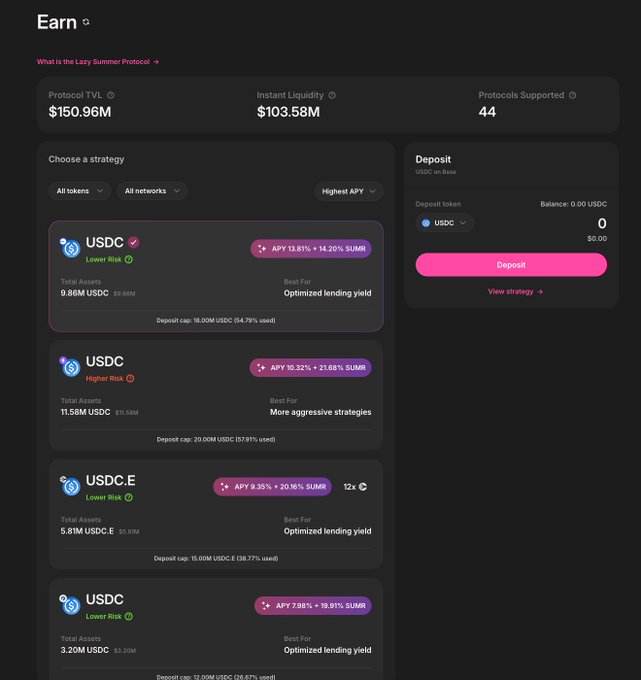

Choosing DeFi yield strategies doesn't need to be overwhelming. Summer.fi breaks down how to pick the right Lazy Summer vault in their latest video guide.

Key selection criteria:

- Chain preference - Choose your preferred network

- Asset type - ETH vs stablecoins (USDC/USDT)

- Risk tolerance - Higher-risk for more yield, lower-risk for stability

The Lazy Summer Protocol automates yield optimization across multiple DeFi protocols, so users can "set it and forget it" while earning competitive returns.

Recent performance highlights:

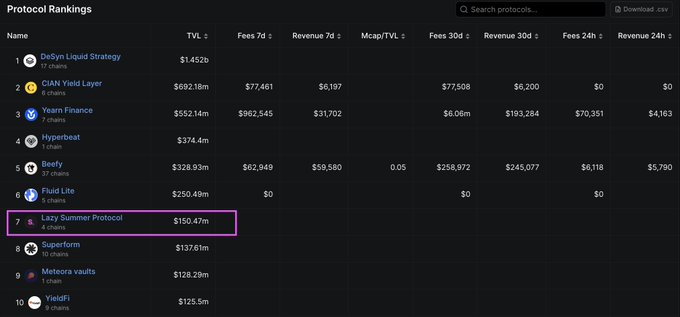

- Protocol TVL: $151M+ across 4 chains

- Featured as Top 7 Yield Aggregator on DefiLlama

- AI-powered rebalancing monitors markets 24/7

Watch the full breakdown to learn vault selection strategies.

Why Institutional DeFi Integrations Are Broken (And How to Fix Them) For years, DeFi has promised institutional investors a transparent, borderless, and permissionless environment to access yield opportunities. But in practice, tapping into that potential yield at scale has been

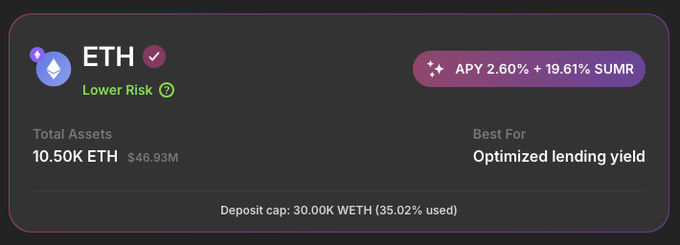

📊 Monday Market Watch Happy new month! 🌞 The Lazy Summer Protocol starts September with strength: Protocol TVL: $151.36M ETH (Lower Risk) Strategy total assets: 10.5K ETH Best for optimized lending yield 🔗 Explore strategies: summer.fi/earn #LazySummer #DeFi #ETH

