sUSDS Becomes Fastest Growing Asset in Spark Savings as TVL Hits $4.1B

sUSDS Becomes Fastest Growing Asset in Spark Savings as TVL Hits $4.1B

⚡ sUSDS Growth Explosion

sUSDS has emerged as the fastest growing asset within Spark Savings, driving significant growth across the platform.

Key Metrics:

- Total Value Locked (TVL) has surpassed $4.1 billion

- Platform is hitting new all-time highs daily

- Represents massive growth from previous milestones

Recent Growth Context:

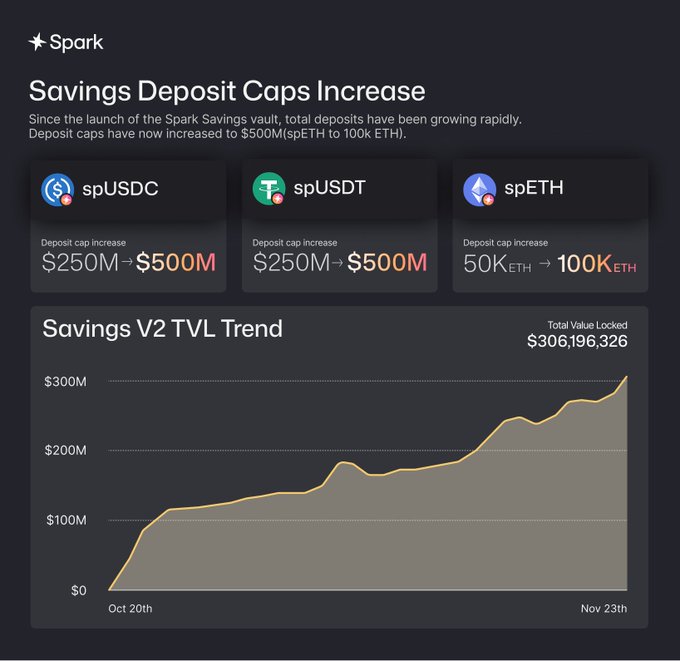

- Savings V2 TVL previously reached $300M in November

- Caps were raised to accommodate demand: USDT 500M, USDC 500M, ETH 100K

- Spark now leads across all chains with +$3B in TVL

Platform Features:

- Institutional-grade, non-custodial access

- Real-time compounding growth

- No platform fees or slippage

- Deposit stablecoins or ETH, withdraw anytime in same asset

The rapid adoption of sUSDS demonstrates growing institutional and retail demand for yield-generating stablecoin products in the DeFi space.

Savings V2 TVL surpased $300M. Demand for Spark Savings continues to grow. ⚡️ Caps have been raised: USDT → 500M USDC → 500M ETH → 100K ETH Spark Savings offers institutional-grade, noncustodial access to real time compounding growth. Deposit stablecoins or ETH and withdraw

sUSDS is the fastest growing asset in Spark Savings. ⚡️ TVL has surpassed $4.1B+, and it’s hitting a new ATH everyday.

The onchain capital allocator market TVL has grown massively from $111M to $10B over the last 18 months. Spark now leads across all chains with +$3B in TVL. This is what an institutional-grade protocol looks like. ⚡️

spUSDC have already reached half of the newly increased cap. ⚡️ Spark Savings offers institutional-grade, non-custodial access to real time compounding growth.

Spark Releases January 2026 Partnership and Development Recap

Spark has published its monthly update covering January 2026 activities. The announcement highlights new partnerships formed during the month and key product updates delivered to the platform. **Key Points:** - New partnership agreements established in January - Multiple product updates and improvements shipped - Continued focus on DAI ecosystem development Spark operates as a DAI-focused money market protocol within the MakerDAO ecosystem, providing liquidity solutions and DeFi protocol integrations through SparkLend. The update follows a similar pattern to previous monthly recaps, with December's report also featuring partnership announcements and platform developments.

SparkLend Freezes Gnosis Chain Market Operations

SparkLend has officially deprecated its Gnosis market, freezing all new deposits and borrows across the chain. **Key Changes:** - All reserves frozen across WXDAI, sDAI, WETH, wstETH, EURe, USDT, USDC.e, GNO, and USDC - Reserve factor increased to 50% for all assets - Existing positions remain unaffected and accessible **Rationale:** The decision stems from low market usage and limited reserve revenue, prompting a strategic reduction in risk exposure. SparkLend remains open to future collaboration with Gnosis Chain when market conditions improve.

Spark Hits Multiple All-Time Highs in November

**Spark achieved multiple all-time highs** during November while delivering significant platform updates. The DAI-centric money market protocol continues its growth trajectory, building on previous monthly successes. Key developments included: - Multiple ATH milestones reached - Important platform updates delivered - Continued integration with top DeFi protocols Spark combines **premium liquidity from Maker** with vertical integration across leading DeFi platforms, strengthening the DAI ecosystem.

🔥 Two weeks left

**Spark Season 2 ending soon** - only two weeks remaining to accumulate points. Current stats: - **425+ billion points** distributed - **15,764 active wallets** participating This is your **final opportunity** to stack points before Season 2 concludes. [Start earning points now](https://app.spark.fi/points)