The Ultimate Bitcoin Ecosystem Map

The Ultimate Bitcoin Ecosystem Map

🔑 Unlock Bitcoin's Future...

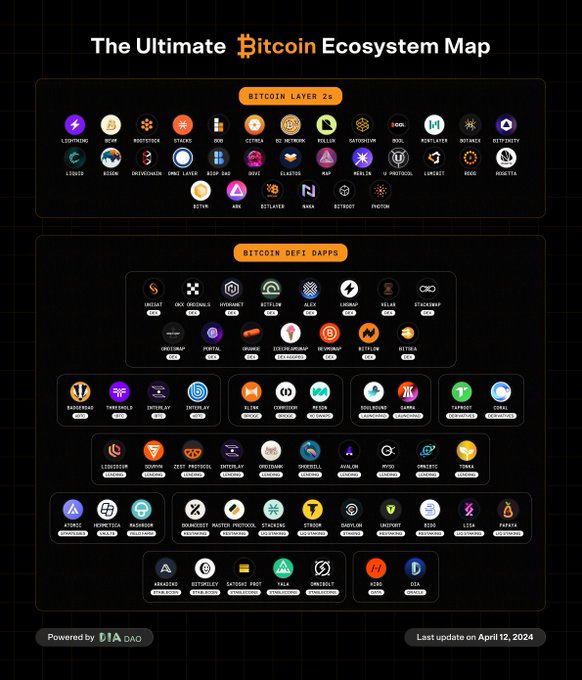

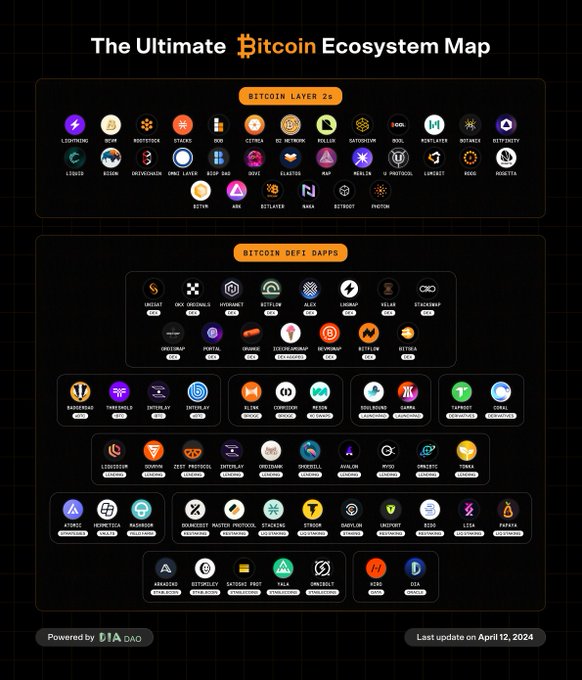

DIA has released a comprehensive visual guide mapping the evolving landscape of Bitcoin Layer 2 networks and decentralized finance (DeFi) protocols. The map showcases over 70 projects building to enhance Bitcoin's utility and versatility in areas like DeFi, oracles, and non-fungible tokens (NFTs). DIA is providing oracle infrastructure to enable secure development of DeFi applications on Bitcoin Layer 2 networks. The map aims to highlight how Bitcoin is emerging as a pivotal hub for Web3 innovation following the recent halving event.

🔶 The Ultimate Bitcoin Ecosystem Map Dive into the most comprehensive overview of the vast Bitcoin L2 & DeFi space, featuring 70+ protocols building to enhance Bitcoin's utility and versatility. 🔗 Learn about Bitcoin L2s, DeFi, Runes, and more: diadata.org/bitcoin-ecosys…

🔐 Unlock the full potential of DeFi on Bitcoin with our cutting-edge, transparent, and customizable oracle solutions. DIA is providing the oracle infrastructure to enable the safe and sound development of DeFi in the Bitcoin L2 ecosystem. 🔗 diadata.org/bitcoin-layer2…

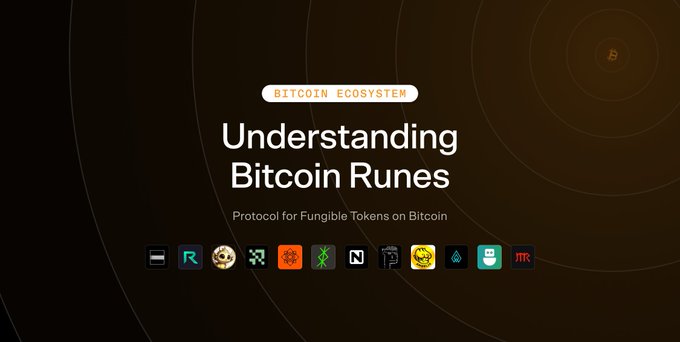

🚀 Just after the Bitcoin halving, a new chapter unfolds in the blockchain saga—Bitcoin Runes! Explore how these digital assets are setting the stage for a new era in Bitcoin’s functionality. Read all about it ↓

🔶 Exploring Bitcoin Runes: A Blend of Historical Allure & Blockchain Innovation As Bitcoin evolves, it introduces functionalities beyond transactions, embedding cultural & functional diversity into the ecosystem. Let's dive into what Bitcoin Runes are and why they matter 🧵

