system integration** with existing infrastructure - **Orchestration** of complex multi-chain operations This comprehensive framework positions Chainlink as an all-in-one oracle platform capable of coordinating enterprise smart contracts across multiple blockchains and traditional systems. [Read the full technical breakdown](https://blog.chain.link/end-to-end-interoperability/)