SuperVaults: A New Approach to DeFi Trading

SuperVaults: A New Approach to DeFi Trading

🤖 When Vaults Get Super

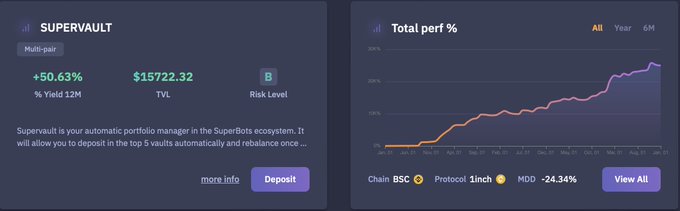

SuperVaults introduces a balanced approach to cryptocurrency trading by combining multiple DeFi vault strategies. The platform aims to provide:

- Dual-sided trading capabilities (Long/Short positions)

- Built-in safety mechanisms to manage volatility

- Integration of trending vault strategies

Recent market observations show how volatile crypto trading can be, especially with examples like Microstrategy's BTC purchases affecting market movements. SuperVaults positions itself as a solution for traders seeking more strategic approaches to market participation.

Key Feature: Safety-first automated trading mechanisms that work in both bull and bear markets.

Learn more about secure DeFi trading strategies →

The key to success in #cryptomarket is sensible trading. A Degen can't miss over #DeFi Vaults. And among these Vaults, Super Vaults amalgamates all the trending Vaults. What is making you wait for the Masterstroke?

SuperBots Tutorial Series: How to Approve USDC and Start Trading

SuperBots has released a comprehensive tutorial series for new users getting started with automated trading: - **Wallet Setup**: Connect MetaMask wallet to SuperBots platform - **Asset Preparation**: Purchase and transfer BNB (for fees) and USDC (for deposits) - **Vault Approval**: Learn how to approve your vault for USDC interactions - **Fund Management**: Step-by-step guide for depositing funds Watch the complete tutorial series here: [SuperBots Getting Started Guide](http://www.youtube.com/watch?v=c8qmMjEDtB0&list=PLZACdq0V8MHJku6rrp-rZZ5rUpko9LiMK) *Note: Complete all steps in order before beginning automated trading.*

Citigroup Predicts Blockchain Breakthrough in 2025

Citigroup forecasts a potential watershed moment for blockchain technology in 2025, comparing it to ChatGPT's impact on AI adoption. Key factors driving this prediction: - Improved user experience and reduced transaction fees - Growing asset tokenization trends - Evolving regulatory frameworks - Increasing institutional adoption The financial giant suggests blockchain could become fundamental infrastructure for global finance, particularly as traditional institutions embrace digital assets. *Current Challenges*: - Scalability issues - Regulatory uncertainty - Market volatility [Read full report](http://www.cointribune.com/en/citigroup-bets-on-a-chatgpt-moment-for-blockchain-in-2025/)

Trump-Related Tokens See Major Market Cap Losses While World Liberty FI Invests in BTC/ETH

Recent market movements show significant volatility in Trump-ecosystem tokens: - $TRUMP token lost approximately $7.5B in market cap - #MELANIA token dropped nearly $1.4B in market cap - Trump's World Liberty FI invested $47M each in Bitcoin and Ethereum **Key Investment Lessons:** - Avoid single-cause portfolio concentration - Focus on fundamental projects with clear utility - Diversification remains crucial for risk management *Polymarket data shows declining odds (36%) for Trump creating a Bitcoin reserve in first 100 days if elected.*

Crypto Vaults Emerge as New Trend in Profit Maximization

**Key Market Updates:** - Crypto space continues to evolve with vaults emerging as the latest profit-maximizing trend - Market observers emphasize the importance of adapting to new developments and learning from past experiences **Strategic Insights:** - Focus shifts from previous setbacks ('L's) to upcoming opportunities ('W's) - Timing highlighted as crucial factor for market participation *Keeping pace with crypto trends requires constant vigilance and adaptability in this dynamic space.* **Action Point:** Research vault strategies to stay ahead of market movements.