Superswaps Launches Cross-Chain Trading Infrastructure

Superswaps Launches Cross-Chain Trading Infrastructure

🌉 Bridge Wars Heat Up

Superswaps has launched across multiple chains in the Superchain ecosystem, offering improved cross-chain swap execution compared to existing bridge aggregators.

Key features:

- Single-app experience for cross-chain swaps

- No separate bridging transactions required for gas

- Open-source infrastructure for easy integration

- Protected against MEV

Currently live on:

- OP Mainnet

- Celo

- Mode

- Lisk

- Fraxtal

- Soneium

- Superseed

- Unichain

Protocols can benefit from:

- Consolidated liquidity

- Pure onchain execution

- Vendor-independent interoperability

Technical documentation available at Superswaps Docs

Superswaps are for Protocols With Superswaps, protocols can launch liquidity on one chain and scale across the ecosystem. - Less fragmented liquidity - Speed and security of pure onchain execution - Future-proof interop without vendor lock-in - MEV protection

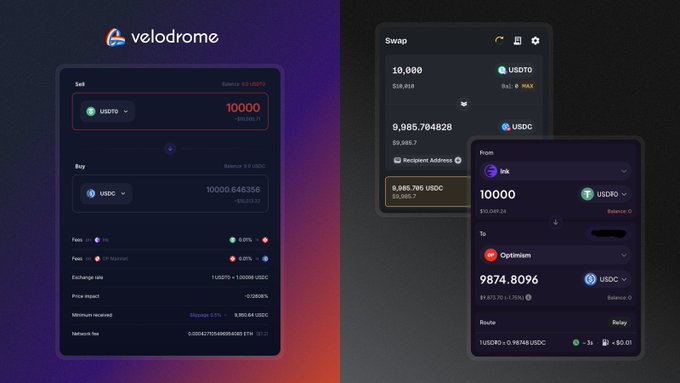

Superswaps went live last week and is already delivering better cross-chain swap execution than leading bridge aggregators. Integrate Superswaps to give users the best cross-chain swaps, all in one app.

One app. One seamless cross-chain experience Swap across the Superchain today Superswaps are live on: OP Mainnet, Celo, Mode, Lisk, Fraxtal, Soneium, Superseed, Unichain

No bridging. No switching chains. No switching apps. One app @VelodromeFi for everything Superchain, powered by Hyperlane. Superswap Here ⏩ velodrome.finance/superswaps

Superswaps are now live across the Superchain, including @inkonchain, Swellchain and @Metal_L2 Experience cross-chain swaps in seconds, all in one app. No multiple transactions. No bridging for gas. See Superswaps in action here:

ETHCC 2025 Highlights: Superswaps Launch and DeFi Innovation

Key developments from ETHCC 2025: - **Superswaps** goes live across Superchain, enabling seamless cross-chain trading experience - New **Pool Launcher** announced, promising user-friendly pool creation with fee earning potential - Notable DeFi discussion at Aerodrome x Base meetup highlighted concerns about recreating traditional finance models in DeFi space - @wagmiAlexander delivered significant DeFi presentation [Watch full talk](https://www.youtube.com/watch?v=elGpQiLYr1w) - @houdiniswap introduced privacy-enabled swapping across Mode, Base, and OP Mainnet Want to learn more about these developments? Join our community discussion.

cEUR Launches on Velodrome with USDT & CELO Pairs

Velodrome Finance expands its offerings on the Celo network with the launch of cEUR trading and liquidity provision options. - New trading pairs include: * cEUR/USDT * cEUR/CELO This follows last month's successful USDC launch with WETH and CELO pairs. Liquidity providers can now participate in both pools with active emissions rewards.

Velodrome Reaches Major Token Lock Milestone

Velodrome Finance continues to demonstrate strong holder commitment with approximately 55% of total $VELO supply now locked. Key metrics show: - Over 14,000 $veVELO holders participating - Average lock duration of 3.61 years - 92% of locks are auto-max locked, meaning they automatically extend to maximum duration *Auto-max locking effectively removes tokens from circulation until manually disabled.* This represents a slight increase from previous months, where 91% of locks were auto-max locked.

Velodrome Maintains Market Leadership on Soneium

Velodrome continues its strong performance on Soneium, maintaining its position as the leading DEX platform. Recent highlights: - Achieved #1 DEX status with highest trading volume - Consistently outperforming all other DEXs combined - Sustained $30M+ weekly trading volume This follows a pattern of growth, with recent weeks showing more than double the average volume compared to previous months. *Trading metrics indicate sustained market dominance rather than temporary spike.*