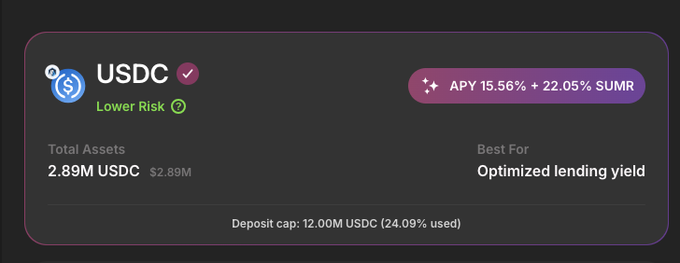

Choosing a DeFi yield strategy shouldn't be a full-time job. Here’s how to pick the right Lazy Summer vault based on chain, asset, and risk. 📺 Watch full video: youtu.be/uAfSwLWNE7M #CryptoYield #ETH #YieldFarming

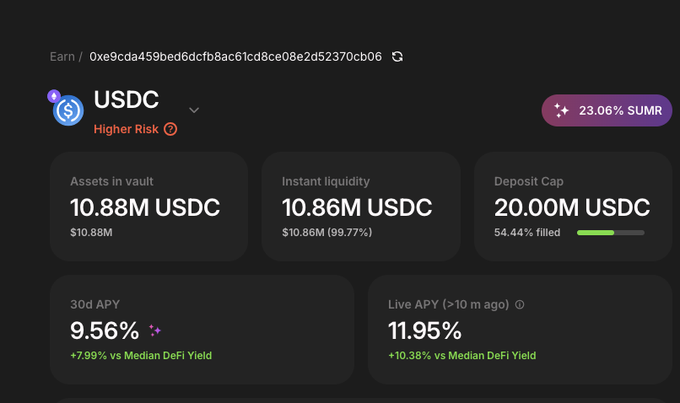

📊 Market Watch Monday: USDC Mainnet Higher-Risk Vault Assets in vault: 10.88M USDC Instant liquidity: 10.86M USDC (99.77%) 30d APY: 9.56% (+7.99% vs median DeFi yield) Live APY: 11.95% (+10.38% vs median DeFi yield) summer.fi/earn/mainnet/p…

Lazy Summer Protocol= fewer choices, smarter strategies. Summer.fi broke down 3 vaults: - USDC Higher-Risk on Mainnet - USDC Lower-Risk on @base - ETH Lower-Risk on Mainnet Which one would you choose? 🎥 Watch the full video: youtu.be/j2YddqRthHg

Picking a vault doesn’t have to feel like solving a puzzle. Lazy Summer cuts through the noise → fewer choices, smarter strategies. 🎥 Watch the full breakdown: youtu.be/j2YddqRthHg?si…

ICYMI: Last week @DefiantNews covered the launch of Summer.fi Institutional A one-stop solution for professional allocators — customizable vaults spanning on-chain + off-chain yield, with automation, risk controls, reporting, and 24/7 support. 👇Read the full

🗳️ Governance Update: Lazy Summer DAO Voting is now live until August 17/18th, 2025. gov.summer.fi Here’s what’s on the table this week. 🧵

Lazy Summer July Recap — Governance, Metrics & New Proposals July was 🔥 and not just the weather. From vault expansions to protocol upgrades & the SUMR Transfer WG kickoff… here’s everything that went down in Lazy Summer DAO 👇

Lazy Summer Protocol on the Top 7 Yield Aggregators on @DefiLlama 🎉 $150M+ TVL secured across 4 chains Optimized yield strategies powered by automation From stablecoins to ETH strategies, Lazy Summer keeps capital working 24/7 so users don’t have to. 👉 Explore all vaults

🏖️ Lazy Summer Protocol Moves to @merkl_xyz for Reward Distribution Summer.fi is excited to announce that from Friday, 15th August, the Lazy Summer Protocol has moved over from it's own staking reward contracts to Merkl for SUMR rewards distribution and claiming

