StableSurge Hook Protects LPs During Market Volatility

StableSurge Hook Protects LPs During Market Volatility

🛡️ LPs Get Paid For Diamond Hands

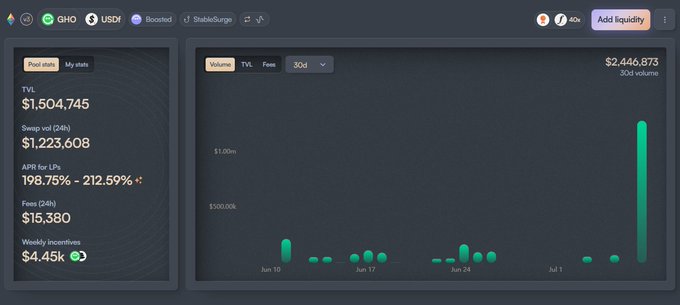

Balancer's StableSurge Hook continues to demonstrate its effectiveness in protecting liquidity providers during market turbulence.

Key features:

- Dynamic fee adjustments increase LP earnings during high volatility

- Surge tax mechanism penalizes destabilizing sellers

- Automatic defense against depegging events

The system rewards loyal LPs who maintain their positions through market stress, while creating resistance against price manipulation.

Learn more about StableSurge's architecture: Balancer Medium Post

When the market gets rough, StableSurge fights back. LPs earn more during high-volatility thanks to dynamic fee adjustments.

Our StableSurge hook just dominated during the increased volumes on $USDf 🔥 Lower TVL and volume but way higher fees, outperforming Uniswap and Curve 📈 This is the power of risk-adjusted rewards. Let's compare 🧵

Balancer Introduces reCLAMM: Automated Concentrated Liquidity Management

Balancer has launched reCLAMM (Readjusting Concentrated Liquidity AMM), a significant advancement in DeFi liquidity management. Key features: - Automated range adjustment for concentrated liquidity - Standard ERC-20 LP tokens instead of NFTs - No manual position management required - Zero rebalancing losses The protocol aims to simplify liquidity provision for DAOs and LPs seeking efficient, passive management solutions. Detailed information available in their [full session recording](https://streameth.org/682f5f23c149844bac821bf0/watch?session=685165c94ac43bf73da30d0c) and [Medium recap](https://medium.com/balancer-protocol/deep-liquidity-sharp-minds-balancer-dappcon-631168b5a361).

Multi-Chain Stablecoin Pools Launch with GHO Integration

Balancer pools now support multiple stablecoins across various blockchain networks, centered around GHO integration. Key features: - Support for GHO (Aave), USDf (Falcon), iUSD (Infinifi) - Integration with major stablecoins: USDC, EURC, USDT - ~$14M total value locked - Continuous swap fee generation - 100% exposure to Aave interest rates - Additional BAL and GHO reward incentives Pools offer efficient yield generation through multiple revenue streams while maintaining stablecoin exposure.

TradFi vs Crypto: Balancing Legitimacy with Innovation

In a recent discussion, @Marcus_Balancer explored the evolving relationship between traditional finance and crypto innovation. Key points emerged: - TradFi contributes institutional legitimacy to the ecosystem - Crypto-native teams excel in rapid development and composability - Focus areas include RWAs and tokenized stocks The conversation highlighted how blockchain technology could transform asset management, similar to how electronic trading revolutionized paper-based systems. Martin Carrica of @MountainUSDM emphasized that crypto's efficiency advantages over traditional systems could drive mainstream adoption of tokenization.

New BOLD-wUSDN Liquidity Pool Launches on Aura Finance

A new liquidity pool pairing two innovative stablecoins has launched on Aura Finance: - **wUSDN**: A synthetic, delta-neutral, yield-bearing dollar from SmarDex - **BOLD**: Liquity Protocol's stablecoin backed by WETH, rETH, and wstETH The pool offers yield opportunities for liquidity providers through Aura Finance's platform. [Check out the pool on Aura Finance](https://app.aura.finance/#/1/pool/265)