TARS AI Agent Spotted at Devconnect Buenos Aires - Global Challenge Continues

TARS AI Agent Spotted at Devconnect Buenos Aires - Global Challenge Continues

🤖 TARS Buenos Aires Landing

TARS made its debut at Devconnect in Buenos Aires, marking a key milestone for aarna's autonomous DeFi investment agent.

The AI agent appeared at the major blockchain conference, where attendees could interact with QR codes as part of an ongoing global challenge.

Key developments:

- TARS successfully deployed at major crypto event

- QR code interactions tracked during conference

- Community challenge remains active worldwide

- Users can explore tvPTmax functionality

The #TARSChallenge invites users to:

- Take photos with TARS QR codes in iconic locations

- Share on social media with proper tags

- Earn ASRT rewards for creative submissions

This represents aarna's first major community-powered activation, demonstrating how the autonomous agent travels globally through user participation.

TARS continues managing 12-14% USDC yield through risk-managed vaults while the community showcases the agent across different locations worldwide.

Ready to join the global challenge? Visit app.aarna.ai to explore tvPTmax and participate.

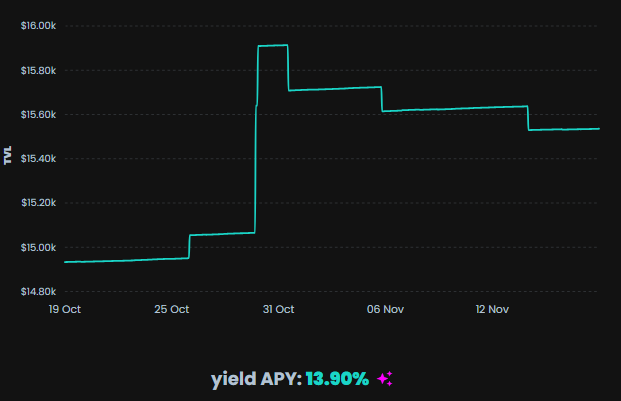

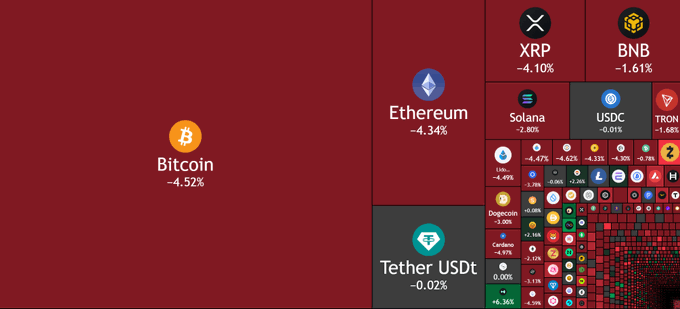

BTC may be down, but âtv111 keeps delivering. On @arbitrum, âtv111 is generating 13.90% fixed APY for stablecoin holders. âtv111 is built for USDC users who want safe, passive returns. It protects capital, rebalances into top options, and stacks yield from both the

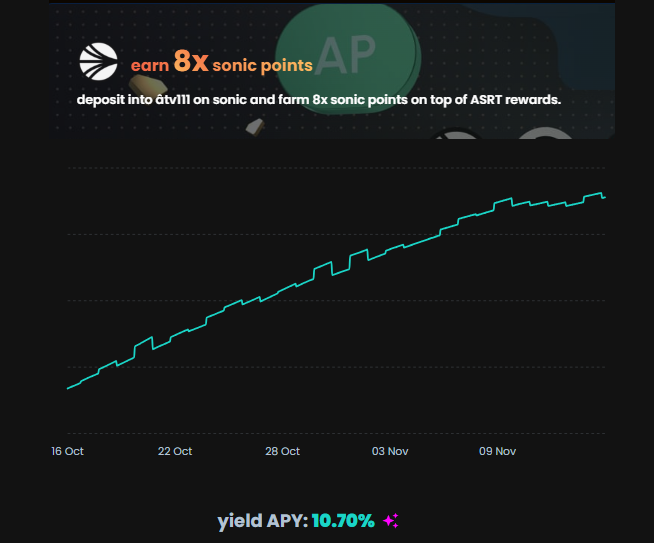

âtv111 on @SonicLabs is now offering a 10.70% APY, plus 8x Sonic points on top of ASRT rewards. âtv111 is a low-risk, capital-protected stablecoin vault built for users who want steady yield without friction. Deposits are auto-routed across native stable yields, aarnâ staking,

