THORChain Achieves Record Swap Volume, Lending Activity Surges

THORChain Achieves Record Swap Volume, Lending Activity Surges

🚀 Record Volume, Lending Boom

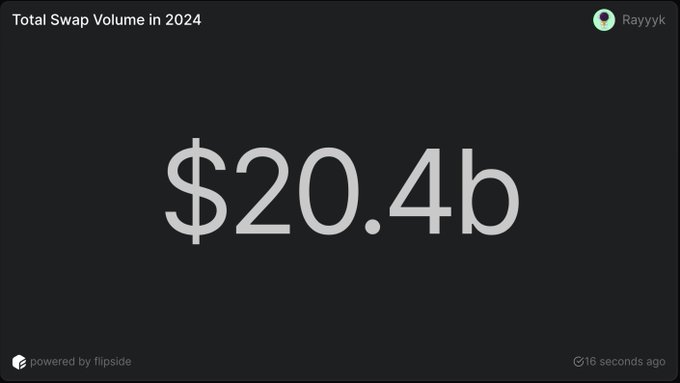

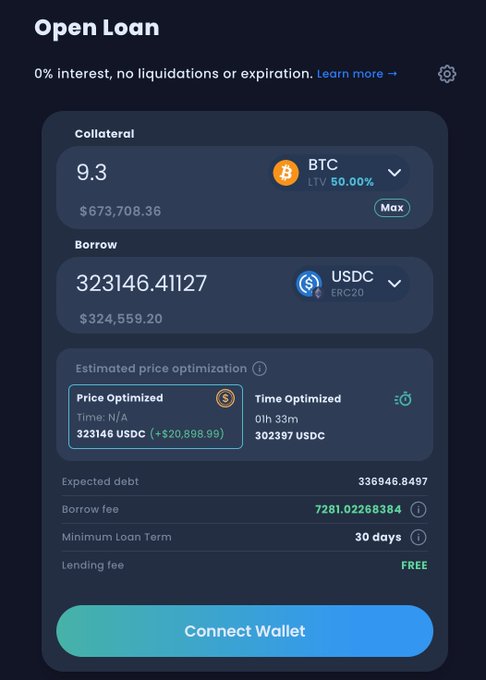

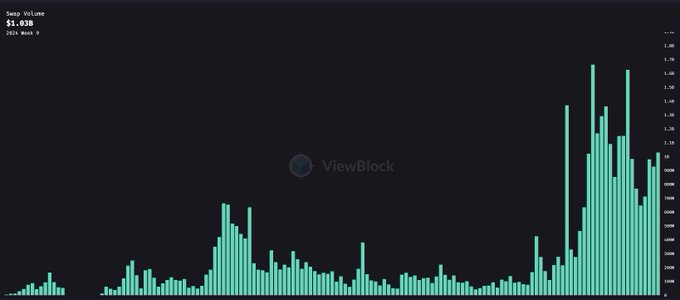

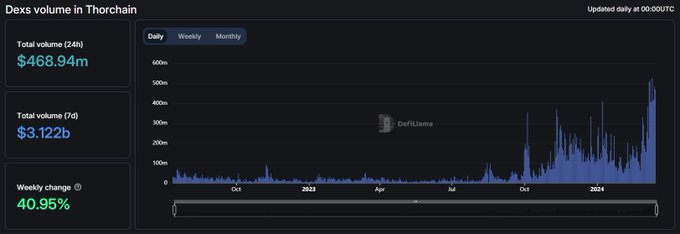

THORChain, a decentralized cross-chain liquidity protocol, has reported record swap volume exceeding $20 billion since the start of 2024, with over half of this volume generated in the last month alone. The platform has also witnessed a significant increase in lending activity, with collateral deposits of Bitcoin and Ethereum surging in recent weeks. THORChain's lending module allows users to borrow against their cryptocurrency holdings without interest or expiration, providing a unique opportunity in the DeFi landscape. As the protocol continues to gain traction, industry observers anticipate further growth in THORChain's swap volume and lending activity in the coming months.

