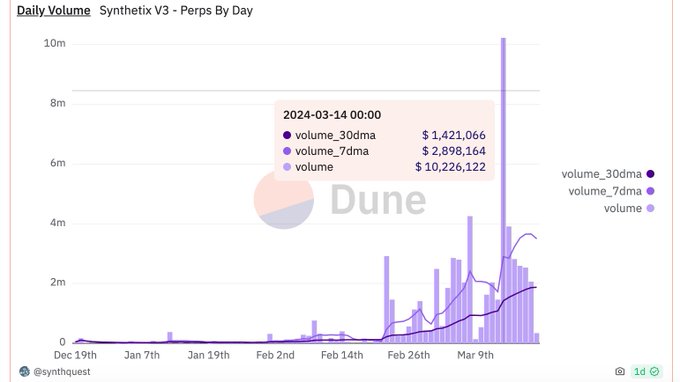

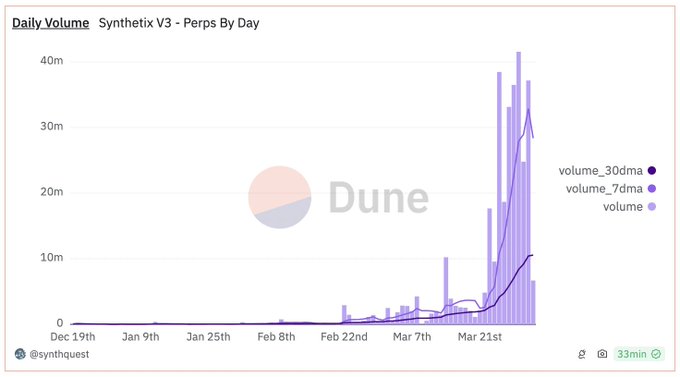

Synthetix, a decentralized synthetic asset platform, has been achieving significant volume milestones on the Base network. The platform's V3 deployment on Base has surpassed $325 million in total volume, with daily volumes regularly reaching $30-40 million. Synthetix's Kwenta trading interface also hit an all-time high 30-day average daily volume of over $200 million on Optimism. As Synthetix continues to expand on Base, it has already recorded a $10 million volume day, indicating an upward trend in adoption and growth.

On this historic day, @Kwenta_io's 30d average daily volume reached ATH, crossing $200M for the first time on @Optimism. Meanwhile, v3 continues to grow. CTTWL 🥂 (and thanks @_Synthquest for the queries)

Kwenta has surpassed $55M in volume on @base! @synthetix_io is expanding caps to fuel more growth. We've already had your first $10M volume day. Up and to the right trend continues. 😏 Go join Base szn: v3.kwenta.io

Up and to the right only. ↗️ New Daily volume PR on @base: $41M 30-40M is the current daily norm. Total @synthetix_io V3 volume on Base is now over $325M. Rookie numbers compared to whats to come. Become based: v3.kwenta.io

*Face melts as it soars into the absolute stratosphere* New PR: 38M Daily Volume We still have like a 10M cap haha, yall are based. Based on @base. ↗️ Contribute to the ascension: v3.kwenta.io

🎯 Competition Wallets Revealed

**Synthetix Trading Competition** eligibility list is now live with 100 confirmed participants competing for a **$1M top prize**. **Key Details:** - Competition starts **October 20 at 23:59 UTC** - Full wallet list available in [Google Sheets](https://docs.google.com/spreadsheets/d/1G0dCwVA2e0LXVnUZPirevAC2n_0Yhw5WuFNqV6D30oQ/edit?usp=sharing) - Eligible traders must contact [Synthetix Help Center](https://support.synthetix.io/) for details **Competition Structure:** - 50 invite-only spots for top crypto traders - 35 spots for pre-depositors (top 20 sUSD + top 10 sUSDe depositors) - 15 spots for Synthetix community members This marks Synthetix's return to **Ethereum Mainnet** with the first native perp DEX, featuring gasless trading and private order data. **Join the discussion:** - [Discord](https://discord.gg/synthetix) - [Telegram](https://t.me/synthetix_dao)

🥊 Round Two Begins

**Synthetix Mainnet Trading Competition Round 2** kicks off with a high-stakes rematch between prominent crypto traders @kaiynne and @crypto_bitlord7. The competition features: - **100 top crypto traders** competing head-to-head - **$1,000,000 top prize** up for grabs - **Leverage trading** on Synthetix's mainnet platform This marks the second face-off between these two well-known traders, building on the momentum from their previous competition. The event showcases Synthetix's synthetic asset trading capabilities while bringing together some of crypto Twitter's most recognized trading personalities. *Follow the competition to see who claims the million-dollar prize.*

Chinese CT Trader Joins $1M Synthetix Competition

**Synthetix reveals another competitor** for their upcoming mainnet trading competition with a **$1,000,000 top prize**. A prominent figure from the **Chinese crypto Twitter community** has secured one of the 100 spots in the high-stakes trading battle. The competition structure includes: - **50 invite-only spots** for top traders - **35 spots for pre-depositors** into sUSD/sUSDe vaults - **15 spots for Kwenta point holders** This follows previous announcements of a **semi-retired trading legend** turned pump.fun streamer also joining the competition. The event will **battle-test the first perp DEX on Ethereum**, with pre-deposit winners selected October 13th at 00:00 UTC. [Pre-deposit here](https://predeposit.synthetix.io/)

Synthetix Mainnet Multi-Collateral Margin Launch

**Synthetix Mainnet** is launching multi-collateral margin trading, allowing users to deposit portfolios of assets as collateral while keeping them productive. **Three supported collateral types:** - **sUSDe** - Ethena's yield-bearing synthetic USD stablecoin - **wstETH** - Lido's liquid staked ETH - **cbBTC** - Coinbase's Wrapped Bitcoin **Key benefits:** - Trade without selling underlying assets - Retain upside potential and yield generation - Improved capital efficiency - Lower capital gains implications The architecture supports any ERC-20 token with sufficient Ethereum liquidity, opening opportunities for partnerships with core Ethereum protocols and positioning Synthetix perps as a critical tool in the ETH ecosystem. Read more: [Multi-Collateral Margin Blog](https://blog.synthetix.io/multi-collateral-margin-on-synthetix-mainnet/)

Synthetix Liquidations Resume - 420 Pool Migration Update

Synthetix is re-enabling liquidations for existing stakers following the 420 Pool migration launch. Key updates: - Stakers with c-ratio below 160% are now at risk of liquidation - The 420 Pool offers complete debt forgiveness for migrators - Over 100m SNX already deposited in first day - New features include: * No liquidation risk * Protocol-managed sUSD liquidity * SNX-backed yield generation * Partnership with Ethena Labs for USDe minting Non-stakers will soon be able to participate with new incentives. A cross-chain Swap & Stake feature is coming to support deposits from multiple EVM chains. [Migrate to 420 Pool](https://420.synthetix.io/) [Read Documentation](https://docs.synthetix.io/welcome-to-synthetix-user-docs/snx-staking/deposit-snx-to-the-420-pool)