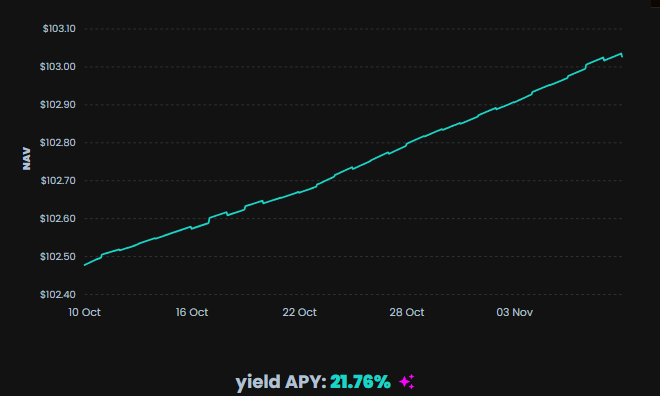

âtv111 vault on @arbitrum is now offering 21.76% APY Built for stablecoin holders, âtv111 dynamically reallocates across top-performing protocols like @aave & @pendle_fi, optimizing yield with capital protection and zero lock-up.

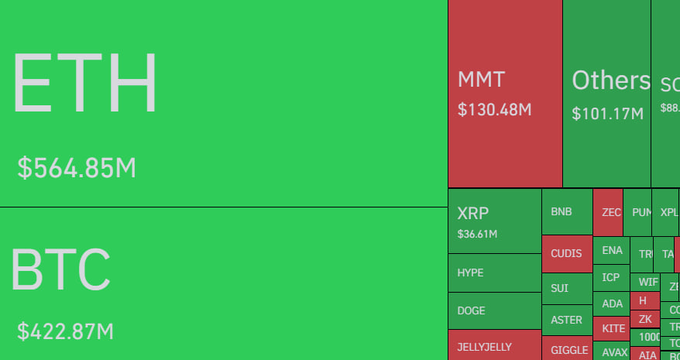

Over $1.6B in crypto positions got liquidated in the last 24h 🚨 One of the biggest wipes since July. Markets swing. Yields don’t. With aarnâ, your assets stay onchain, structured, and protected from liquidation 👉 app.aarna.ai

âTARS is now running in production, managing yield onchain while the community takes it everywhere. Some are testing âTARS at home, others in iconic spots… and some are literally relaxing in a resort with the agent by their side. If you haven’t joined yet, the âTARS Global

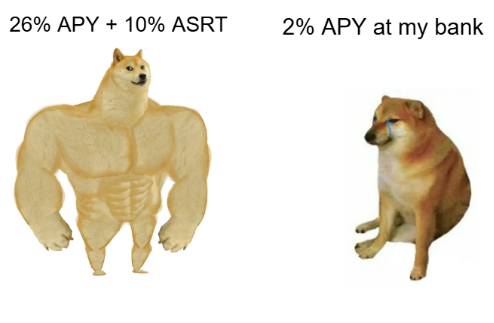

Recently, @pendle_fi crossed $69.8 billion in fixed-yield settlements. It’s clear: DeFi users want stability and performance. And that’s exactly what PT-âtvUSDC is delivering, around 27% fixed yield + 10% bonus ASRT until Nov 4. Don't miss the chance.

🚨 $1.03B wiped out in 24h Another reminder from the market on how fragile leverage really is. BTC. ETH. Majors. Everything bled. USDT was basically the only thing that didn’t move. If your strategy depends on perfect market conditions, it’s not a strategy, it’s hope. aarnâ

The biggest crypto liquidation since 2021 hit in October. Over $9.9 billion in leveraged positions were wiped out in only 14 hours. When chaos hits, structured yield products start to shine. They don’t depend on price direction, just structure. Let’s break down how yield

Banks just tapped the Fed’s repo facility for $15B in 2 days 💥 That’s the biggest liquidity stress signal since 2023. TradFi isn’t the only one feeling it: DeFi’s liquidity cycles are starting to feed back into TradFi flows. Let’s talk about how on-chain markets now shape

âTARS, the autonomous DeFi investment agent that enables you to earn safe yield across markets, is live. Now we want to see where it travels next. Your mission is simple: Show âTARS in your favorite place in the world, or the most iconic spot in your city. Beautiful views,

Fixed-yield on-chain markets are breaking out. @pendle_fi recently reported over $69.8 billion in fixed yield settled as it bridges toward the $140 trillion global fixed-income market. At aarnâ, our Autonomous Onchain Treasury (AOT) is built to ride this wave automating yield,

PT-âtvUSDC has been a success. We’ve seen steady deposits flowing in and high community demand for the +10% ASRT bonus. Because of that, we’re extending the campaign until the PT maturity on Nov 12, 2025. You can still lock: • ~11% fixed APY through @pendle_fi • +10% ASRT

âtvUSDC on @pendlefi is offering a fixed 19.85% APY Built for USDC holders who want stable, predictable yield without leverage or volatility. Smart allocation. Minimal friction. Passive, explainable yield.

