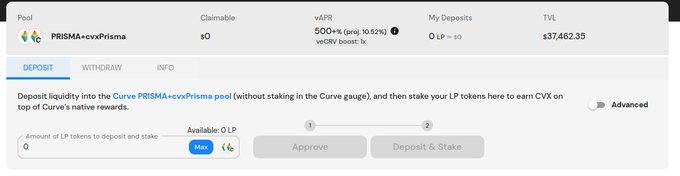

Convex Finance now allows users to stake their $PRISMA in the PRISMA+cvxPrisma liquidity pool.

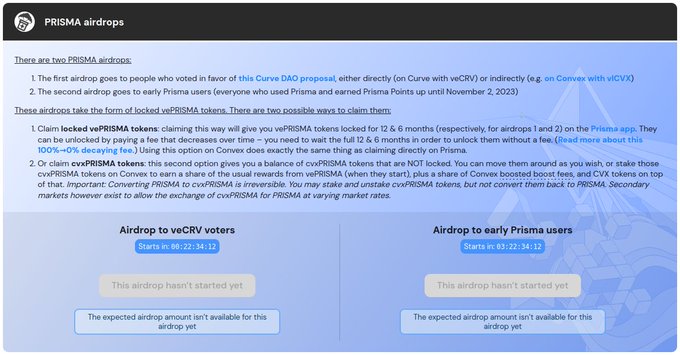

The first PRISMA airdrop will be claimable on November 6th, 9 a.m. UTC. Claim 100% of your airdrop as #cvxPrisma at prisma.convexfinance.com/claim.

We're excited to unveil the Prisma Retroactive Airdrop🌈 All veCRV voters who helped whitelist Prisma on @CurveFinance and Prisma Point holders are eligible for the airdrop.

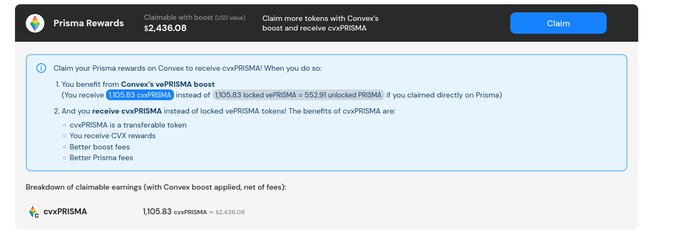

You can now claim your @PrismaFi $mkUSD staking rewards directly on Convex as #cvxPRISMA! prisma.convexfinance.com/claim

The second $PRISMA airdrop is here! If you are an early $PRISMA user, claim your #cvxPrisma here: prisma.convexfinance.com/claim

Retroactive $PRISMA airdrop for veCRV voters are live! Claim your $PRISMA as #cvxPRISMA here 👇 prisma.convexfinance.com/claim

The waiting is over! Start staking your $PRISMA on prisma.convexfinance.com.

We're thrilled to announce that $PRISMA, the Prisma Governance Token, is live now on Ethereum mainnet!🌈 Ethereum Address: 0xdA47862a83dac0c112BA89c6abC2159b95afd71C The future of LSTfi is here!

You can now stake your $PRISMA in the PRISMA+cvxPrisma liquidity pool on Convex! convexfinance.com/stake/ethereum…

Convex Issues Security Warning Against Phishing Links

**Convex has issued a critical security alert** to its community regarding fraudulent activity on social media. **Key Points:** - Convex will **not post any links** following their official announcements - Any links appearing below their tweets claiming to be from Convex are **spam, fake, or phishing attempts** - Users are strongly advised **not to click** on any such links This warning has been repeated multiple times (December 2025, January 2026, and February 2026), indicating ongoing phishing attempts targeting the Convex community. **Stay vigilant and verify all communications directly through official Convex channels.**

🥈 DeFi Education Video Wins 3,000 CVX in Community Contest

A creator has secured second place in a community contest, earning **3,000 CVX tokens** for producing educational content about the Convex and Curve ecosystem. **Key Details:** - The winning entry is a video that combines storytelling with DeFi education - The content focuses on explaining the Convex and Curve protocols - Community members praised the work for its educational approach [Watch the winning video](https://x.com/objkt0/status/2009762349419319630) The contest appears to reward creators who make complex DeFi concepts more accessible through engaging content formats.

Convex Distributes 10,000 CVX to January Creator Collective Winners

Convex Finance announced the winners of its January Creator Collective program, distributing 10,000 CVX tokens among the top 5 content creators. **The program rewards creators who produce educational and engaging content about:** - Boosted staking yields on Convex - Governance mechanisms and voting power - Platform features and tools **Key details:** - Winners created diverse content including videos, tutorials, and educational threads - Content must be posted in Convex's Discord Creator Collective channel to be eligible - The program continues monthly with the same prize pool Convex controls 53.13% of all veCRV and manages $1.28B in TVL, offering boosted yields to users who stake through their platform.

🚨 Convex Issues Security Warning About Phishing Links

**Convex has issued a critical security alert** to its community regarding fraudulent activity on social media. **Key Points:** - Convex will **not post any links** following their official announcements - Any links appearing below their tweets claiming to be Convex are **spam, fake, or phishing attempts** - Users are strongly advised **not to click** on any such links This warning has been repeated multiple times since December 2025, indicating an ongoing phishing campaign targeting Convex users. The protocol is taking proactive measures to protect its community from potential scams. **Stay vigilant** and verify all communications directly through official Convex channels.

Convex Issues Repeated Security Warning Against Phishing Links

**Convex Finance has issued multiple security warnings** across several days, alerting users about fraudulent links appearing in their social media replies. The DeFi protocol explicitly states they **will not post any links** after their official announcements. Any links appearing below their tweets claiming to be from Convex are: - Spam attempts - Fake websites - Phishing scams This repeated warning suggests **ongoing impersonation attacks** targeting Convex users. The frequency of these alerts indicates scammers are persistently trying to exploit the protocol's community. **Stay vigilant** - only interact with official Convex channels and verify all links independently.