🌊 Streaming swap has started [9c5u]: 68.0 BTC ($4.7M) → ⚡ → ETH / 485.8ᚱ clout 299 swaps every 3 blocks, duration is about 1 hour 29 min + outbound delay. Track Tx: track.ninerealms.com/AA0E55E881FB61…

THORChain just passed $40b in total volume 🎉 For months now, processing >$100m every 24h Next target? $1 billion in daily volume Onwards

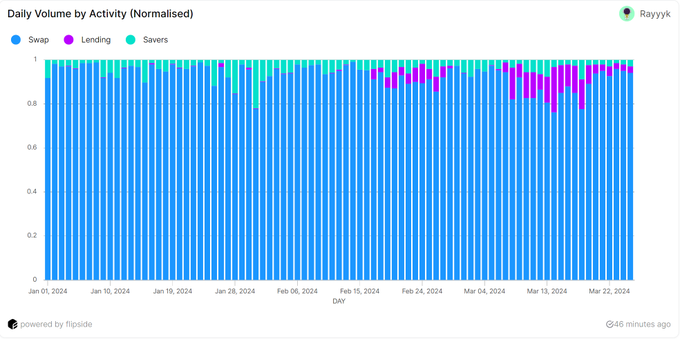

Since the start of 2024, swap volume on @THORChain has exceeded $20 billion, with over half of this volume generated in the last month alone. As we move into Q2, what can we anticipate for @THORChain's swap volume?

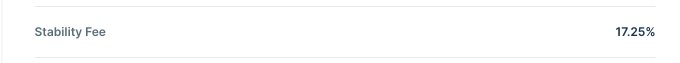

WOW one of the biggest opportunities to eat a DeFi platform's lunch has just presented itself for @THORChain MakerDAO has "Temporarily" raised their interest rate to 17.25% as of 12 hours ago. I was running math on my vault and I am now paying $60,375 PER YEAR in interest

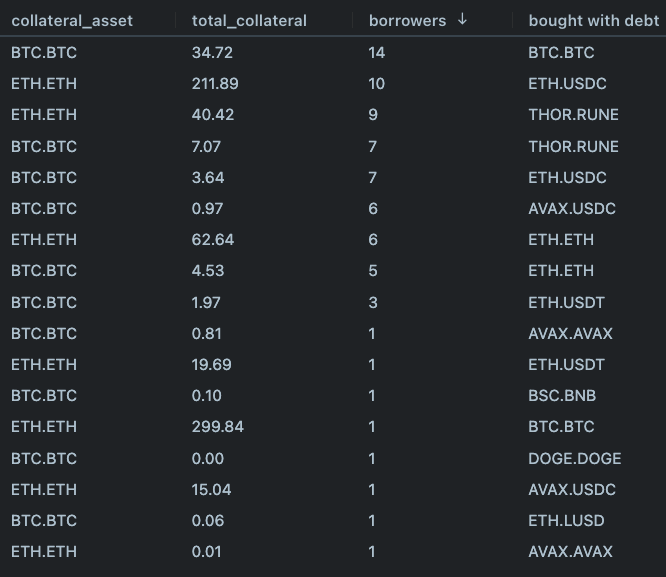

Just pulled some lending numbers. 3968 total loans to date on THORChain. 3046 come from THORSwap. THORSwap accounts for > 76% of all loans. By volume: $37,685,622 / $46,964,769 Collateral TS/TC (80.24%) $14,550,546 / $18,398,112 Borrowed TS/TC (79.09%) Basically, 80% of all

> they don’t know @thorchain lending is an option

🏦→ Loan open [58nx] Collateral deposited: 3.0 BTC ($209,550) CR: x2.0 Debt: $104,643 Target asset: BTC dashboards.ninerealms.com/#lending

$RUNE Highest monthly volume on @THORChain and we are not even halfway through the month....we are gonna see Billion dollar daily volumes soon. #THORChads #Thorchain

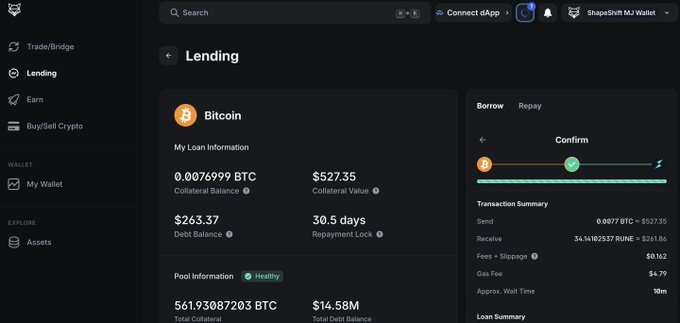

I'm doing a small scale test of borrowing BTC against my BTC using shapeshift.com So far, I am liking what I am seeing.