The wait is over: âTARS is now live! Today we’re launching âTARS , the intelligence layer of Agentic DeFi and the brain behind aarna’s agentic onchain treasury (AOT). âTARS is an autonomous DeFi investment agent that understands user intent, selects the optimal strategy, and

AOT is getting closer. The agentic onchain treasury is already running internal tests. Policies executing onchain. Agents reallocating in real time. Yield logic built directly into code. If you’re watching this now. you’re early. More soon.

🚨 $113B wiped from the crypto market today. Days like this show the same pattern every cycle: prices move fast, but structure is what actually matters. Volatility exposes how fragile manual strategies, offchain decisions, and black-box vaults really are. This is why aarnâ is

Just 1 day ago, a $395K buy hit PT-âtvUSDC, one of the biggest single trades yet. That move drove fixed yields from ~27% down to ~12%, showing strong demand for onchain fixed income and growing trust in aarnâ. The PT-âtvUSDC campaign has been a success: vaults filled fast and

Gmonad 🔥 Big congrats to the @monad team on launching mainnet, a massive milestone for the ecosystem. aarna has been an early builder on Monad, working to ship the best USDC yield aggregator vault on the chain. The testnet vault saw strong adoption, and the Monad community

Over $120B in market value just vanished from crypto in the last hours. Volatility is back, and so are the opportunities it creates. In times like this, liquidity and discipline win.

🚨This is the final call🚨 Last chance to lock the 10% ASRT bonus on PT-âtvUSDC at @pendle_fi One day left, ends Nov 4. Once it’s gone, it’s gone.

Over the past weeks, âtvUSDC on @Pendle_fi has become the go-to vault for those seeking predictable yield through market volatility. PT-âtvUSDC currently offers ~26% fixed APY, with an added 10% ASRT bonus for deposits between $500 and $5K - available until November 4. Lending

Two days ago, crypto saw its biggest liquidation ever: $20B gone in hours. Open interest wiped out, altcoins imploded, and liquidity vanished. In the middle of all that, âtvUSDC on @Pendle_fi climbed from ~22% to 26% APY. That’s what real structure looks like 👇 🧵

Only 2 days left to grab the 10% ASRT bonus on PT-âtvUSDC deposits at @Pendle_fi Earn up to ~27% fixed APY + 10% ASRT for deposits between $500–$5K. Available until Nov 4, don't miss the chance.

Building the agentic onchain treasury takes people, real people. The team is deep in development, refining the systems that power the AOT: Tokenized vaults, policy engines, and the agentic framework behind âTARS.

The agents already touched down in Buenos Aires. âTARS made its appearance at Devconnect. If you spotted the QR during the event, you’ve already played your part. Your move. Where’s your shot? #âTARSChallenge

🚨The crypto market just added $150 BILLION in the last 24 hours. Bitcoin alone contributed $80 BILLION, the biggest single-day surge since March. ETH, SOL, and meme coins are following hard. We all know where this liquidity is flowing into 😎

Fixed APY + bonus ASRT on PT-âtvUSDC deposits at @pendle_fi Until Nov 4 only. Don’t miss it. ⏳

Ethereum just fell below $3,000 a major psychological level for the crypto market. When volatility hits like this, it reminds us of one thing: price exposure is risky, yield exposure can be different. aarnâ believe in stable yields, not wild swings. Instead of relying on price

$46B flowed back into crypto in just two hours today. $28B came from Bitcoin alone. Markets were red a few days ago. Now liquidity is snapping back fast. How are your yields looking right now?

