Stobox is building comprehensive products and processes to drive mass adoption of tokenized real-world assets (RWAs).

The company serves businesses of various sizes as their primary tokenization provider, offering:

- Stobox 4 platform - sophisticated yet user-friendly tokenization solution

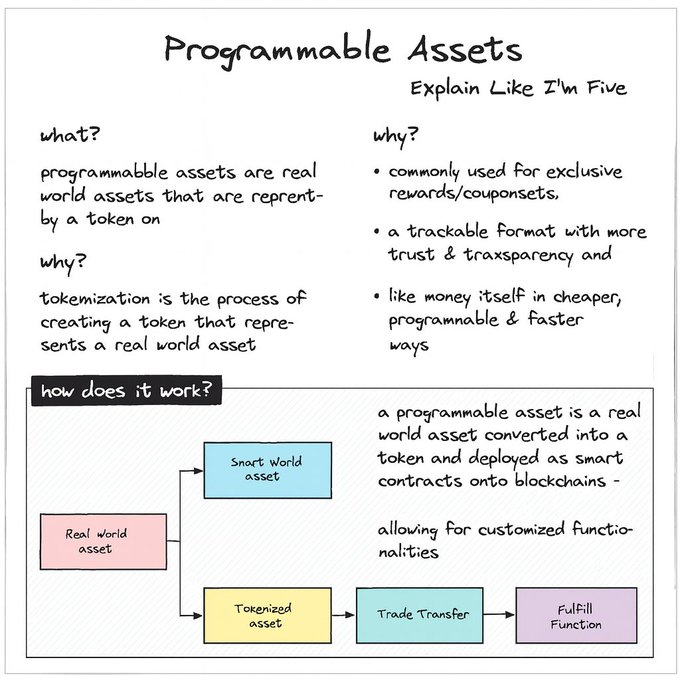

- Programmable assets with embedded data via Chainlink and Redstone oracles

- Global Partnership Program integrated into platform dashboard

- STV3 Protocol - proprietary modular protocol for RWA distribution

Recent developments include:

- Partnership with Particula for institutional-grade risk ratings

- STBU → STBX rewards program offering real tokenized equity

- Integration with industry leaders like Fireblocks, Sumsub, and Plume

- 7+ years serving 100+ projects across 40+ partnerships globally

The platform provides complete ecosystem access including legal structuring, KYC/AML compliance, institutional custody, and compliant secondary markets.

Stobox targets enterprise-grade infrastructure for the institutional RWA era, positioning itself as a reliable partner for businesses exploring tokenization.

Contact Stobox for tokenization partnership opportunities.

Insights from @DeyevGene on: 1. Stobox 4⃣ for Asset Issuers 2. Stobox 4⃣ for #RWA Investors 3. STV3 - The modular protocol for Real-World Asset distribution and lifecycle control. 4. What is Stobox Security Token $STBX 5. Reward Program for $STBU Holders. Stay ahead of

RWA Tokenization = Programmable assets! Stobox is embedding data into tokens via @chainlink @redstone oracles. Built on proprietary Stobox STV3 Protocol. Compatible with ERC-7943. Built on ERC-2535. Building Finance 2.0. #Stobox #RWA

The STBU → STBX program is here ✅ An unprecedented RWA airdrop giving the community real tokenized equity in Stobox. Buy STBU → Bridge to Arbitrum → Deposit in Stobox 4 → Verify → Hold → Earn STBX. stobox-platform.medium.com/the-stbu-stbx-… Real RWA. Real ownership. More details coming

🚨 BREAKING: Stobox Partners with Particula Stobox is proud to announce a partnership with @particula_io, a leading institutional-grade risk-rating and verification platform for digital and tokenized assets. This collaboration strengthens Stobox’s ecosystem with advanced due

Over 7 years, Stobox has powered tokenization for 100+ projects across 40+ partnerships worldwide. Every collaboration represents a unique use case - from energy infrastructure to real estate, from FinTech platforms to mining operations. Starting today, we're revisiting these

Stobox launches Global Partnership Program, now integrated into Stobox 4 🌐 Connect with industry leaders like Fireblocks, Sumsub, Plume, Chainlink, Crowe, tZero, and more - all from one dashboard. Access vetted partners for legal structuring, KYC/AML compliance, institutional

