Synthetix Reboot Voting Reaches Quorum

Synthetix Reboot Voting Reaches Quorum

🗳️ Synthetix vote: What's next?

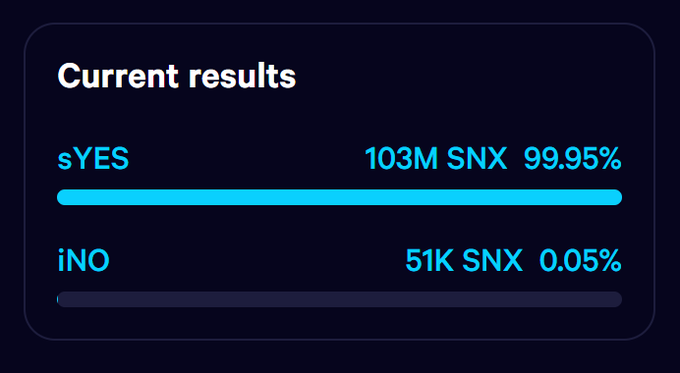

The Synthetix Reboot referendum has achieved quorum, marking a significant milestone in the governance process. This vote follows a series of important events:

- A referendum proposing changes to the DAO structure was introduced on September 25th

- New council members were elected on September 17th

- Voting for council members took place from September 11th to 16th

- The election process introduced SNAXchain, Synthetix's new app chain

Current status:

- Quorum reached on October 4th

- Voting remains open for community participation

Next steps:

- Review current results

- Cast your vote if you haven't already

Visit the governance portal to participate in shaping Synthetix's future.

A referendum has been proposed for Synthetix governance by Fenway, highlighting a number of changes to the current DAO structure, operations, and recommendations for SNX moving forward. 📲Join our Discord to discuss and register for the upcoming townhall: discord.gg/synthetix?even…

The Synthetix DAO election results are in 🗳 As SNX prepares for a new chapter of progress and major launches, it’s time to welcome your new councilors who will lead the initiatives that shape the future of our ecosystem.

Voting for the referendum has begun 🗳 Cast your vote here ⬇️ gov.synthetix.io/#/proposal/0x1…

It’s time to cast your vote for the Synthetix governance council members ⚔️ Voting will conclude on September 16th Links and details below 👇

It's time for a new election epoch for Synthetix Governance. But this one comes with a twist - nominations are now live on SNAXchain, the phase 1 version of Synthetix's new app chain built on the @Optimism superchain.

Quorum has been achieved ✅ See the current results and cast your vote for the Synthetix Reboot ⬇️ gov.synthetix.io/?ref=blog.synt…

🎯 Competition Wallets Revealed

**Synthetix Trading Competition** eligibility list is now live with 100 confirmed participants competing for a **$1M top prize**. **Key Details:** - Competition starts **October 20 at 23:59 UTC** - Full wallet list available in [Google Sheets](https://docs.google.com/spreadsheets/d/1G0dCwVA2e0LXVnUZPirevAC2n_0Yhw5WuFNqV6D30oQ/edit?usp=sharing) - Eligible traders must contact [Synthetix Help Center](https://support.synthetix.io/) for details **Competition Structure:** - 50 invite-only spots for top crypto traders - 35 spots for pre-depositors (top 20 sUSD + top 10 sUSDe depositors) - 15 spots for Synthetix community members This marks Synthetix's return to **Ethereum Mainnet** with the first native perp DEX, featuring gasless trading and private order data. **Join the discussion:** - [Discord](https://discord.gg/synthetix) - [Telegram](https://t.me/synthetix_dao)

🥊 Round Two Begins

**Synthetix Mainnet Trading Competition Round 2** kicks off with a high-stakes rematch between prominent crypto traders @kaiynne and @crypto_bitlord7. The competition features: - **100 top crypto traders** competing head-to-head - **$1,000,000 top prize** up for grabs - **Leverage trading** on Synthetix's mainnet platform This marks the second face-off between these two well-known traders, building on the momentum from their previous competition. The event showcases Synthetix's synthetic asset trading capabilities while bringing together some of crypto Twitter's most recognized trading personalities. *Follow the competition to see who claims the million-dollar prize.*

Chinese CT Trader Joins $1M Synthetix Competition

**Synthetix reveals another competitor** for their upcoming mainnet trading competition with a **$1,000,000 top prize**. A prominent figure from the **Chinese crypto Twitter community** has secured one of the 100 spots in the high-stakes trading battle. The competition structure includes: - **50 invite-only spots** for top traders - **35 spots for pre-depositors** into sUSD/sUSDe vaults - **15 spots for Kwenta point holders** This follows previous announcements of a **semi-retired trading legend** turned pump.fun streamer also joining the competition. The event will **battle-test the first perp DEX on Ethereum**, with pre-deposit winners selected October 13th at 00:00 UTC. [Pre-deposit here](https://predeposit.synthetix.io/)

Synthetix Mainnet Multi-Collateral Margin Launch

**Synthetix Mainnet** is launching multi-collateral margin trading, allowing users to deposit portfolios of assets as collateral while keeping them productive. **Three supported collateral types:** - **sUSDe** - Ethena's yield-bearing synthetic USD stablecoin - **wstETH** - Lido's liquid staked ETH - **cbBTC** - Coinbase's Wrapped Bitcoin **Key benefits:** - Trade without selling underlying assets - Retain upside potential and yield generation - Improved capital efficiency - Lower capital gains implications The architecture supports any ERC-20 token with sufficient Ethereum liquidity, opening opportunities for partnerships with core Ethereum protocols and positioning Synthetix perps as a critical tool in the ETH ecosystem. Read more: [Multi-Collateral Margin Blog](https://blog.synthetix.io/multi-collateral-margin-on-synthetix-mainnet/)

Synthetix Liquidations Resume - 420 Pool Migration Update

Synthetix is re-enabling liquidations for existing stakers following the 420 Pool migration launch. Key updates: - Stakers with c-ratio below 160% are now at risk of liquidation - The 420 Pool offers complete debt forgiveness for migrators - Over 100m SNX already deposited in first day - New features include: * No liquidation risk * Protocol-managed sUSD liquidity * SNX-backed yield generation * Partnership with Ethena Labs for USDe minting Non-stakers will soon be able to participate with new incentives. A cross-chain Swap & Stake feature is coming to support deposits from multiple EVM chains. [Migrate to 420 Pool](https://420.synthetix.io/) [Read Documentation](https://docs.synthetix.io/welcome-to-synthetix-user-docs/snx-staking/deposit-snx-to-the-420-pool)