Crypto Market Daily Update - July 1, 2025

Crypto Market Daily Update - July 1, 2025

🔥 Robinhood's Secret EU Plan

Key Market Movements:

- BTC and ETH show modest gains

- Trading volume experiences significant increase

- Layer2 and NFT sectors leading performance

Major Developments:

- Robinhood plans to launch tokenized U.S. stocks for European market via Arbitrum or Solana

- U.S. Supreme Court grants IRS access to Coinbase user data

- XRP Ledger launches Ethereum-compatible sidechain

- Robinhood EU begins offering private company tokens including OpenAI and SpaceX

- Aptos Labs CEO joins CFTC advisory committee

- BitMine raises $250M for Ethereum strategies

- German banking sector embraces crypto services

- Solana staking ETF preparation underway

🚀 Crypto moves fast. Stay faster. 🚀 Get real-time price predictions, AI-driven market analysis, daily insights and more. Powered by SWFTGPT, the first domain-specific LLM built for #crypto. 📲 swft.pro/#Download #Crypto #AI #DeFi #Web3 #CryptoNews #LLM

📊 SWFT GPT Daily Crypto Recap – June 23, 2025 🔻 Market Cools | Liquidations Surge | ADreward Leads Gainers | Tether Mints 1B USDT 🗞️ Key Headlines ⚙️ SoDEX Testnet Live SoSoValue’s high-performance trading chain launches testnet with 1M $SOSO token rewards. 💥 Bitcoin Dips

📊 SWFT GPT Daily Crypto Recap — June 25, 2025 🔻 Market Eases | Layer2, RWA, DeFi Lead Gains | Mastercard Expands Crypto Access 🗞️ Crypto News Highlights 🐳 Whale Activity on HyperLiquid Whale deposits 14M USDC, acquires 287,153 $HYPE on leverage, holding a significant 10x

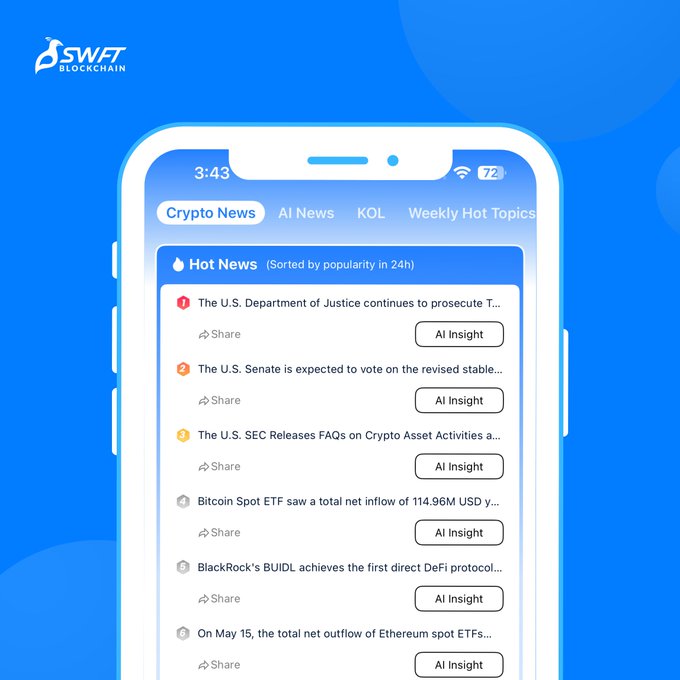

Catch up on the hottest crypto headlines with SWFTGPT 🔥 Here’s what’s making waves in the #crypto world today: 🏛️ DOJ continues prosecution of Tornado Cash co-founder Roman Storm — some charges dropped, but key ones remain. 🪙 U.S. Senate eyes stablecoin bill vote before

📰 SWFT GPT Daily – May 27, 2025 Crypto Market Sees Mixed Moves | ETH Surges | Elderglade +285% | SharpLink $425M Deal 🧠 Headlines & Highlights: 🔹 SharpLink closes $425M PIPE with Consensys; will convert to $ETH treasury. 🔹 Cantor Fitzgerald launches $2B Bitcoin financing

Crypto Market Recap — June 29, 2025 BTC and ETH climb | Layer2 and AI surge | Stablecoins dominate web payments 🗞️ Crypto News Highlights 🌍 Yuxin Tech Bets on Global Stablecoin Expansion Yuxin Technology (300674.SZ) ramps up international efforts across

📉 SWFTGPT Daily – June 17, 2025 BTC Rises to $106K | Polyhedra +107% | SoDEX Testnet Launches | Truth Social ETF Filed 📰 Key Headlines • SoSoValue launches SoDEX testnet – EVM-compatible high-speed trading chain, 1M $SOSO in rewards • Public firms invest $1.19B in BTC –

📊 SWFT GPT Daily Crypto Recap — June 26, 2025 🔻 Market Dips | Bitcoin ETFs See Major Inflows | Hong Kong Expands Crypto Access 🗞️ Crypto News Highlights 📈 Bitcoin Spot ETFs See $547.72M Inflow BlackRock’s IBIT leads with $340.28M daily inflow. Total Bitcoin ETF net assets