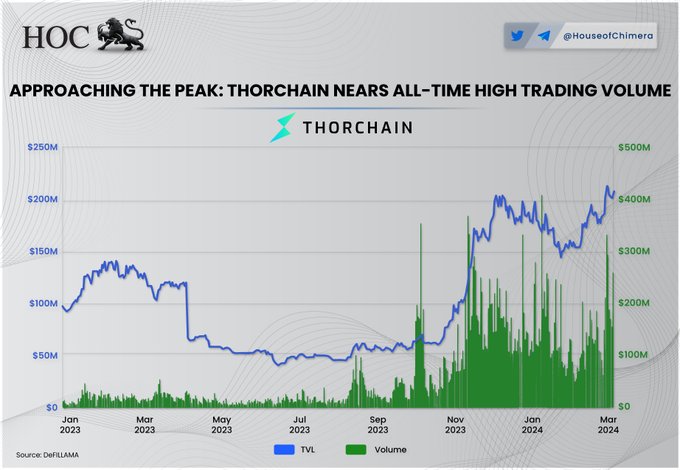

Approaching the Peak: @THORChain Nears All-Time High Trading Volume 🔹The rise of the $RUNE Ecosystem has been significant, as the ecosystem is currently processing over 100M in daily volume. 🔸@Thorchain can capitalize on the latest volatility, as the DEX is perceived as

🌊 Streaming swap has started [6e8e]: 6.0 ETH.WBTC ($402.0K) → ⚡ → BTC / 14.4ᚱ clout 192 swaps every 3 blocks, duration is about 57 min 36 sec + outbound delay. Track Tx: track.ninerealms.com/664A3BFC10F1F3…

Tweet not found

The embedded tweet could not be found…

$RUNE is fully distributed. The Treasury sits on 7m RUNE (1.4% of supply) for long term ecosystem funding. Literally everything else is circulating, burnt or locked in the protocol. Major investors all puked last cycle. Only the thorchads hold rune now.

Tweet not found

The embedded tweet could not be found…

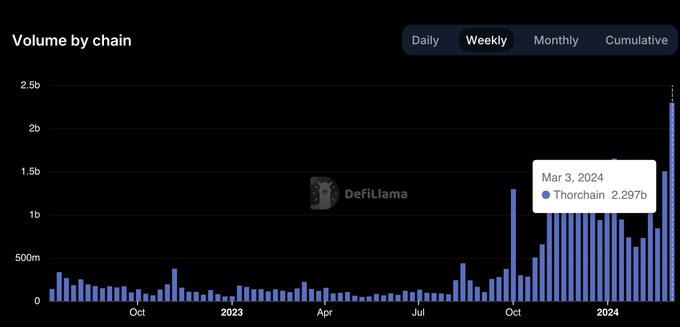

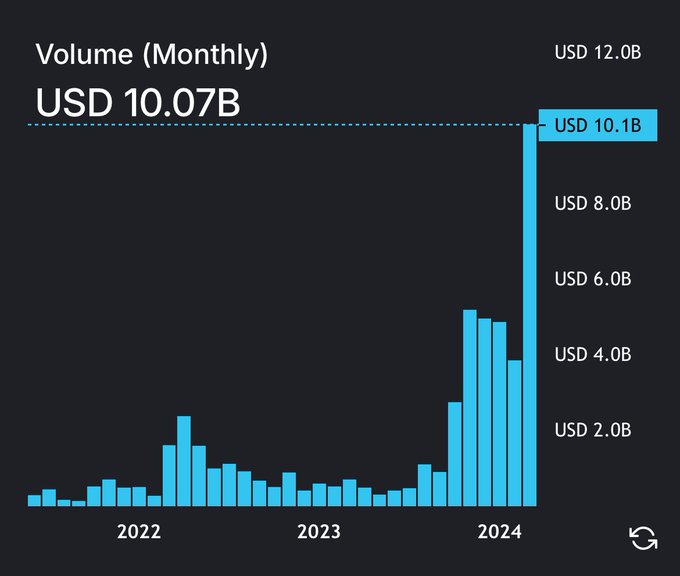

This one chart summarizes @THORChain's journey to becoming the #1 cross-chain DEX in the industry. The network survived the Terra blow up, 2 year bear market, and growing pains while scaling, and now its doing >$1b in volume per week. We have more scaling to do, onwards.

