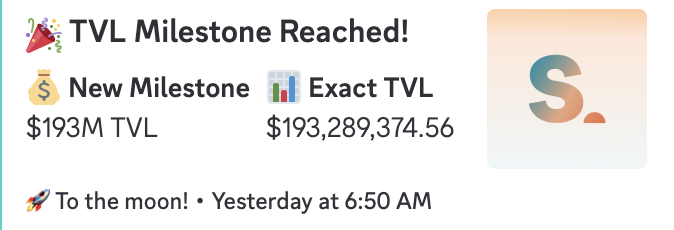

🌊 Summer.fi Surpasses $190M TVL Across Multiple Chains

🌊 Summer.fi Surpasses $190M TVL Across Multiple Chains

🌊 $190M milestone reached

Summer.fi reaches new milestone with over $190 million in Total Value Locked (TVL) across multiple blockchain networks.

Multi-chain expansion continues with capital flowing across:

- Base network

- Arbitrum

- Sonic Labs

- Additional chains

The platform enables 24/7 automated rebalancing and compounding of user funds across different protocols and layers.

Capital deployment accelerating as the DeFi platform consolidates its position as a trusted entry point for decentralized finance activities.

Users can access borrowing, yield farming, and leverage features through the unified interface at summer.fi/earn.

New Week, New Milestone. 🎉 $190M+ TVL and counting🚀 From @base to @arbitrum to @SonicLabs and more, capital keeps flowing, rebalancing, and compounding 24/7 The wave’s getting stronger. Are you riding it, or watching it? 🌊 👉 summer.fi/earn #HappyNewWeek

🗳️ Lazy Summer DAO Governance Update: SUMR Transferability GTM Plan & New Vault Strategies Live

**Lazy Summer DAO voting is active until October 12th** with key developments across governance and protocol expansion. **Major Updates:** - **SUMR Transferability Go-To-Market plan** outlined with comprehensive strategy for communications, influencer partnerships, and user growth targeting significant expansion - **Delegate rewards distributed** for September with 140,599.95 SUMR allocated to active participants - **New vault strategies proposed** including Euler Finance and Morpho Labs integrations **Active Proposals:** - [SIP2.31] Add Euler Earn USDC strategy to Mainnet higher-risk vault - [SIP2.32] Add Morpho USDC strategy to Arbitrum lower-risk vault - [SIP2.30] Onboard infiniFi siUSD for institutional-grade yield diversification - [SIP5.5.3] Referral campaign payouts covering 419 referrers with 40,582 SUMR + 1,337 USDC distribution **Community Participation:** Vote and discuss proposals at [forum.summer.fi](https://forum.summer.fi) and [gov.summer.fi](https://gov.summer.fi) The protocol continues building toward becoming DeFi's leading auto-yield platform with expanding cross-chain strategies.

🏖️ Beach Club Momentum

Summer.fi's Beach Club referral program shows strong growth with **460 users** actively participating in deposits and referrals. Key metrics: - Users earning SUMR tokens through deposits - Building on-chain momentum through referral system - Rising deposit activity driving reward distribution The program combines DeFi yield farming with social incentives, allowing users to earn rewards both from deposits and successful referrals. [Visit Beach Club](http://summer.fi/beachclub) | [View Dashboard](http://dune.com/lazysummer/lazy-beach-club)

🔄 ETH Evolves Beyond Crypto

**ETH is transforming from a cryptocurrency into a yield-bearing asset class** that's catching institutional attention. **Key developments:** - On-chain yields are outperforming traditional off-chain rates - Automated strategies now span staking, restaking, looping, and AI-driven rebalancing - Operations scale across Base, Arbitrum, and Ethereum Mainnet **What institutions get:** - Transparent risk management - Automated portfolio management - 24/7 yield generation **The new approach** combines risk-tiered automation with composable yield access. Allocators are building automated vaults where capital works continuously without manual intervention. Institutions are adopting on-chain strategies faster than expected, moving beyond simple crypto exposure to sophisticated yield-generating mechanisms. [Read the full analysis](http://blog.summer.fi/the-return-of-eth-what-institutional-allocators-should-know-about-on-chain-yield)

Lazy Summer DAO Hits $182.7M TVL as $SUMR Token Audit Nears Completion

**Lazy Summer Protocol** achieved significant milestones in September with **TVL growing $34M to $182.7M** and the $SUMR token transferability moving into audit phase. **Key Developments:** - $SUMR token and Governance V2 now in Sherlock audit (ends Oct 7) - **Target: Enable transferability by end of October** - DAO Treasury grew to $186K with liquidity incentives ready **Growth Metrics:** - **SUMR holders:** 5,536 (+490) - **Delegates:** 521 (+7) - **SUMR delegated:** 360.5M (+7M) **Chain Performance:** - Ethereum: +$31M to $143M - Base: +$3M to $25M - Arbitrum: +$3.4M to $9.8M The protocol deployed **26 new strategies** across chains while processing multiple expansion proposals including Plasma Network integration and new vault strategies.