🧭 Crypto Market Snapshot – June 2, 2025 Total Cap Down | Volume Sinks | All Sectors Green | $MASK +31.7% | NFT Sector Leads All 16 tracked sectors are up today — led by NFT, RWA, and SocialFi: 🎨 NFT +3.88% (PFVS +13.3%, DOOD +11.9%, ANIME +11.5%) 🏛 RWA +2.43% (KTA +30.4%, OM

📉 SWFTGPT Daily – June 18, 2025 Market Dips 4% | SPK +483% | Coinbase Eyes Tokenized Stocks | GENIUS Act Advances 📰 Headlines • SoDEX Testnet Live – SoSoValue unveils high-speed EVM-compatible chain with $1M $SOSO incentives • Coinbase seeks SEC nod for tokenized stock

🌐 Crypto Market Daily Update — June 30, 2025 📍 BTC & ETH edge upward | Trading volume surges | Layer2 & NFT sectors lead 🗞️ Top Crypto Headlines 🔐 Robinhood Eyes Tokenized Stocks in EU Robinhood prepares to tokenize U.S. stocks for European users—potentially via Arbitrum

🚨 Crypto Market Roundup! 🚨 Here are the key updates: •Bitcoin hit a record high near $112,000 [$1]. •Senate advanced the GENIUS Act for stablecoin regulation . •Trump hosted a dinner for $TRUMP meme coin buyers . •Coinbase joined the S&P 500 despite a probe . •A new

SWFTGPT Daily – May 21, 2025 BTC Hits $106.5K | ETF Inflows Continue | SEC Sues Unicoin | South Korea to Lift Crypto Ban Top Headlines: • James Wynn expands 40x BTC long to $832M, unrealized gains hit $16.5M • Bitcoin ETFs net $329M, led by IBIT’s $287M inflow • SEC charges

📊 Crypto Market Update – June 4, 2025 Market Cap Dips, Volume Climbs | $SUIA +61% | BTC & ETH Dominate 70% of the Market 📰 Crypto News Highlights: 🪪 TRUMP coin partners with Magic Eden to launch official Trump Crypto Wallet 🗳️ South Korea’s election: Democratic candidate Lee

📉 SWFT GPT Daily – May 29, 2025 Crypto Market Dips | SocialFi Pops | FCA Drafts Stablecoin Rules | Ooki +232% 🚀 🧠 Key Headlines: 🔹 UK FCA proposes stablecoin rules: Reserve transparency & custody protection. 🔹 Fed Policy: Stable rates expected till Q3; trade tension clouds

WBTC on Unichain Now Available for Cross-Chain Transfers

Bridgers has added WBTC support on Unichain network, expanding its cross-chain capabilities. Users can now route WBTC across multiple blockchains using smart contract-powered execution and aggregated liquidity pools. The integration follows recent additions of USDC, TICS, and YURU tokens to the platform. Bridgers maintains a non-custodial approach, allowing users to retain control of their assets throughout the transfer process. Key features: - Smart contract-based execution - Non-custodial transfers - Aggregated liquidity - User-authorized transactions [Try it now](http://dapp.bridgers.xyz)

Ripple Seeks US Banking Charter and Fed Account for RLUSD Stablecoin

Ripple has taken significant steps toward mainstream financial integration by applying for a US national bank charter. This move aims to bring their stablecoin $RLUSD under federal oversight. The company's subsidiary is pursuing a Federal Reserve master account, which would enable: - 24/7 stablecoin issuance - Direct redemption capabilities - Integration with traditional banking infrastructure This follows their earlier development of RLUSD in 2024, which still awaits full regulatory approval for launch. *This represents a notable convergence of traditional banking and digital asset infrastructure.*

Figma Files IPO, Reveals Significant Bitcoin Holdings and Investment Plans

Design software giant Figma has filed for an Initial Public Offering (IPO) with the SEC, revealing substantial cryptocurrency holdings. The company currently holds **$69.53 million** in Bitcoin spot ETFs and received board approval for an additional **$30 million** Bitcoin investment in May. The San Francisco-based company has temporarily converted funds to USDC with plans to reinvest in Bitcoin, demonstrating a strategic approach to digital asset treasury management. This move represents a significant intersection of traditional tech and cryptocurrency markets, as Figma becomes one of the first major design platforms to publicly disclose substantial crypto holdings pre-IPO.

Verge (XVG) Expands Cross-Chain Support on Bridgers

**Verge (XVG)**, the privacy-focused cryptocurrency, has expanded its cross-chain capabilities through full integration with Bridgers. The implementation enables users to transfer XVG across multiple networks including: - ERC20 (Ethereum) - BSC (Binance Smart Chain) - Base - Polygon Key features of Verge include: - Built-in Tor integration for enhanced privacy - Stealth address transactions - Community-driven development - Open source codebase - Bitcoin network improvements Users can now execute non-custodial cross-chain transfers at [dapp.bridgers.xyz](http://dapp.bridgers.xyz)