🏦→ Loan open [0787] Collateral deposited: 520.7 ETH ($2,097,543) CR: x2.0 Debt: $1,047,035 Target asset: ETH.USDC dashboards.ninerealms.com/#lending

Tweet not found

The embedded tweet could not be found…

Collateral is being onboarded onto THORChain at a rate of $1m/hour. Previously it was $1m/day. At this rate, lending caps will be full in a week. However, Lending Caps are based on RUNE:L1 prices. Any price reflexivity will result in a higher collateral cap.

Tweet not found

The embedded tweet could not be found…

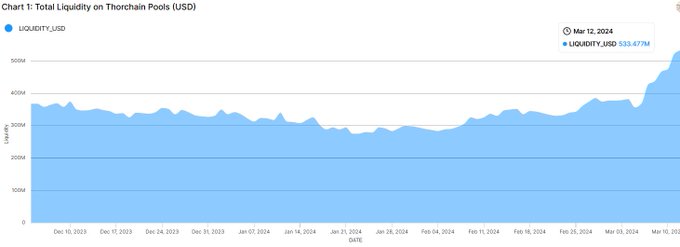

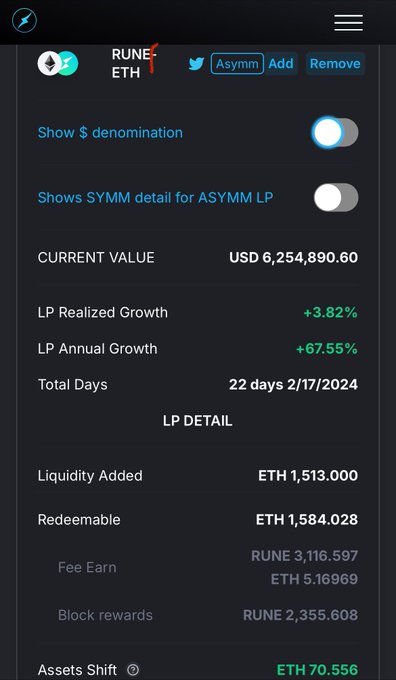

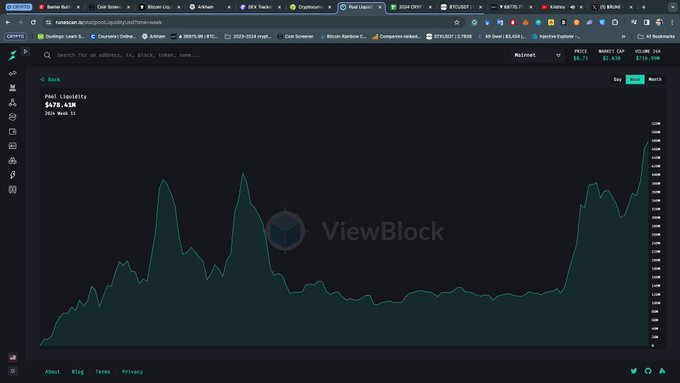

Liquidity on @THORChain is surging. This surge could be attributed to the price action of $RUNE, which increases the value of liquidity pools when measured in dollars. However, the question arises: Is this surge affecting the profitability of liquidity providers (LPs)?

Retail may not be here already, but when they are, one thing is certain: @lifiprotocol will be part of their foray into crypto. Robinhood — the home of retail. MetaMask — the entry point to the EVM ecosystem. Phantom — the gateway to the memecoin casino. All of them have one

🌊 Streaming swap finished 👤[c819]: 120.0 $ETH → ⚡ → 6.1 $BTC ($435.3K) ShapeShift Aff. fee: $435.3 (0.1%) Slip: 0.030 %, liq. fee: $221.3 ⏱️ Time: 2 min 36 sec. runescan.io/tx/A0CDA7D6716…

Tweet not found

The embedded tweet could not be found…

🌊 Streaming swap has started [1123]: 350.0 ETH ($1.1M) → ⚡ → BTC / 2,058ᚱ clout Swaps every 10 blocks. Track Tx: track.ninerealms.com/A24DB72E2AB06E…

Loans are streaming in at a huge rate. As RUNE is reflexive, the space just keeps opening up. The caps (right now) can now onboard a total of $216m in Collateral. Let's gooo!

