SynFutures has released a significant update to their concentrated liquidity pools, allowing liquidity providers to set custom asymmetric price ranges on both ends when creating pool positions. The platform continues to expand with new trading competitions, including a $10,000 LRDS rewards pool and Base Bonanza campaign. The protocol also announced a partnership with Bybit for their upcoming F token launch. Weekly stats show continued growth with substantial trading volume and user engagement.

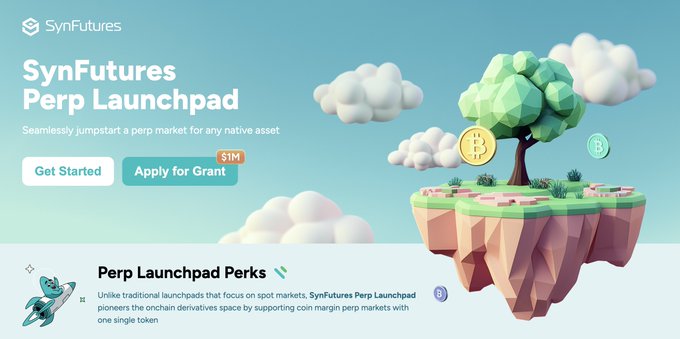

Launch a perp market for any token, instantly. SynFutures Perp Launchpad lets you create a perpetual futures market for any asset. We also have a $1 million grant to help projects bootstrap liquidity and build community presence. Learn more in our blog (linked below).

The Pearl Press: Issue 32 is live! 📰 📊 Cumulative Volume: $190B 📈 7-Day Volume: $3.42B 🧑🤝🧑 7-Day Active Users: 38,856 🔄 Total Transactions: 11.68M 🆕 New listings: $LRDS, $ai16z 🪙 @BLOCKLORDS & @0xBONSAICOIN & @KlimaDAO campaigns + more!

Introducing SynFutures Perp Launchpad + a $1,000,000 Grant 🎉 This is the first ever crypto derivatives launchpad. Now, any project can launch perpetual futures trading pairs for any crypto asset. Additionally, SynFutures is allocating $1 million Perp Launchpad Grant to support

We're proud to introduce the industry's first Perp Launchpad. By fostering innovation and supporting promising projects like @degentokenbase, @MewsWorld, @LidoFinance, and @SolvProtocol, we're shaping the future of open and efficient DeFi. 👇Learn more about our Perp Launchpad

Decentralized derivatives startup SynFutures introduces its 'Perp Launchpad' and $1 million grant initiative theblock.co/post/324691/de…

Due to current market conditions, we're letting any meme launch its perp market on SynFutures. Go, check out our Perp Launchpad.

The Pearl Press: Issue 34 is live! 📰 📊 Cumulative Volume: $202.8B 📈 7-Day Volume: $4B 🧑🤝🧑 7-Day Active Users: 33.84k 🗒️ New Listing: #VIRTUAL || @virtuals_io @BLOCKLORDS & Base Bonanza campaigns + more!

The Pearl Press: Issue 33 is live! 📰 📊 Cumulative Volume: $193.9B 📈 7-Day Volume: $4B 🧑🤝🧑 7-Day Active Users: 34,120 🔥 Introducing the industry's first Perp Launchpad! 🪩 Join us at Based Hour at DevCon Bangkok on Nov 12! 🪙@BLOCKLORDS & @0xBONSAICOIN campaigns + more!

Bitcoin Drops Below $70k as Vitalik Challenges L2 Narratives

**Bitcoin falls under $70,000** amid market turbulence this week, marking a significant price level breach. **Vitalik Buterin delivers reality check on Layer 2 solutions**, challenging prevailing narratives about Ethereum scaling technologies. **House investigation targets WLFI**, adding regulatory pressure to the crypto sector. These developments come as market sentiment shifts, with the Crypto Fear & Greed Index showing increased caution among traders.

SynFutures Partners with DCENT Wallet for Year-End Quest Campaign

**SynFutures** has partnered with **DCENT Wallet** for their Year-End Gala as a quest partner. Users can complete SynFutures quests directly within the DCENT app to earn rewards while celebrating self-custody principles. This collaboration combines decentralized derivatives trading with secure wallet functionality, offering users an integrated experience for both trading and asset management. - Complete quests in DCENT app - Stack rewards through participation - Celebrate self-custody practices The partnership highlights the growing trend of protocol integrations with wallet providers to enhance user engagement.

🏀 Top Shot Revisited

**NBA Top Shot** gets a deep dive on the *What The F* podcast as @bigdog_max from @momentumxglobal explores crypto's wildest cultural moment. The discussion covers: - How Top Shot transcended typical NFT projects - Its massive cultural impact during crypto's peak - What happened after the initial hype Hosted by @iamtonebone, the full episode drops soon. *Top Shot moments are now tradable on OpenSea via Flow blockchain.*

SynFutures Wave 1 Private Beta Goes Live

**SynFutures Wave 1 Private Beta is now active**, bringing invite-only access to test the next generation of DeFi trading infrastructure. **Key Features:** - CEX-level performance with ~10ms latency - Tighter spreads and smoother market maker workflows - Fully on-chain transparent infrastructure **Participation Benefits:** - Early users can test and provide feedback - Top participants earn invites for others - All actions count toward Season 2 $F token rewards - Exclusive rewards for early participants **Access & Timeline:** - Currently invite-only for Wave 1 - Wave 2 coming soon - Applications open through their [Notion page](http://synfutures.notion.site/27e48d36614f80ed98a0dcb6734d59e8?pvs=105) The upgrade focuses on deeper liquidity, lower slippage, and reduced fees compared to traditional DeFi trading platforms. [Apply for early access](http://synfutures.notion.site/27e48d36614f80ed98a0dcb6734d59e8?pvs=105) to help shape the future of decentralized derivatives trading.

🇰🇷 SynFutures Launches 30M $F Trading Competition on UPbit

**SynFutures launches major trading event on South Korea's largest exchange** UPbit has kicked off the $F TOP Trading Event, offering **30 million $F tokens** in rewards for top traders. The competition runs from October 24-27, featuring F/KRW trading pairs. **Event Structure:** - Round 1: Oct 25 (full day KST) - Round 2: Oct 26-27 (partial days KST) - Total rewards: 30,000,000 $F - Winners announced: November 3, 2025 This campaign follows $F's recent listing on UPbit earlier this month, marking a significant milestone for SynFutures' expansion into the Korean market. Korean traders can now access $F on one of the country's premier exchanges while competing for substantial rewards across two separate rounds. [Full event details](https://knowledgehub.synfutures.com/f-top-trading-event-live-now-on-upbit/) | [Official UPbit announcement](https://upbit.com/service_center/notice?id=5682)