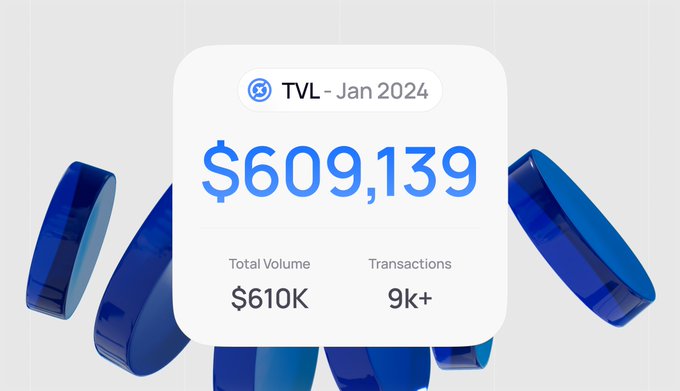

Swapr had a successful start in 2024 with the launch of Swapr V3 beta on Gnosis Chain, addition to Swapr Eco Router, new incentives and $SWPR emissions. Incentive distributions are handled by Angle Protocol. GnosisDAO provided 500K liquidity on WETH-WXDAI pair. There were also UI changes and bug fixes. The total value locked (TVL) reached 605K by the end of January. Swapr has bigger plans for the future.

We are really happy to announce that we have received over 500k in deposits from @gnosisdao for our WETH-XDAI campaign in Swapr V3! 🎉 It is truly amazing to witness their support! This is the beginning of availability of range based liquidity in @gnosischain and we are

Swapr crushed it in January! 🎉 Check out our highlights: ⚫ Swapr V3 beta launch on Gnosis Chain, powered by @CryptoAlgebra ⚫ Swapr V3 added to Swapr Eco Router ⚫ New incentives and $SWPR emissions ⚫ Incentive distributions handled by Angle Protocol through Merkl ⚫

Shutter's MEV Protection Launches on Gnosis Chain

Gnosis Chain users now have protection against Maximal Extractable Value (MEV) attacks, including front-running, thanks to Shutter's Shielded Trading technology. Key points: - Transactions are encrypted, reducing vulnerability to manipulation - Particularly beneficial for DeFi traders - Promotes fairness and prevents value loss from MEV attacks How to use: 1. Add Shutterized RPC to your wallet 2. Enjoy secure transactions via Gnosis Chain's encrypted mempool For more information, visit the Gnosis Blog.

DeFi Resilience Amid Traditional Exchange Downtime

On August 5, 2024, most traditional exchanges experienced downtime, while decentralized finance (DeFi) platforms remained operational. This event highlighted the robustness of DeFi systems compared to centralized counterparts. Key points: - Traditional exchanges: Down - DeFi platforms: Fully functional - Trading volume: Over 2 million (and increasing) This occurrence underscores the potential advantages of decentralized systems in terms of reliability and continuity of service. It may prompt discussions about the future of finance and the role of DeFi in ensuring uninterrupted market access. Investors and traders might consider diversifying their trading strategies to include DeFi platforms as a hedge against centralized exchange downtime.

Swapr Introduces SHU/USDC Pool in V3

Swapr has launched a SHU/USDC pool in its V3 decentralized exchange (DEX). This addition aims to provide Validators, Keypers, and Staking Delegators with a reliable platform to acquire SHU tokens. The new pool is designed to: - Offer easy access to SHU tokens for validators - Ensure efficient price discovery - Enhance liquidity provisioning Swapr is also engaging with automated liquidity managers to deepen liquidity in a concentrated range. This move aligns with ShutterDAO's efforts to protect users from MEV on Ethereum and expand to other chains, including Gnosis Chain.

Uniswap Announces New Incentives for V3 Liquidity Pools

Uniswap has introduced new incentives for its V3 liquidity pools, offering attractive annual percentage rates (APRs) to liquidity providers. Notably, the SAFE-WXDAI pool is offering a 4,000% APR, with 1,000 SWPR tokens distributed daily. Liquidity providers are encouraged to add funds to this pool to earn substantial yield rewards.

Major Crypto Companies to Challenge SEC Regulations

On April 29th, 2024, major cryptocurrency companies Coinbase, Uniswap, and ConsenSys announced their intention to take legal action against the U.S. Securities and Exchange Commission (SEC) over regulatory issues. The companies expressed their shared vision and commitment to supporting each other in this endeavor.