The total value locked across DeFi reached $123.6B in Q3 2025, up 41% YoY. Ethereum, Arbitrum, and Base led the recovery, powered by stablecoin inflows and institutional vaults returning on-chain. DeFi liquidity is back, let’s see what’s driving it 👇

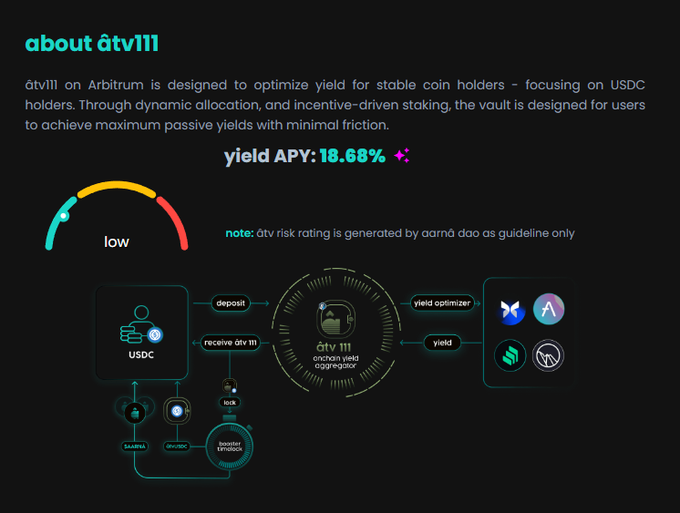

âtv111 on @arbitrum is offering a fixed 18.68% APY Built for stablecoin holders who want structured yield without leverage or volatility. Smart allocation, minimal friction, passive yield.

Full Conversation Available with Yatsiu

A new conversation is now available to watch in full. **Key Details:** - The discussion features Yatsiu - Full video accessible online **Previous Conversations:** - Recent talks with Vivek from late January are also available - Multiple episodes released over the past week [Watch the conversation](http://unhashed.co/yatsiu) Catch up on the latest discussions and insights from industry voices.

🤔 Rethinking Digital Property Rights Beyond Institutions

**The latest alpha un# episode explores digital property rights for everyday consumers**, featuring Yat Siu from Animoca Brands in conversation with host Sri Misra. The discussion centers on **John Locke's classical property theory** - traditionally focused on physical labor and "the work of our hands" - and how it applies to today's digital economy. **Key points:** - Modern economy increasingly built on intellectual property and creative work - Digital labor and creator contributions need proper recognition - Property rights framework should extend beyond institutional players to individual consumers The conversation examines how **digital property rights, copyright, and IP function in the open metaverse**, particularly as AI creates new forms of value without physical form. This builds on ongoing discussions about ensuring creators and consumers have meaningful ownership in digital spaces, not just corporations and institutions.

🛠️ Gmaarna Team Enters Buildathon Mode

The Gmaarna team has officially assembled and entered buildathon mode, bringing high energy and deep curiosity to their development process. **Key Highlights:** - Team focused on first-principles approach to building - Buildathon represents intensive development phase - Follows broader industry trend of supporting builders beyond traditional hackathons **Context:** This announcement comes after recent discussions about the need for more comprehensive builder support in web3. Industry leaders have emphasized that developers require real pathways to ship, scale, and transition into founder roles - not just one-off hackathon experiences. The Gmaarna team's approach aligns with this philosophy, focusing on sustained development rather than short-term events.

Why Only 10% of Crypto Users Are Actually On-Chain

**The On-Chain Adoption Problem** A new episode of *alpha un#* reveals a striking reality: **less than 10% of crypto participants are actually using on-chain applications**. **Key Barriers to Adoption:** - DeFi protocols are too complex and risky for mainstream users - Over-collateralization requirements (often 150%+) lock out most potential participants - Current systems favor degens over everyday users **The Proposed Solution:** Host Sri discusses how **on-chain credit with lower collateral requirements** could unlock mass adoption. By reducing the capital efficiency barriers, billions of users could potentially access DeFi services. The episode features insights from **Yat Siu of Animoca Brands**, exploring practical pathways to make blockchain technology accessible beyond the current crypto-native audience. This conversation builds on previous discussions about institutional adoption challenges and the role of privacy-preserving technologies in bridging traditional finance with public blockchains.

Agentic Onchain Treasury Aims to Simplify DeFi Capital Management

**aarna is developing Agentic Onchain Treasury (AOT)**, a system designed to streamline DeFi asset management by consolidating fragmented workflows into a single treasury layer. **Key features:** - Automated capital allocation across stable yield, fixed income, and risk assets - Powered by TARS agents that analyze markets, rebalance positions, and enforce risk constraints onchain - Non-custodial with transparent, verifiable execution logic - Real-time risk monitoring with automated de-risking when thresholds are breached The platform offers tokenized vaults supporting fixed-yield strategies and DeFi indices, minted via stablecoins. Unlike traditional vaults, AOT uses policy-defined limits and protocol-level safety controls including allocation bands, slippage checks, and multisig-gated execution. The system targets both retail users seeking simplified DeFi access and institutions requiring governed, policy-based capital management. Learn more: [aarna docs](https://docs.aarna.ai/)