At least they are talking about us. I wouldn't advise anyone to put #BTC into @thorchain without having done proper due dilligence. For the majority it is better to hodl cold storage. But thorchain offers a fantastic option to those willing to take the risk. #RUNE

Time to watch the next class get REKT. Nothing comes without risk. Ever. Protect your #Bitcoin at all costs.

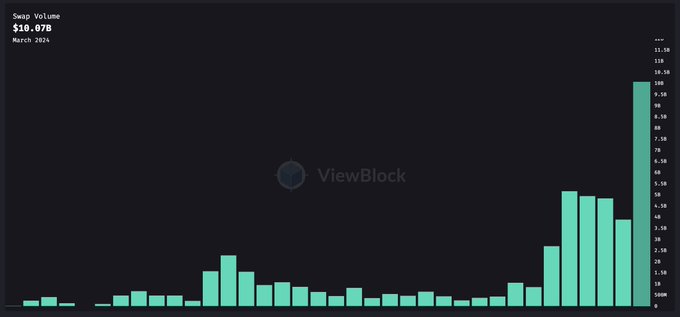

March 2024 was the first month in THORChain history with over $10b in trading volume 🎉 A major win for DEXs, but the goal is unambiguously to flip the volume and liquidity of centralized exchanges. Bitcoin liquidity will live natively, on-chain. Onwards

🏦→ Loan open [hye3] Collateral deposited: 4.96 BTC ($325,293) CR: x2.0 Debt: $162,356 Target asset: BTC dashboards.ninerealms.com/#lending

@THORChain is the leading player in this category of cross-chain BTC/ETH DEX, and it achieved $2.29B in trading volume last week, surpassing Curve Finance. This implies that smart money is gradually shifting from BTC to ETH in parts.

🌊 Streaming swap has started [1123]: 350.0 ETH ($1.2M) → ⚡ → BTC / 1,982ᚱ clout Swaps every 10 blocks. Track Tx: track.ninerealms.com/D5C33D551576A6…

THORChads grind. The last 3 years everything has been thrown at the protocol and yet currently shooting for ATH metrics. Onwards. $RUNE

This one chart summarizes @THORChain's journey to becoming the #1 cross-chain DEX in the industry. The network survived the Terra blow up, 2 year bear market, and growing pains while scaling, and now its doing >$1b in volume per week. We have more scaling to do, onwards.

new loan activity today new Collateral totals: BTC: 53.86 ETH: 649.54

I noticed from @THOR_InfoBot this huge $eth LP deposit 22 days ago. They’re currently up 70 eth already ⚡️🔥

🐳→⚡ Add liquidity 👤[46d9]: 212.5K Rune ($1.9M) ↔️ 2.0M $USDC (ETH) ($2.0M) Total: $3.9M (12.52% of pool) Pool depth is $31.1M now. runescan.io/tx/307860A788C…

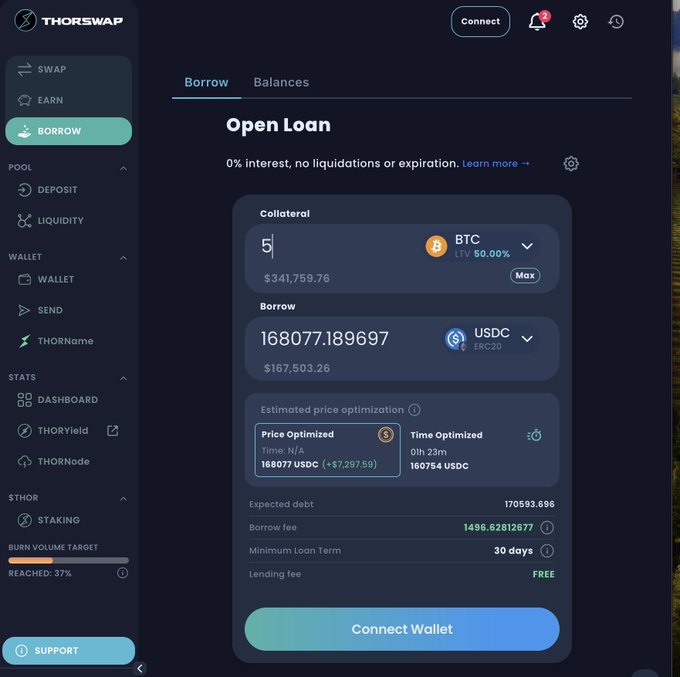

People can borrow 50% against their $BTC on @THORChain with 0% interest and no liquidations… and this BUYS and BURNS $RUNE off the open market… and the current caps allow another 20M $RUNE to be bought and burned… and nearly nobody understands this yet… interesting.