Stobox 4⃣ is the most sophisticated and easy-to-use #tokenization platform on the market. Available to various businesses and industries. Now with @particula_io ratings for #RWA trust. Tokenize with #Stobox 🔗 stobox.io/contactus

Stobox builds products and processes for the mass adoption of Tokenized Real-World Assets. Businesses of different sizes select Stobox as their tokenization provider. Looking for a reliable partner? Speak to us - stobox.io/contactus -- #Stobox #RWA #Tokenization

🚨 BREAKING: SEC’s Paul Atkins says tokenization boosts market transparency and the agency fully embraces RWA tokenization to keep the US leading global finance. The shift is happening. 🚀

Stobox Deploys $23M in Real-World Assets on Arbitrum Network

Stobox has expanded its real-world asset (RWA) infrastructure on Arbitrum, bringing seven RWA projects onchain with a combined value of $23 million since launching its Stobox4 beta platform. **Key developments:** - Arbitrum is now the primary blockchain across the Stobox ecosystem - The platform enables compliant asset issuance and lifecycle management - Integration includes the STV3 programmable asset protocol and decentralized identity tools The Stobox ecosystem provides an all-in-one SaaS platform for issuing and managing tokenized real-world assets. The company offers onchain transparency through its [Dune dashboard](https://dune.com/stobox/rwaboard) and maintains a presence on the [Arbitrum Portal](https://portal.arbitrum.io/?project=stobox). Read the full announcement on the [Stobox blog](https://blog.stobox.io/stobox-expands-its-rwa-infrastructure-on-arbitrum-network/).

Stobox Completes January STBU to STBX Rewards Distribution

Stobox has completed its January rewards program, distributing 3,201 tokenized shares of STBX to STBU token holders on the Stobox 4 platform. **Key Details:** - The snapshot for January STBU holdings has been finalized - STBX tokenized shares distributed as rewards to qualifying holders - Distribution follows the STBU → STBX community rewards program structure **What's Next:** February rewards are now open. STBU holders can participate by: - Registering on Stobox 4 - Depositing STBU tokens on Arbitrum The program allows STBU token holders to earn ownership stakes in Stobox through regular distributions of STBX tokenized shares. [Read full details](https://stobox-platform.medium.com/two-tokens-one-ecosystem-how-stbu-holders-earn-stbx-ownership-in-stobox-65edb7f79842) [Program documentation](https://docs.stobox.io/about/programs/stbu-stbx-community-rewards-program)

🔥 Stobox Builds While Others Talk

**Stobox delivered major ecosystem updates in November:** - **STBU & STBX Community Rewards** launched with $1M allocation - **Canada's first regulated stablecoin issuer** tokenizes on Stobox 4 - **Global Partnership Program** integrated into platform - **Particula partnership** strengthens asset verification - **REAL Finance MoU** expands cross-chain infrastructure The company continues focusing on **real-world asset (RWA) adoption** through partnerships and community building rather than just announcements. [Read full update](https://blog.stobox.io/november-update-building-trust-through-community-partnerships-and-transparency/)

Stobox Launches STBU-STBX Rewards Program Offering Real Tokenized Equity

**Stobox has launched its STBU → STBX community rewards program**, offering holders real tokenized equity in the company. **How it works:** - Buy STBU tokens - Bridge to Arbitrum network - Deposit in Stobox 4 platform - Verify identity - Hold tokens to earn STBX rewards **Key details:** - STBX represents **actual corporate shares** in Stobox, not just utility tokens - Eligible holders can receive **up to 25% of deposited value** in STBX allocation - Over **15 million STBU already deposited** on the platform **Important restrictions:** - STBX is classified as a security token - Participation limited to verified, eligible users - May be restricted by jurisdiction - Full compliance requirements apply This program gives the Stobox community direct exposure to company growth through real ownership stakes. Track live deposit data on their [RWA Adoption Dashboard](https://dune.com/stobox/rwaboard). [Read full details](https://stobox-platform.medium.com/the-stbu-stbx-community-rewards-program-ca196d9cbfa1) about program mechanics and eligibility requirements.