In the next network upgrade, Thorchain will burn 60m RUNE to create space for lending, onboarding a minimum of $100m in new collateral for monetisation. Borrowers will enjoy a 50% LTV loan with no liquidation. The system is expected to double in TVL and quadruple in price action as it expands.

In the lead-up to the MAXCR drop from 500% to 200% many BTC lenders closed (likely in order to re-open). 425 BTC ($22m) down to 226 BTC ($11m). A very good stress test on the system. Almost 50% of the lending book closed in 3 days. How did the system go in the last few days?

Big news in @THORChain land! TC now offers the best loan terms in all of crypto: 50% LTV, 0% interest, NO LIQUIDATION, and no expirary Seems too good to be true, but it is! A $RUNE 🧵👇

All @THORChain loans can now be taken out at 50% LTV. This user borrowed $26k against a 1 $BTC deposit to do whatever they like with. They'll pay 0% interest for this service, and won't be liquidated even if BTC goes to $1. It's hard not to see lending get maxxed out soon⚡️

🏦→ Loan open [m90j] Collateral deposited: 0.999 BTC ($51,872) CR: x2.0 Debt: $25,927 Target asset: Rune ᚱ dashboards.ninerealms.com/#lending

My looped $ETH position is currently up an extra 44% compared to holding spot. I pay no interest fees and can't be liquidated. Interested? If you missed the boat before, free leverage on $BTC and $ETH is about to become available on @THORChain again ⚡️

I took out an early $ETH backed loan through Thorchain at around 47% LTV. I looped back into $ETH 3x and now have exposure to 70% more $ETH compared to holding spot. There are no interest costs, funding fees or liquidations. If you're ok with the smart contract risk and are

V128 will burn 60m RUNE to make space for lending. This will onboard a minimum of $100m in new collateral for TC to monetise in its liquidity. Borrowers get an amazing loan (50% LTV), TC gets assets to monetise. Win-Win

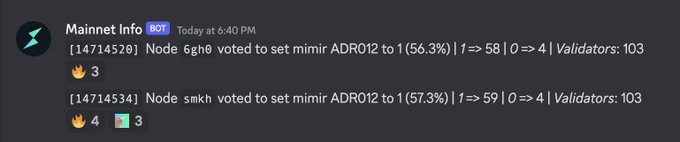

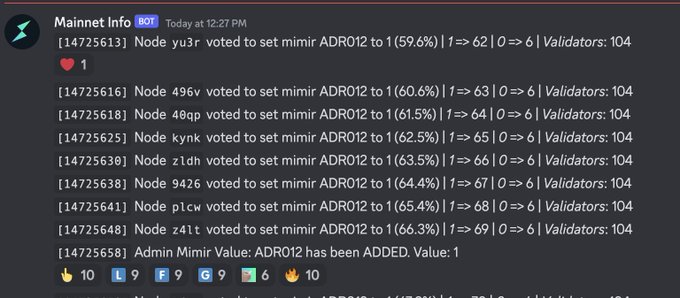

10 more nodes to vote. 60,000,000 $RUNE will be burnt, and effectively turned into collateral buffer - allowing an additional $100m+ of collateral to be onboarded to the system. $100m of BTC and ETH loans at 200% CR. Onwards

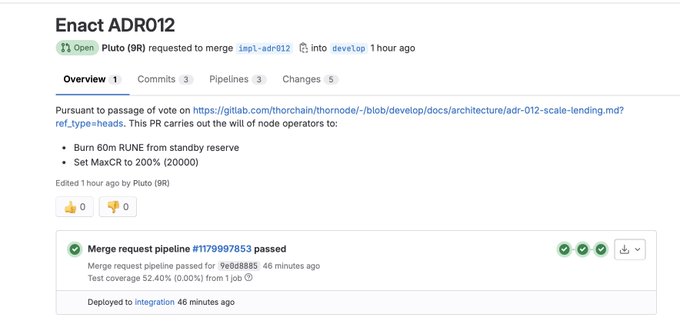

In the next THORNode release v128, 60m $RUNE will be burned to create capacity for 2.1k BTC (or 41k ETH) collateral for lending with a fixed LTV of 50% Keep track with the below PR: gitlab.com/thorchain/thor…

ADR12 has been voted on. 60m RUNE will now be burnt, and provided for acceleration of lending. Lending CR's will drop to 200% flat - ie, a 1 BTC loan will yield $25k debt (50%). Onwards.

Now that ADR12 has passed, let's talk about how it will be enacted and compare it with any similar events in past. 🧵

ADR12 has received strong support. 1) Burns 60m RUNE (essentially giving the protocol control of that supply) 2) Allowing Lending Collateral to scale to ~25m RUNE ($125m worth of collateral can be onboarded) 3) Collateral is given to TC for free by users, for TC to monetise

103 THORNodes are currently voting on whether to burn 60m $RUNE (worth over $300m) and drop lending collateralisation ratios to 200%. Currently at 32% for. Jump in the discord to participate in the discussion. Onwards!