Tweet not found

The embedded tweet could not be found…

Cross-chain liquidity protocol @THORChain has seen its usage and TVL surge after burning 60M RUNE last week to boost its lending capacity. $RUNE is up nearly 70% in the past week🚀 Read more: thedefiant.io/thorchain-thun…

Tweet not found

The embedded tweet could not be found…

🏦→ Loan open [q36j] Collateral deposited: 2.0 BTC ($135,418) CR: x2.0 Debt: $67,637 Target asset: ETH.USDC dashboards.ninerealms.com/#lending

Tweet not found

The embedded tweet could not be found…

THORChain investment thesis: 1. @THORChain's fundamentals are arguably at an all time high: users, volume, liquidity, network effect, integrations, features, etc. It's a battle tested protocol with a large moat and strong community behind it. This is reason enough for an

This Thorchain lending with native #Bitcoin collateral might be a very big deal. - Unlocks DeFi for Bitcoin - Never sell your BTC, just borrow against it - No liquidations, so no cascading liquidations: 'fuck begets fuck' never gets rolling. - No stored collateral, so nothing to

🌊 Streaming swap finished 👤[tzxz]: 10.3 $BTC → ⚡ → 689.1K $USDT (ETH) ($688.6K) Aff. fee: $4.8K❗ (0.7%) Slip: 0.040 %, liq. fee: $351.4 ⏱️ Time: 12 min 24 sec. runescan.io/tx/DEDB550E4B7…

🏦→ Loan open [2f8a] Collateral deposited: 21.0 ETH ($72,403) CR: x2.0 Debt: $36,239 Target asset: ETH.USDC dashboards.ninerealms.com/#lending

🌊 Streaming swap has started [0663]: 400.0 ETH ($1.5M) → ⚡ → BTC / 10.3ᚱ clout 91 swaps every 9 blocks, duration is about 1 hour 21 min + outbound delay. Track Tx: track.ninerealms.com/D34806F10CB77F…

🌊 Streaming swap finished 👤[zqmu]: 2.9 $BTC → ⚡ → 56.3 $ETH ($203.5K) Aff. fee: $1.4K (0.7%) Slip: 0.030 %, liq. fee: $106.8 ⏱️ Time: 1 min 12 sec. runescan.io/tx/3817E943671…

Tweet not found

The embedded tweet could not be found…

🏦→ Loan open [a352] Collateral deposited: 50.0 ETH ($177,566) CR: x2.0 Debt: $88,630 Target asset: ETH dashboards.ninerealms.com/#lending

Lending on @THORChain averages around 5% of the daily volume (in purple), which is a notable increase since 2024. Despite not dominating the volume metrics, it remains a pivotal component of THORChain's ecosystem and strengthens THORChain's position in the DeFi landscape.

Anyone know what fraction of this 10B is purely from lending? Looks like there is 15M $RUNE worth of collateral deposited so approx 130M USD. So even if 1 deposit causes 2 or 3 swaps, it's still only a small fraction of all the volume right?

🌊 Streaming swap finished 👤[8e77]: 211.0K $USDT (ETH) → ⚡ → 3.1 $BTC ($209.2K) Aff. fee: $1.5K (0.7%) Slip: 0.040 %, liq. fee: $104.3 ⏱️ Time: 3 min 48 sec. runescan.io/tx/130E8B892B5…

🌊 Streaming swap finished 👤[tkes]: 5.8 $BTC → ⚡ → 115.2 $ETH ($404.4K) THORSwap Aff. fee: $1.2K (0.3%) Slip: 0.030 %, liq. fee: $206.8 ⏱️ Time: 7 min 30 sec. runescan.io/tx/8846ACFD883…

⚡DeFi degens have piled more than $100 million into Thorchain after the cross-chain liquidity protocol raised its collateral limits. The surging activity follows a spike in Thorchain's volume and TVL 👀 Read More: thedefiant.io/thorchain-loan…