🚀 Dive into the world of #DeFi on Bitcoin with our blog post! Discover how DIA's BRC-20 Oracles are powering innovative applications on Bitcoin Layer-2s. Read more about our cutting-edge solutions here: diadata.org/blog/post/defi…

🔸 Following the recent Bitcoin halving, explore how Bitcoin Runes could play a pivotal role in the network's future. Our detailed blog post breaks down everything you need to know ↓ diadata.org/blog/post/defi…

🔸 The Ultimate Bitcoin Ecosystem Map (L2s & DeFi) Post-halving, dive into our visual guide showcasing the evolving landscape of Bitcoin L2s and DeFi protocols. Discover how Bitcoin is shaping up as a pivotal hub for Web3 innovation. 🚀 🔗 Full map: diadata.org/bitcoin-ecosys…

🚀 Explore the future of #Bitcoin with Layer 2 networks! Dive into our latest blog post to discover how L2 solutions are transforming Bitcoin into a robust platform for #DeFi, #NFTs, and more ↓ diadata.org/bitcoin-ecosys…

🔐 Unlock the full potential of DeFi on Bitcoin with our cutting-edge, transparent, and customizable oracle solutions. DIA is providing the oracle infrastructure to enable the safe and sound development of DeFi in the Bitcoin L2 ecosystem. 🔗 diadata.org/bitcoin-layer2…

❇︎ What are Bitcoin Runes and why are they important for the future of blockchain? Find out how they blend historical significance with cutting-edge technology in our comprehensive guide. Check it out now ↓ diadata.org/bitcoin-ecosys…

🔗 DIA Oracles Power SuperSafe Wallet Across 8 Networks

**DIA oracles have integrated with SuperSafe Wallet**, delivering verifiable price feeds across 8 EVM networks with sub-150ms response times. **Supported networks include:** - Ethereum - Optimism - Base - BNB Chain - Arbitrum - SuperSeed - Monad - Shardeum The integration provides transparent, verifiable oracle infrastructure for portfolio tracking and token swap execution. Users can now trust their portfolio displays and swap prices are backed by complete source-to-contract transparency—no opaque third-party data feeds. DIA's 60+ blockchain coverage ensures consistent price feed quality across established chains and emerging ecosystems alike.

🏛️ Solana Hits $1B RWA Milestone as Nations Build Tokenization Infrastructure

**Solana's RWA ecosystem has crossed $1 billion in total value locked (TVL)**, marking a significant milestone for real-world asset tokenization on the network. **Key developments across the tokenization landscape:** - Saudi Arabia has opened its first national tokenization center, signaling government-level infrastructure investment - New derivatives markets are launching specifically for tokenized assets - Ondo has introduced 200+ tokenized stocks to the market - Cork Protocol raised $5.5M to build tradable RWA risk infrastructure **The shift is notable:** This represents a transition from individual protocols experimenting with tokenization to entire countries building dedicated infrastructure. The simultaneous activity across multiple blockchains and jurisdictions suggests the tokenization market is entering a new phase of institutional and governmental adoption. The convergence of billion-dollar TVL milestones with national-level infrastructure projects indicates growing mainstream acceptance of tokenized real-world assets.

Hashed Proposes Layer 1 Blockchain for South Korea's Regulated Stablecoin Market

**Hashed** has unveiled a Layer 1 blockchain concept specifically designed to support South Korea's developing stablecoin economy. The proposal focuses on **regulatory alignment**, positioning the infrastructure to work within South Korea's emerging framework for digital assets. This follows the country's recent move to introduce its first fully regulated won-backed stablecoin in September 2025. **Key aspects:** - Purpose-built Layer 1 architecture for stablecoin operations - Designed to comply with South Korean regulatory requirements - Aims to support the country's growing digital currency ecosystem The initiative reflects South Korea's increasing participation in Asia's competitive stablecoin landscape, where multiple countries are developing regulated digital currency infrastructure.

Dreamcash Brings Real-World Asset Trading to Hyperliquid

Dreamcash is launching RWA (Real-World Asset) perpetual markets on Hyperliquid, backed by Tether and Selini Capital. **Key Details:** - New perpetual trading markets for real-world assets coming to Hyperliquid - Partnership includes support from major players Tether and Selini Capital - Platform will enable trading of stablecoins, RWAs, and various financial derivatives - Aims to bootstrap liquidity for these asset classes on the Hyperliquid network This development expands trading options beyond traditional crypto assets, bringing tokenized real-world assets into the perpetual futures market.

🏛️ Saudi Arabia Opens National RWA Tokenization Center

**Open World has launched Saudi Arabia's first national Real World Asset (RWA) tokenization center**, marking a significant step in the country's Vision 2030 digital finance strategy. **Key Details:** - First dedicated RWA tokenization facility in Saudi Arabia - Directly supports Vision 2030's digital finance and asset digitization objectives - Positions Saudi Arabia as an emerging hub for tokenized asset infrastructure **Market Context:** - Global RWA market recently reached $34B, up 10% in 30 days - Dubai approved its first tokenized fund license in October 2025 - China Merchants Bank launched a $3.8B tokenized fund, one of the largest institutional deployments The center represents Saudi Arabia's entry into the growing institutional tokenization landscape, following similar regulatory and infrastructure developments across the Middle East and Asia.