🗳️ Governance Update: Lazy Summer DAO Voting is now live until August 24th, 2025 gov.summer.fi Here’s what’s on the table this week 🧵

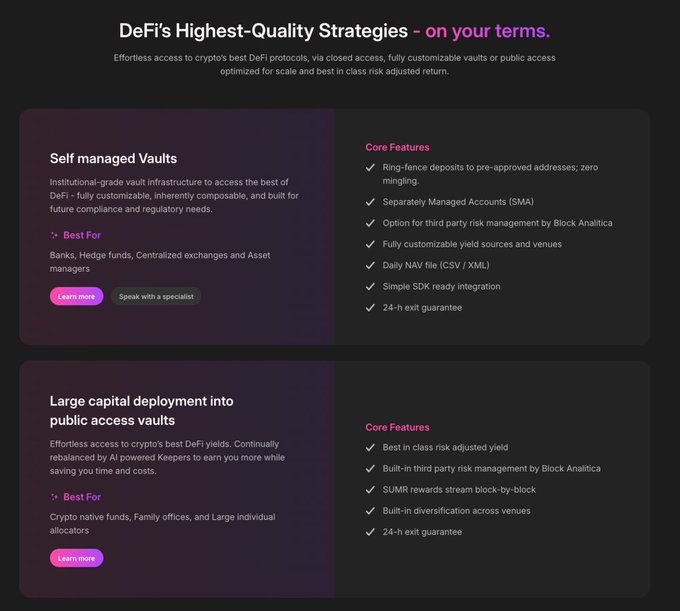

🚨 Summer.fi Featured in @stablecoininfo Institutional DeFi has been broken for too long fragmented integrations, manual processes, and zero real customization. Stablecoin Insider just covered how Summer.fi Institutional fixes that with self-managed

Institutions don’t need to wrestle with fragmented integrations or missed opportunities anymore. With Summer.fi Institutional allocators can access customizable vaults designed for compliance, transparency, and automated rebalancing. Thanks to @stablecoininfo for

. @MorphoLabs 🤝 @summerfinance_ DeFi users continued to earn more, while saving time in July because of Lazy Summer's automated rebalancing. Of all the protocols supported, one really stood out this month. @MorphoLabs dominated stablecoin strategies, thieir USDC strategies

🗳️ Governance Update: Lazy Summer DAO SUMR Token Transfer Readiness Checklist is live on forum! + new strategies proposed are up for voting until August 24th, 2025 → gov.summer.fi Here’s what’s on this week 🧵

🗳️ Governance Update: Lazy Summer DAO Another busy week in Lazy Summer DAO, with key updates from the transfer readiness, new vaults, liquidity plan, and onchain votes. Below is everything you need to know 🧵

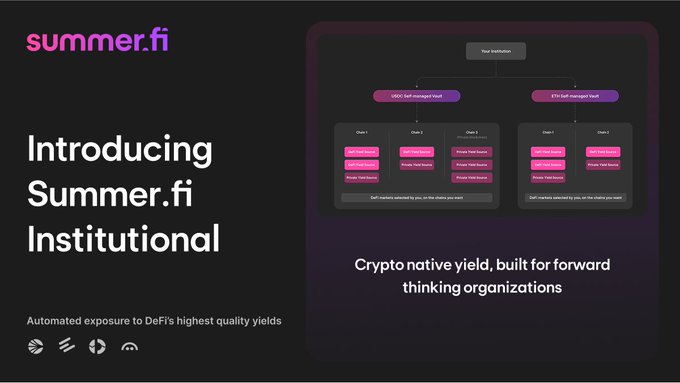

Introducing Summer.fi Institutional: Crypto-native yield, purpose-built for professional allocators and asset managers

Fluidkey Integrates Lazy Summer Protocol: Yield That Starts Earning the Moment Funds Arrive @fluidkey has integrated the Lazy Summer Protocol into its auto-earn feature, unlocking instant access to curated, risk-managed yield opportunities. With the new Optimized Profile, every

DeFi is scattered. Managing @aave, @MorphoLabs, @compoundfinance + risk dashboards = endless tabs & gas fees. Summer.fi Institutional simplifies everything: - One vault - AI-powered rebalancing - Risk-curated strategies 👉 Read more: blog.summer.fi/one-vault-to-r…

. @maplefinance is quickly becoming one of the top protocols in DeFi. This past month, @maplefinance Syrup ranked second at ~8.8% of all stable coin TVL in Lazy Summer (USDC 6.4%, USDT 2.4%), ahead of other blue chip protocols like Spark USDC (3.4%) and Aave v3 (2.7%).