🏦→ Loan open [su69] Collateral deposited: 2.57 BTC ($169,349) CR: x2.0 Debt: $84,558 Target asset: ETH.USDC dashboards.ninerealms.com/#lending

Tweet not found

The embedded tweet could not be found…

🏦→ Loan open [6341] Collateral deposited: 42.0 ETH ($150,182) CR: x2.0 Debt: $75,110 Target asset: ETH dashboards.ninerealms.com/#lending

🏦→ Loan open [4837] Collateral deposited: 50.0 ETH ($178,855) CR: x2.0 Debt: $89,168 Target asset: BTC dashboards.ninerealms.com/#lending

⚡BREAKING: New monthly volume ATH on THORChain and we are only halfway through March. Previous ATH- $5.17 B, November. $RUNE onwards!

🐳→💰 Add to savings vault 👤[kwc2]: 3.0 synth $BTC Total: $194.6K Savers cap is ▰▰▰▰▰▰▱▱▱▱ (61.8%) full. You can add 1.5K BTC more. runescan.io/tx/A624F33669A…

🏦→ Loan open [4cy7] Collateral deposited: 7.5 BTC ($509,221) CR: x2.0 Debt: $254,284 Target asset: ETH.USDC dashboards.ninerealms.com/#lending

Now tracking THORChain Lending on @THORChain THORChain Lending provides USD-denominated loans against native assets as collateral, with no interest or expiry

Over $3.1 BILLION traded on @THORChain in the past 7d. The utility is real. Resilient project. Don't fade. 💫 $RUNE

Tweet not found

The embedded tweet could not be found…

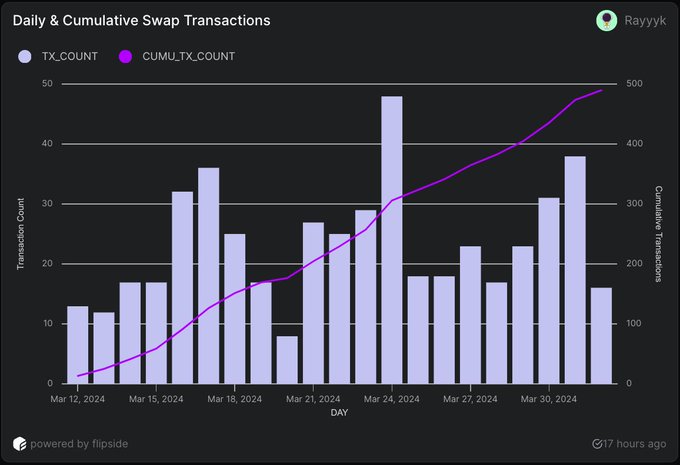

The integration of @THORChain into @lifiprotocol has experienced a consistent increase in swap activity, with close to 500 swaps conducted. A peak of 48 swaps occurred on 24th March 2024, marking it the highest number of swap transactions.

The redemption arc has begun. ATH in swaps, volumes, users, TVL. THORChads have ground, worked, hustled and shipped for years for this moment. The largest cross-chain DEX is about to become much, much larger. Onwards.

🏦→ Loan open [jap2] Collateral deposited: 2.0 BTC ($131,480) CR: x2.0 Debt: $65,680 Target asset: ETH.USDT dashboards.ninerealms.com/#lending

Tweet not found

The embedded tweet could not be found…

🏦→ Loan open [4268] Collateral deposited: 36.0 ETH ($129,004) CR: x2.0 Debt: $64,489 Target asset: ETH.USDC dashboards.ninerealms.com/#lending

$0 liquidations on @THORChain lending. That's it. $RUNE

🏦→ Loan open [BtiB] Collateral deposited: 7.0 BTC ($469,565) CR: x2.0 Debt: $234,527 Target asset: BTC dashboards.ninerealms.com/#lending

Update -- I have now successfully used Thorchain's native #Bitcoin lending at low power. I put in $527 worth of native #Bitcoin as collateral (.0077 BTC) (Note: I needed to use the local @ShapeShift Bitcoin wallet -- I could not get it to work with OKeX web wallet and

So @THORChain currently has space for 17.82m RUNE worth of collateral for new loans. At a $RUNE price of $11, this is ~ $200m worth of collateral that can be deposited into TC. 50% of loan collateral is used to market buy and burn $RUNE. This creates a price agnostic $100m bid

