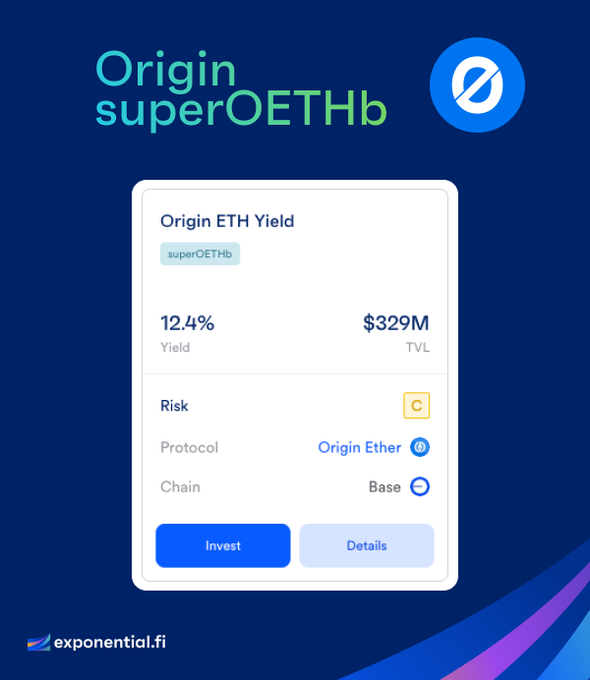

Super OETH has been launched on exponential.fi. This development brings enhanced functionality to Origin Ether (OETH), an ERC20 LST aggregator that generates yield while in your wallet.

Key features of OETH:

- Backed 1:1 by ETH, WETH, stETH, rETH, and frxETH

- Daily yield payouts through positive rebase

- Yield sources include: 1. Deployment across DeFi protocols 2. LST validator rewards 3. Optional exit fee 4. Interest from non-rebasing tokens

OETH aims to provide higher yields than manual LST farming. Collateral allocation and strategies are governed by OGV stakers.

Super OETH is now available on exponential.fi 💙

Excited to announce @OriginProtocol's Super OETH on Base is now available as our newest investable ETH pool on Exponential! Super OETH is a next-gen liquid staking token (LST) that offers higher ETH yields by leveraging Layer 2 rewards on Base, while maintaining a strong peg.

OUSD Expands Curve Integration with New Stablecoin Pools

**OUSD is expanding its presence on Curve Finance** through multiple new liquidity pools paired with various stablecoins and yield tokens. **Key developments:** - New pools are delivering **double-digit APYs** for liquidity providers through Pool Booster incentives - The **frxUSD/OUSD pool** launched with Frax Finance has surpassed **$1M in TVL** within one week, offering up to 19.7% APY - A new **OUSD/MUSD pool** went live in collaboration with Mezo Network - Pool Booster directs protocol incentives to maintain deep liquidity and competitive returns These launches establish a framework for bringing new stablecoin markets to Curve with sustainable liquidity. Origin is working with multiple stablecoin protocols to build institution-grade markets, with additional deployments already underway. [Explore OUSD pools on Curve](https://www.curve.finance/dex/ethereum/pools/?search=OUSD)

Origin Protocol Community Call Recap: Token Buybacks, DeFi Integrations, and OUSD Phase 2

**Key Updates from Monday's Community Call** Origin Protocol shared several important developments: - **$OGN Buybacks Update** (7:07): Latest information on token buyback program - **Ecosystem Integrations** (11:06): Progress on integrations with [Morpho](https://morpho.org), [Curve](https://curve.fi), and [Compound](https://compound.finance) - **$OUSD Phase 2** (22:22): Next phase rollout details for the stablecoin product - **ARM Updates** (25:10): Technical improvements to the protocol - **OUSD Pool Booster** (28:20): New liquidity strategy implementation - **Guest Spotlight** (30:04): Discussion with [@fraxfinance](https://twitter.com/fraxfinance) team The call covered strategic developments across Origin's product suite, focusing on expanding DeFi partnerships and enhancing yield generation mechanisms for users.

Origin Protocol January Update: Revenue, Buybacks, and Product Progress

Origin Protocol has released its January 2026 token holder update, providing transparency on key metrics and developments. **Key highlights include:** - Protocol revenue performance for the month - Details on $OGN token buyback activities - Product development updates for $OUSD - Progress report on ARM (Automated Risk Management) The update offers token holders insight into the protocol's financial health and ongoing product improvements across Origin's DeFi ecosystem. [Read the full January update](https://www.originprotocol.com/blog/january-2026-token-holder-update?lang=en&category=all&page=1)

🔥 stETH Volatility Trading

**Pendle Finance** now offers the first-ever **stETH volatility trading** market. - ARM protocol captures the spread between different stETH positions - Pendle transforms this into a tradeable market for users - Traders can now directly trade volatility exposure on staked Ethereum This creates a new DeFi primitive allowing users to speculate on or hedge against stETH price movements without holding the underlying asset. [Trade stETH volatility on Pendle](https://app.pendle.finance/trade/markets/0x53f940db819400f226466f5ad330c177a4be6b3c/swap?view=pt&chain=ethereum)

💰 Negative Rates Alert

**Morpho's Borrow Booster markets** are offering negative interest rates on USDC loans, meaning borrowers get paid to borrow. **Key Details:** - Available on Base and Ethereum Mainnet - Base Super OETH market offering ~9.7% APY to borrowers - Higher LTV loops earn more rewards - Auto-deleverage feature reduces liquidation risk **How it works:** - OETH and Super OETH yield subsidizes borrow costs - Borrowers effectively earn money on USDC loans - Risk management through automatic deleveraging **Available Markets:** - [Base Super OETH](https://app.morpho.org/base/market/0x67a66cbacb2fe48ec4326932d4528215ad11656a86135f2795f5b90e501eb538/superoethb-usdc) - [Ethereum OETH](https://app.morpho.org/ethereum/market/0xb8fef900b383db2dbbf4458c7f46acf5b140f26d603a6d1829963f241b82510e/oeth-usdc) Check out these markets to explore earning while borrowing.