Where does DeFi yield come from? Summer.fi Product Manager @samehueasyou explains from lending & borrowing, to collateral quality, to farming rewards, and how it all works in Lazy Summer Protocol. 📺 Watch now: youtu.be/Jw-EvcXG6AM

Manual DeFi Yield Chasing: Hidden Costs Eating Your Gains

**Manual vault-hopping might be costing you more than you think.** While chasing the highest yields across DeFi protocols seems profitable, the reality includes: - **Gas fees** from frequent transactions - **Time costs** monitoring multiple positions - **Stress** from constant rebalancing - **Opportunity costs** from manual execution delays **Automation offers a solution** through yield aggregators that handle: - Vault rebalancing - Gas-optimized execution - Cross-chain strategies - 24/7 monitoring The math often favors **set-and-forget approaches** over active management, especially when factoring in all hidden costs. [Read the full analysis](https://blog.summer.fi/the-hidden-cost-of-manual-defi-yield-chasing/)

AI Automates DeFi Yield Optimization Across 1,834 Pools

**DeFi's complexity problem**: With 1,834 stablecoin pools across 460 protocols and 101 chains, manually optimizing yields has become nearly impossible. **The AI solution**: Automated yield strategies now handle: - Real-time pool monitoring - Risk assessment across protocols - 24/7 position optimization - Predictive APR analysis **Why it matters**: Most DeFi users lose potential returns not from bad protocols, but from **suboptimal timing and positioning**. Yields fluctuate constantly while funds sit idle in outdated strategies. **Key benefits**: - Eliminates manual yield chasing - Reduces opportunity cost - Maintains optimal risk/reward ratios - Works continuously without user intervention Read the full analysis: [How AI + DeFi Creates Always-On Yield Strategies](https://blog.summer.fi/how-ai-defi-creates-always-on-yield-strategies/)

**DeFi Integration Crisis: Why Institutions Can't Access Yield Efficiently**

**Major institutional barriers plague DeFi adoption**, despite promises of transparent, borderless yield opportunities. **Key problems identified:** - Protocols operate in complete isolation - Capital rotation requires inefficient 2-3 leg trades (withdraw, bridge, deposit) - Maintenance costs escalate with each new connection **The impact:** Banks, hedge funds, and DAO treasuries face partial market exposure, high operational overhead, and missed opportunities. **Current reality:** Instead of seamless innovation, institutions battle constant integration challenges that prevent them from scaling DeFi operations effectively. Read the full analysis at [blog.summer.fi](blog.summer.fi/why-instituti)

Summer.fi Institutional Simplifies DeFi Access for Professional Allocators

**Summer.fi Institutional** addresses the complexity barrier that keeps institutions out of DeFi yield markets. **The Problem:** - Fragmented liquidity across protocols and chains - Multiple costly integrations required - Constant upgrades and high risk exposure **The Solution:** Summer.fi Institutional offers a **single integration** to access all major yield markets for stablecoins, ETH, and BTC. **Key Features:** - Customizable institutional-grade vaults - Automated rebalancing and yield optimization - Compliance and transparency built-in - Expert technical support tailored to risk frameworks - Access to both on-chain and off-chain markets **Target Users:** - Asset managers - Crypto custodians - Family offices - Crypto funds - Fintech applications The platform utilizes DAO-managed vaults with risk expertise from Block Analytica and offers SDK integration for branded yield products. [Learn more about Summer.fi Institutional](https://summer.fi/institutions)