TEN BILLION DOLLAR MONTHLY VOLUME TARGET ACHIEVED!!! ⚡️🐴 ▓▓▓▓▓▓▓▓▓▓ 100% 🔥🔥🔥 $rune

$RUNE long and strong.... has the best fundamentals and usage at ATH. Pool Liquidity at #AllTimeHigh and it's not gonna stop anytime soon. It's @THORChain 's time to #ReignOn

Tweet not found

The embedded tweet could not be found…

What happens next: 1) 100% of nodes update: V1.128 code path executed 2) 60,000,000 $RUNE moved into RESERVE and insta-burned 3) Lending Caps opened ~$100m in Collateral Space opened 4) Resume onboarding collateral at a rate of $1m/day Who's ready?

🕖 Version upgrade progress ▰▰▰▰▰▰▰▰▰▰▰▰▱▱ 83 % 85 of 102 nodes upgraded to version 1.128.0. ⚡️ Active protocol version is 1.127.2 (17 nodes). * Minimum version among all active nodes.

THORChain Affiliates Earn $46M as Solana Integration Approaches

**THORChain affiliate program generates significant revenue** - Affiliates have earned over $46M to date, averaging $29K daily across current chains - Solana integration is imminent, with SOL holding $7.9B TVL - second only to Ethereum - Solana's active builder community and high transaction volume expected to substantially increase affiliate earnings **Wallet providers called to integrate** Major wallets including MetaMask, Phantom, Coinbase Wallet, Atomic Wallet, Exodus, and Binance Wallet are being urged to integrate before the Solana launch. The combination of deep liquidity and multi-platform access continues to drive sustainable ecosystem growth for THORChain's cross-chain swap infrastructure.

Whale Swaps $3.9M USDC to Bitcoin via Ledger Using THORChain

A user executed two large swaps totaling $3.9M, converting USDC to Bitcoin through Ledger's integration with THORChain's SwapKit. **Key Details:** - $2M USDC → BTC swap - $1.9M USDC → BTC swap - Native Bitcoin transactions with full self-custody - No centralized exchange required **The Opportunity:** Any wallet can integrate THORChain to offer similar swaps and earn affiliate fees. Potential integrators mentioned include Rabby, Phantom, Magic Eden, and MetaMask. **Recent Performance:** THORChain's frontend processed $534M in Q4, saving users $1.8M in fees compared to typical DEX costs - all without KYC or custody risk.

THORChain January 2026 Network Report Released

THORChain has published its State of the Network report for January 2026, providing insights into the protocol's performance and metrics for the month. The report covers key operational data across THORChain's cross-chain liquidity infrastructure, which supports swaps, earning, and borrowing across Bitcoin, Ethereum, BNB, Cosmos and other chains. **Key areas likely covered:** - Trading volumes and liquidity metrics - Network security and node operations - Protocol revenue and treasury updates - User activity across supported chains The full report is available on the [THORChain blog](https://blog.thorchain.org/state-of-the-network-january-2026-2/). This monthly update follows THORChain's regular cadence of transparency reporting, with the previous marketing update published in late January covering November-December activities.

THORChain Processes $30M BTC-ETH Swap, Largest in DeFi History

THORChain's January metrics show the protocol operating at institutional scale: - **$30M BTC-ETH trade** executed via streaming swaps - the largest single swap ever completed in DeFi - **$1.1M in protocol revenue** generated despite slow market conditions - **1M cumulative wallets** milestone reached - **$53M bonded** to secure the network The data demonstrates THORChain's capacity to handle institutional-grade transactions through its native cross-chain infrastructure.

THORChain Reports $4B Swap Volume in Q4, Plans Solana and ZCash Integration

THORChain released its Q4 2025 ecosystem report showing significant activity across its decentralized liquidity protocol. **Key Metrics:** - $4.02B in swap volume - 108,000 unique swappers - 1.22M total trades - $5.02M collected in swap fees - Beta launch of swap.thorchain.org **2026 Roadmap Highlights:** - Solana integration - ZCash support - Rapid Swaps feature The numbers represent a slight decrease from Q3's $4.5B volume and 1.8M swaps, though the platform maintained strong user engagement with over 100,000 active swappers. [Read the full report](https://blog.thorchain.org/thorchain-q4-2025-ecosystem-report-2026-roadmap/)