Every little $ETH price pump is like a knife to my heart… cos my lending collateral was liquidated at $1700. Not blaming that specific lending protocol… BUT, no liquidation, no interest, no expiry, flat 50% LTV loans NOW AVAILABLE on @THORChain ?!? Sign me up!!! 😻💚⚡️

🏦→ Loan open [m90j] Collateral deposited: 0.999 BTC ($51,872) CR: x2.0 Debt: $25,927 Target asset: Rune ᚱ dashboards.ninerealms.com/#lending

What if you could double your exposure to $ETH without liquidations or paying interest? That is the benefit of looping your loan on @THORChain Loop your loan 7x and you will have twice the exposure with: ⚡️No expiry ⚡️No interest ⚡️No liquidations 7x Loop loan: You have

MaxCR has been lowered to 200%. All loans now opened are 50% LTV - deposit 1 BTC, borrow $25k in debt. No liquidations, no interest, no expiry. Lending is now 9 months old and has almost 1000 users. Now let's talk about how TC benefits from this.

What's going to happen now? 1) Next network upgrade will burn 60m RUNE 2) Mimir will drop maxCR down to 200% This will mean: 1) Over $100m of new loans to the system 2) Unbeatable loan terms TC is now positioned to be the lead for decentralised L1 lending

Whale Swaps $3.9M USDC to Bitcoin via Ledger Using THORChain

A user executed two large swaps totaling $3.9M ($2M + $1.9M) converting USDC to Bitcoin through Ledger's interface, powered by THORChain's SwapKit. **Key Details:** - Native Bitcoin swaps with no centralized exchange required - Full self-custody maintained throughout transactions - Wallets like Rabby, Phantom, Magic Eden, and MetaMask can integrate THORChain to earn affiliate fees **Context:** THORChain processed $534M in Q4 2025, saving users $1.8M in fees compared to typical DEX costs. The protocol enables native asset swaps (BTC, ETH, stablecoins) at competitive pricing without KYC or custody risks.

THORChain January Network Report Released

THORChain has published its State of the Network report for January 2026, providing insights into the protocol's performance and metrics for the month. The report covers key operational data across THORChain's cross-chain liquidity infrastructure, which enables swaps and yield generation across Bitcoin, Ethereum, BNB Chain, and Cosmos ecosystem assets. **Key areas likely covered:** - Trading volumes and liquidity metrics - Protocol revenue and node operator performance - Cross-chain activity across supported blockchains - Network security and validator statistics Read the full analysis: [State of the Network - January 2026](https://blog.thorchain.org/state-of-the-network-january-2026-2/)

THORChain Processes $30M BTC-ETH Swap, Largest in DeFi History

**January 2026 Performance Highlights** - Protocol generated **$1.1M in revenue** despite subdued market conditions - Reached **1M cumulative wallets** milestone - Network security maintained with **$53M in bonded assets** **Record-Breaking Transaction** Streaming swaps facilitated a **$30M BTC-ETH trade**, marking the largest single swap ever executed in decentralized finance. The transaction demonstrates THORChain's capacity to handle institutional-scale operations. The protocol continues operating as designed, processing large-value cross-chain swaps without centralized intermediaries.

CoinGecko's Bitcoin DEX Rankings Questioned Over Classification Standards

A community member has challenged CoinGecko's Bitcoin DEX rankings, pointing out apparent inconsistencies in how platforms are classified. The rankings currently show: - **ChangeNOW** listed at #1 with 99.8% market share, despite being a custodial aggregator - **Magic Eden** included, though it trades Runes NFTs rather than Bitcoin swaps - **THORChain** absent from the list, despite processing $118 billion in native BTC swaps through 100+ independent node operators The question raises concerns about what qualifies as a "decentralised" exchange in CoinGecko's methodology. If platforms with custody or validators can be classified as DEXs, the absence of THORChain - which operates with native Bitcoin swaps and no wrapped assets - appears inconsistent. The issue highlights ongoing challenges in the industry around defining and categorizing decentralised infrastructure.

THORChain Reports $4B Swap Volume in Q4, Plans Solana and ZCash Integration

THORChain released its Q4 2025 ecosystem report showing significant activity across its decentralized liquidity protocol. **Key Metrics:** - $4.02B in swap volume - 108,000 unique swappers - 1.22M total trades - $5.02M collected in swap fees - Beta launch of swap.thorchain.org **2026 Roadmap Highlights:** - Solana integration - ZCash support - Rapid Swaps feature The numbers represent a slight decrease from Q3's $4.5B volume and 1.8M swaps, though the platform maintained strong user engagement with over 100,000 active swappers. [Read the full report](https://blog.thorchain.org/thorchain-q4-2025-ecosystem-report-2026-roadmap/)