Exciting Update for DeFi Enthusiasts

- Super OETH has launched on exponential.fi

- This new offering expands options for decentralized finance users

- Potential benefits may include enhanced yields or additional features

What is Super OETH? Super OETH likely represents an upgraded or optimized version of OETH (Origin Ether), a yield-bearing token.

Why it matters:

- Could provide improved returns for ETH holders

- May offer new strategies for DeFi participants

Visit exponential.fi to explore Super OETH and its potential advantages for your portfolio.

Super OETH is now available on exponential.fi 💙

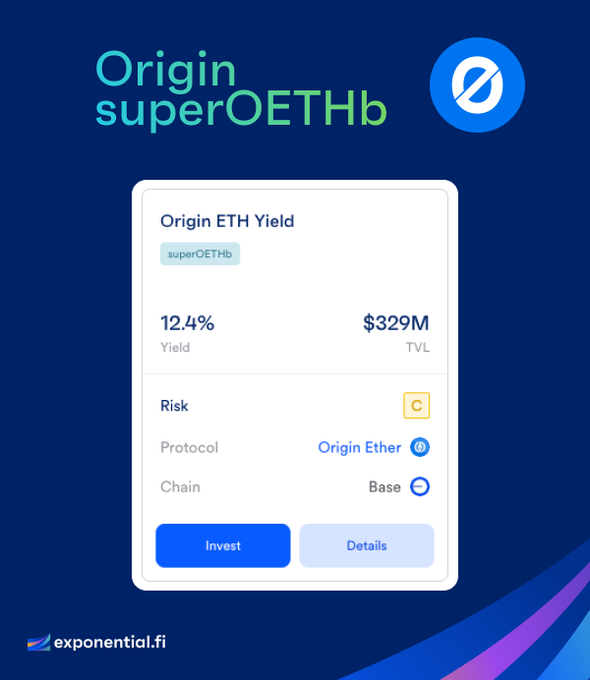

Excited to announce @OriginProtocol's Super OETH on Base is now available as our newest investable ETH pool on Exponential! Super OETH is a next-gen liquid staking token (LST) that offers higher ETH yields by leveraging Layer 2 rewards on Base, while maintaining a strong peg.

OUSD Expands Curve Liquidity with Three New Stablecoin Pools

Origin's OUSD stablecoin is expanding its presence on Curve Finance through three new liquidity pools, each offering double-digit APYs through Pool Booster incentives. **New Pools:** - **ynRWAx/OUSD** (with YieldNest): Connects real-world asset yield with onchain stablecoin liquidity. LPs retain native ynRWAx rewards while earning Pool Booster incentives. - **MUSD/OUSD** (with Mezo Network): Pairs OUSD with bitcoin-collateralized stablecoin MUSD, supporting tight USD pegs on both sides. - **frxUSD/OUSD** (with Frax): Surpassed $1M TVL within one week, offering LPs up to 19.7% APY through co-incentives. Pool Booster directs protocol incentives to these pools, helping scale liquidity while maintaining competitive yields for liquidity providers. The expansion establishes a framework for bringing new stablecoin markets to Curve with sustained depth. [Explore OUSD pools on Curve](https://www.curve.finance/dex/ethereum/pools/?search=OUSD)

Origin Protocol Community Call Recap: OGN Buybacks, OUSD Phase 2, and Frax Finance Integration

Origin Protocol held its Monday community call covering several key developments: **Key Updates:** - **$OGN Buybacks** - Latest status on token buyback program (7:07) - **Ecosystem Integrations** - New partnerships with Morpho, Curve, and Compound protocols (11:06) - **$OUSD Phase 2** - Next phase rollout details for Origin Dollar (22:22) - **ARM Updates** - Progress on Automated Risk Management system (25:10) - **OUSD Pool Booster** - New liquidity strategy implementation (28:20) - **Frax Finance Spotlight** - Guest appearance discussing collaboration opportunities (30:04) The call provided technical updates on Origin's stablecoin infrastructure and DeFi integrations, with timestamps available for those who missed the live session.

Origin Protocol Releases January 2026 Token Holder Update

Origin Protocol has published its monthly token holder update for January 2026. The report provides transparency on three key areas: - **Protocol revenue** performance metrics - **$OGN buyback** program activity - **Product development** updates for OUSD and ARM Token holders can review the complete financial and operational details in the [full update](https://www.originprotocol.com/blog/january-2026-token-holder-update?lang=en&category=all&page=1). These monthly reports offer stakeholders regular insights into Origin Protocol's financial health and product roadmap progress.

Frax Finance and Origin Discuss Stablecoin Yields During Market Volatility

Frax Finance and Origin Protocol hosted a community call focused on generating stable yields through stablecoins amid volatile market conditions. **Key Discussion Points:** - Strategies for maintaining consistent returns in uncertain markets - Stablecoin mechanisms and yield generation approaches - Community insights on $OGN token utility The conversation explored how decentralized protocols can offer predictable returns when traditional crypto assets experience significant price swings. Both teams shared their approaches to balancing stability with competitive yields. [Watch the full community call](https://x.com/i/broadcasts/1BRJjgwDMeRxw)

**Pendle Launches First stETH Volatility Trading Market via ARM Integration**

**Pendle introduces liquid yield trading for stETH volatility** through ARM (Automated Risk Management) integration. **How ARM generates yield:** - Buys stETH at discount during volatility - Redeems back to ETH at 1:1 ratio via Lido - Captures spread as profit for depositors **Pendle splits ARM yield into tradeable tokens:** - **PT (Principal Tokens):** Steady ETH exposure + fixed yield - **YT (Yield Tokens):** Leveraged upside to ARM yields This creates the **first direct way to trade stETH volatility** on Pendle. Higher stETH price swings = more arbitrage opportunities = increased yields for ARM depositors. Traders can now: - Speculate on stETH volatility through YT - Lock in fixed yields from ARM via PT - Provide liquidity to earn trading fees The ARM vault combines Lido stETH arbitrage with lending yield on idle ETH via Morpho, creating a unique yield source tied to protocol-driven arbitrage. [Trade the market](https://app.pendle.finance/trade/markets/0x53f940db819400f226466f5ad330c177a4be6b3c/swap?view=pt&chain=ethereum)